In today’s dynamic business landscape, innovation is crucial for long-term sustainability. By investing in innovation, organizations can adapt, grow, and pursue competitive advantage through disruptive changes such as technological advancements or shifting market trends. Investing in innovation should not be a periodic, one-off decision. It should be an ongoing strategic area of investment embedded in the enterprise planning process.

I have found that when it comes to enterprise planning and execution, to be good at doing “yes,” you must be great at saying “no.” This is never truer than when contemplating investing in innovation. Not just because innovative initiatives are inherently risky, but because saying “yes” to them comes at the cost of saying “no” to the budget and capacity needed to invest in other, lower risk initiatives that promise a more reliable ROI. The way to being great at saying “yes” to innovative initiatives is to embed the right practices into your enterprise planning process.

Embedding Innovation into your Enterprise Planning

The “practice” starts with determining and ring- fencing the right amount of budget to spend on innovation in your current enterprise planning cycle. I recommend starting by categorizing all your candidate investments in this cycle into categories and splitting your budget between them. The two broadest categories are:

- Non-Discretionary: Investments required to keep current service levels, meet government or legal requirements, and ensure business continuity. Aka keeping the lights on.

- Discretionary, or Innovation: Includes a combination of investments to grow or expand your current products, services, and customer experiences, as well as disruptive initiatives to create new products or move into new markets.

The Innovation category is generally broken down into subcategories:

- Venture or Disruptive Investments: Introducing a new capability that enables existing customers to engage with your organization in new ways or engages new customers in existing or new markets.

- Incremental Growth Initiatives: Exploiting existing or incremental capabilities that enable existing customers to engage with your organization more, or in new ways.

Once your investment candidates are categorized, you’ll need to allocate your available budget across the investment categories. One of the toughest challenges for an organization is finding the right balance of spend between non-discretionary and innovation. In an article for Harvard Business Review,* How to Prioritize Your Innovation Budget, Brad Power and Steve Stanton state that many companies are spending about 15% of their resources on innovation, which includes sustaining incremental growth as well as large, disruptive innovation. Yet the consensus across those same companies is that ideal spend is more like 25%. So how much innovation spending is right for your company, and how do you decide if your focus should be on incremental growth or large disruptive investments?

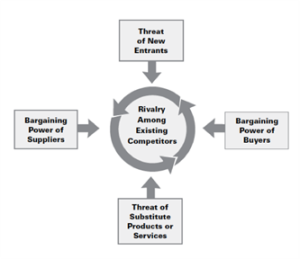

Using a strategic analysis model like Porter’s Five Forces can help determine what your innovation focus or strategy should be for this planning cycle. It can also help determine the appropriate allocation of budget to each category based on the size and immediacy of the opportunities and threats you identify for your company in your market and/or industry.

For instance, if your competitors are catching up with your value proposition, offering similar products or experiences – and your customers are seeing your competitor’s products as an attractive alternative to yours, you may consider a higher level of investment in incremental innovation focused on growing your customers’ share of wallet and ensuring their continued loyalty. If you determine that the products and services you offer in your markets are likely to face new government or legal regulations that limit your ability to differentiate, and/or it’s highly likely your market or industry is moving towards commodity pricing, a heavier focus on venture or disruptive innovation initiatives may be called for. Once you’ve landed on the right strategy to guide your innovation investment, you’ll be able to measure the alignment for each of your investment candidates to that strategy as part of determining their relative value.

The Five Competitive Forces That Shape Strategy*

The five forces identified by Porter that influence a corporate strategy, including your innovation strategy, are:

- Competition in the industry

- The potential of new entrants into the industry (barriers of entry)

- The power of suppliers

- The power of customers

- The threat of substitute products

In addition to measuring an investment candidate’s strategic alignment, you also need to determine its relative financial worth, and then discount its potential value by risk: where risk is the likelihood of not realizing the promised value of the investment. In my experience, this simple value equation has been very effective in enabling conversations focused on the relative, objective value of individual investment candidates in a portfolio.

If your company has adopted a standardized financial worth measurement (e.g., ROI, payback period) then you can use that calculation to assign a relative financial worth to each of your candidates. If your organization does not have a standard approach for measuring financial worth, you can still create the apples-to-apples comparison you need by evaluating each candidate using a simple 1-to-4-point assessment based on a financial performance metric that is relevant to your company. The purpose of assigning a relative value to each candidate is to enable an objective scoring, not to derive an absolute worth. Here is an example of a framework I used with success in a large company that was looking at a portfolio of digital innovation investments:

- < $(X)M in Operating Income over a three-year period = “1”

- $(X)M – $(Y)M in Operating Income over a three-year period = “2”

- $(Y)M – $(Z)M in Operating Income over a three-year period = “3”

- >$(Z) in Operating Income over a three-year period = “4”

Once you have your combined Financial Worth and Strategic Alignment score, you’ll need to discount by a risk factor. Measuring the risk of an innovation candidate requires determining the likelihood that your company will not realize its potential financial worth or strategic contribution due to risk in your company’s organizational and technological readiness; how easily the initiative, if developed, can scale; the availability of resource requirements; etc. If your company does not already have a risk assessment they require when evaluating new investments, then a 1–4-point framework can be applied here as well. A risk assessment questionnaire with each risk evaluation question requiring the selection of a pre-written, 1-4 scored answer can work quite well. As with financial worth and strategic alignment, the purpose of this evaluation is to enable conversations based on an apples-to-apples comparison between investment candidates, not to get to absolute values.

You can improve the comparability of more inherently risky venture candidates to incremental growth candidates by including an initial discovery and validation phase in the scope of the venture candidate. The purpose of the phase is to limit the amount of money being put at risk in the face of significant uncertainty, and to further understand the opportunity and validate assumptions before investing in the full solution.

Enabling the right planning conversations

Once you have evaluated and scored each of your innovation candidates for value, you can represent them in a forced rank list and “draw the line” where your allocated budget runs out. This is where you say ‘no’ or at least ‘not yet’ to investments that fall below the line of what you can afford, and you now have an objective, initial forced-rank list of high value candidates for your decision makers to consider in this planning cycle. Starting with a ranked list based on established, objective value criteria is critical to limiting the influence of the loudest voice in the room and ensuring that candidates promise a higher overall value to the company can be prioritized over individual “pet” candidates. It also reduces the cycles of debate. However, in my experience, it is, still critical to make room for the unique knowledge and insights that your decision makers bring to the discussion before locking in the final ‘above the line’ list of candidates.

Establishing a quarterly enterprise planning process that includes a performance evaluation of your currently funded innovation investments and ensures that your list of prioritized candidates is maintained and revisited enables your company to act quickly to reallocate your discretionary budget from investments that are performing poorly or in which you have discovered greater risk, to those that are yielding compelling results. Thus, reducing the overall risk in your investments, realizing more value from your investments in innovation, and ultimately, ensuring the long-term sustainability of your company.

Lisa Gorman brings over 20 years of experience working with global organizations on more effective approaches for enterprise planning and strategy execution through designing and leading large programs of change. Lisa is known for her ability to introduce the right mix of best practice methods applied with a practical, curious, and empathetic approach. She has a proven track record in helping organizations make better, more transparent decisions on where to spend their next dollar, and executing transformations that deliver on those investments.

Lisa is currently at Starbucks working on the adoption of a new digital operating model, collaborating closely with enterprise planning, transformation, and finance teams to incorporate a complementary portfolio governance approach and funding model, grounded in the achievement of OKRS versus large annual programs.

*How to Prioritize Your Innovation Budget, Harvard Business Review, Brad Power and Steve Stanton (September 24, 2014)

**Porter, M.E. (2008) The Five Competitive Forces That Shape Strategy, Harvard Business Review, January 2008

Recent Comments