Press Releases

FILTER BY

- All

- Aerospace & Defense

- Best Practices Awards

- Business & Financial Services

- Chemicals, Materials & Nutrition

- Energy & Environment

- Healthcare

- Industrial

- Information & Communications Technology

- Manufacturing

- Mobility

- TechVision

- White Papers

Cutting-edge Technologies Catalyze the Global Commercial Aircraft Aerostructures Market Growth

With sustainability as a key tool, the commercial aerospace industry is enhanced by innovative technologies

New Satellite Design Advances Fuel Market Growth for Satellite Propulsion Solutions

Satellite constellations generate ongoing demand for propulsion systems, according to Frost & Sullivan

Global Maritime SATCOM Services Growth to be Boosted by Smart Shipping

Rising demand for broadband connectivity among customers and crew members drives several segments of the maritime industry to adopt SATCOM services

Landing Gear System Market on a Growth Trajectory as Regional Connectivity Surges

The adoption of ultra-low-cost carrier business model expedites the global commercial aircraft landing gear system industry, says Frost & Sullivan

Global Aircraft Tire Market Growth Driven by the Recovery of the Aviation Industry

Growth potential in commercial flights will propel the demand for aircraft tires, with sustainability as a key investment area among vendors, says Frost & Sullivan

Global Ground Station Services Market to be Transformed by Innovative Business Models

Emerging business models help users cost-effectively schedule their data exchange tasks with their respective satellites, says Frost & Sullivan

How Can Airports Reach Sustainability Goals by Investing in Waste Management

Green efforts and focus on waste management will increase as air passenger traffic recovers, says Frost & Sullivan.

Robin Joffe Appointed as Partner-Managing Director of Frost & Sullivan Middle East, Africa, and South Asia

He brings over two decades of international business experience in market entry across various regions.

Innovation in Surveillance Technologies Ignites Global Surveillance Solutions Market Growth

Industry verticals need to address security concerns and acquire business intelligence data, says Frost & Sullivan.

Digitalization and Innovative Business Models Key to Transformational Growth in APAC, Finds Frost & Sullivan

With digital transformation and new technologies already disrupting multiple industries, organizations must innovate for the future to create value and drive better business outcomes.

Frost & Sullivan and TERI’s Sustainability 4.0 Awards 2021 Honor Companies Embedding Sustainability with Economic Value Creation

At the 12th edition, 23 awards were presented to companies for their exemplary performance in sustainability

Improvements in Flight Operations Expediting Global Commercial Avionics Market Growth

Regulatory mandates and new aircraft purchases inflate the global demand for avionics systems, says Frost & Sullivan.

Frost & Sullivan Marks its 60th Anniversary with a Renewed Focus on Enhanced Core Competencies and Streamlined Customer Experience

The company’s new digital platform will provide an expansion of data analytics to continually improve accuracy and service delivery

Global Aviation Satcom Market to Take Off as Airlines Offer Better Passenger Experience, Says Frost & Sullivan

The global aviation Satcom market is estimated to reach $730.4 million by 2030 from $527.2 million in 2020.

Frost & Sullivan Reveals the Top 10 Global Economic Trends Shaping the Growth Prospects in 2021 and 2022

Discover how the 2022 economic growth outlook is set to evolve globally and potential factors impacting businesses in our upcoming growth opportunity briefing.

Frost & Sullivan Reveals the Growth Opportunities in the Urban Air Mobility Industry

In this webinar, learn about the existing Urban Air Mobility (UAM) value chain, state of regulations, and likely roadmap to allow UAM operations globally. In addition, understand the links between the evolving technology supplier landscape and major UAM integrators.

Global Airline Digitalization Gains Traction, Thanks to Digital Technologies and Data Analytics

Asia-Pacific is expected to remain the largest revenue contributor to the airline digitalization market in 2030, while North America will be the fastest-growing region.

Frost & Sullivan Analyzes the Future of Digital Identity Management and Value Chain Compression

Join Frost & Sullivan’s webinar highlighting the impact of digital identity management and value chain compression on societies and industries on July 13th, 11 a.m. (EDT).

NTT DATA Receives Frost & Sullivan’s 2025 Asia-Pacific Competitive Strategy Leadership Recognition for Excellence in Generative AI Solutions

NTT DATA is honored for its end-to-end GenAI transformation capabilities and customer-centric innovation across APAC

RapidClaims Receives Frost & Sullivan’s 2025 North American Healthcare IT-Software and Services Technology Innovation Leadership Recognition for Excellence in AI-Driven RCM Automation

Recognized for driving operational efficiency and accelerating customer acquisition through AI-powered automation and a highly adaptive deployment model

TC&C Receives Frost & Sullivan’s 2025 Global New Product Innovation Recognition for Real-Time Deepfake Detection

The recognition acknowledges TC&C’s Deepfake Guard platform for pioneering real-time, enterprise-grade protection against synthetic media threats through innovation, scalability, and customer-focused design.

Penta Security Receives Frost & Sullivan’s 2025 South Korea Company of the Year Recognition for Excellence in Web Application Firewall Technology

Penta Security honored for its innovation-driven cybersecurity strategy, delivering intelligent threat detection and robust customer-centric solutions in the web application firewall market

QualiZeal Receives Frost & Sullivan’s 2025 India Technology Innovation Leadership Recognition for Excellence in GenAI Quality Engineering Platforms

QualiZeal’s AI-powered platforms are revolutionizing software quality engineering and accelerating innovation through GenAI-driven automation.

MatchMove Receives Frost & Sullivan’s 2025 Singapore Enabling Technology Leadership Recognition for Excellence in Embedded Finance Innovation

Recognition underscores MatchMove’s leadership in delivering cutting-edge embedded finance solutions that accelerate digital transformation through API-driven integration, AI, and scalable BaaS models.

AeC Receives Frost & Sullivan’s 2025 Brazilian Company of the Year Award for Excellence in Customer Experience Management

The company is recognized for innovation, operational excellence, and customer-centric digital transformation in Brazil’s fast-evolving CXM landscape

TP Receives Frost & Sullivan’s 2025 North American Company of the Year Recognition for Excellence in Secure Innovation

Frost & Sullivan recognizes TP’s AI-powered cybersecurity innovation, market leadership, and customer trust in safeguarding digital customer experiences across high-risk sectors.

Dräger Receives Frost & Sullivan’s 2025 Global Company of the Year Recognition for Excellence in Respiratory Devices Innovation

Dräger recognized for pioneering innovations in respiratory care, delivering measurable improvements in patient outcomes, clinical efficiency, cost-effectiveness and critical care training

NETSCOUT Earns Frost & Sullivan’s 2025 MENA Technology Innovation Leadership Recognition for Excellence in Cybersecurity Solutions

NETSCOUT pioneers AI-driven cybersecurity and integrated network visibility across digital ecosystems

Ubiquity Receives Frost & Sullivan’s 2025 North American Transformational Innovation Leadership Award for Excellence in Customer Experience Management

Recognized for transformational innovation and delivering breakthrough customer experience solutions through advanced technology and a customer-first strategy

NTT TechnoCross Receives Frost & Sullivan’s 2025 Japan Company of the Year Recognition for Leadership in Privileged Access Management

The company is recognized for pioneering innovation and customer-centric security solutions in the PAM industry

Fictiv Receives Frost & Sullivan’s 2025 Global Supply Chain for Custom Mechanicals Technology Innovation Leadership Recognition

Recognized for its innovative approach to global supply chain orchestration, delivering customer value and enabling sustainable growth potential across the custom mechanicals sector

Novotech Earns Frost & Sullivan’s 2025 Global Company of the Year Recognition for Excellence in Biotech Clinical Research Services

Recognized for its biotech-first focus, innovation in clinical trial delivery, and best-in-class client experience, Novotech sets the global standard in contract research for biotechs and small- mid-size pharma companies.

Ameresco Receives Frost & Sullivan’s 2025 Global Company of the Year Award for Excellence in Energy Services

Recognized for customer-centric innovation, strategic execution, and leadership in flexible, turnkey energy solutions worldwide

Frost & Sullivan Recognizes Leading Organizations with Prestigious 2025 Best Practices Awards

Frost & Sullivan celebrates companies for their outstanding achievements at the Frost & Sullivan Best Practices Awards Gala

Synopsys Receives Frost & Sullivan’s 2025 Global Technology Innovation Leadership Award for Advancing Analog In-Memory Computing

Synopsys recognized for its comprehensive AI-driven EDA suite and cloud-enabled design environment accelerating analog in-memory computing development—a next-gen solution enabling advanced AI chips

Chunghwa Telecom Receives Frost & Sullivan’s 2025 Taiwan Competitive Strategy Leadership Award for Excellence in Data Center Services

This recognition highlights Chunghwa Telecom’s strategic focus on delivering scalable, sustainable, and AI-ready data center solutions tailored to the evolving demands of Taiwan’s enterprise and hyperscaler clients.

ARC Group Applauded by Frost & Sullivan for Reliable and Superior Investment Advisory Service and Its Market-leading Position

ARC Group leverages its experience, expert workforce, and personalized customer relationships to build its brand among industry stakeholders and beyond.

Halal Economy Thrives as Product Demand from Muslims and non-Muslim Nations Surges

The buoyant market for the global halal economy is expected to reach $4.96 trillion by 2030, says Frost & Sullivan

Businesses Winning Women’s Hearts to Thrive: 9 Mega Trends Leading the Way in the Sheconomy

With a significant rise in women’s consumer spending, businesses across industries are turning toward AI-enabled solutions to better understand female clients, says Frost & Sullivan.

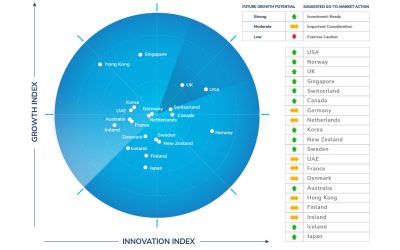

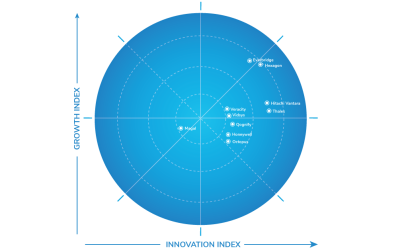

Top 3 Countries for Future Growth Potential: The United States, Norway, and the United Kingdom

Based on macroeconomic growth indicators and citizen-centricity, the United States, Norway, and the United Kingdom have been ranked the top three countries, demonstrating high future growth potential, according to the 2022 edition of Frost & Sullivan’s Frost Radar™ for Economic Development.

Robin Joffe Appointed as Partner-Managing Director of Frost & Sullivan Middle East, Africa, and South Asia

He brings over two decades of international business experience in market entry across various regions.

Frost & Sullivan Reveals Strategic Growth Opportunities Amidst Global Economic Recovery in 2022

Think Tank will explore how sustainability, digitalization and economic trends across regions are shaping regional and industry outlook

Tailored Digital Platforms Help Banks Enhance the Customer Experience throughout the Customer Journey

Banks use technology partners to spread risks while raising customer service levels, finds Frost & Sullivan

Financial Service Companies Look to Elevate Security by Partnering with Cloud Experts Offering Integrated Solutions

The financial services industry is amongst the earliest adopters of cloud and other new digital technologies. However, due to security risks, the road to modernisation has its challenges. Can the right solution provider ensure successful outcomes?

Frost & Sullivan Reveals the Top 10 Global Economic Trends Shaping the Growth Prospects in 2021 and 2022

Discover how the 2022 economic growth outlook is set to evolve globally and potential factors impacting businesses in our upcoming growth opportunity briefing.

Frost & Sullivan Analyzes the Future of Digital Identity Management and Value Chain Compression

Join Frost & Sullivan’s webinar highlighting the impact of digital identity management and value chain compression on societies and industries on July 13th, 11 a.m. (EDT).

Frost & Sullivan Commemorates Juneteenth as a Federal Holiday

The DEI Alliance at Frost & Sullivan honors the latest holiday addition with educational and celebratory resources.

Frost & Sullivan Announces New Vice President of Human Resources for Middle East, Africa and South Asia

She will be responsible for leading all human resources functions in the region and ensuring that the company continues to build a culture that attracts, engages, and develops the best teams.

Frost & Sullivan Unveils Strategic Opportunities in Digital Upskilling Shaping the Future of Work and Crowd Analytics

Various transformative trends and emerging opportunities are shaping the future of work and powering business and operational intelligence, opening up new avenues in digitalization

Frost & Sullivan Analyzes the Mega Trends Transforming the United States Through 2030

Millennials will remain the largest age group the US has ever seen (26.6% in 2030), ushering in a dramatic national shift as this population moves into leadership positions, family roles, and suburban living.

Global Companies Turn to Cloud-Based, Unified Solutions to Address Rising Demands from Investors, Regulators, and Internal Stakeholders

Frost & Sullivan’s white paper identifies factors driving the uptake of cloud-based reporting solutions and the advantages they bring.

Frost & Sullivan Experts to Analyze Economic Outlook of a Post-pandemic 2021

Frost & Sullivan outlines top 2021 predictions and growth opportunities expected to transform the global economic landscape.

8 Global Shifts for 2021 Reshaping Industries, Governments and Society

Changes in user behavior patterns will trigger major changes in consumption and business models.

5 Growth Opportunities to Seize in the Fintech Industry in 2021

Discover key trends and strategic recommendations in cybersecurity, big data, partnerships, digital banks, and personalization.

Antimicrobial Materials Sector Surges Amid Hygiene and Health Revolution

Pandemic-Driven Demand Shifts Focus to Safe, Durable, and Natural Compounds

Global Transformation: The Dynamics of Mergers & Acquisitions in the Packaging Industry

The packaging industry is filled with instances of mergers & acquisitions (M&A) as there is limited room for the industry to grow on its own. Its total dependence on end markets compels players to seek M&A activities to expand their capabilities and stay competitive.

Supply Chain Visibility to Ensure Humanitarian Assistance for All in Need

NEC focuses efforts on leveraging digital technologies to contribute to resolving supply chain visibility problems

Advantages of Hot Melt Adhesives (HMAs) Drive the Industry’s Growth

The global HMAs market is expected to garner $13.81 billion in revenue by 2028, registering growth at a CAGR of 6.3%, says Frost & Sullivan.

Global Cannabidiol Legalization Trend to Shape the CBD Market’s Future Growth

The global market for CBD will likely reach $4.09 billion by 2030, expanding at a CAGR of 9.5%, says Frost & Sullivan

Collaboration Between Drug and Medical Food Manufacturers to Boost Market Growth

Frost & Sullivan says the prevalence of lifestyle diseases and geriatric population drives demand for medical food globally.

Growth of Sustainable Farming Practices Drives the Agricultural Biologicals Market

The increasing need for crop protection products and product awareness will expand the biopesticides and biostimulants segments, says Frost & Sullivan.

The Global Aquaculture Market Witnesses Growth as the Demand for Protein Surges

The industry is a sustainable means to supply and feed the global population with environment-friendly protein products through smart farming, says Frost & Sullivan.

The Outbreak of COVID-19 Unlocked the Demand for Antimicrobial Technologies

Innovations triggered by the pandemic are pushing industries to adopt long-lasting antimicrobial technology, says Frost & Sullivan

Halal Economy Thrives as Product Demand from Muslims and non-Muslim Nations Surges

The buoyant market for the global halal economy is expected to reach $4.96 trillion by 2030, says Frost & Sullivan

Will the flooring materials market continue catering to its consumers with technological innovations?

The flooring materials market is poised to grow at a CAGR of 5-6%.

Global Automotive Plastics Market Boosted by the Need to Minimize CO2 Emissions

The global automotive sector will inflate the demand for sustainability targets to minimize CO2 emissions in the next 3–5 years, says Frost & Sullivan.

Spike in Geriatric Population Boosts Bone and Joint Health Ingredients Market

Manufacturers should focus on higher bioavailability ingredients and innovation says, Frost & Sullivan.

How DSM Merged with Firmenich: When Capabilities Complement each other

The complementary capabilities of the two companies are the biggest competitive advantage and will offer higher innovation and growth acceleration opportunity in the Nutrition, Health, & Beauty Space

How Global Healthcare Spending and Regulations Boost the Surgical Gloves Market

Demand for environmentally friendly biodegradable surgical gloves unlocks new opportunities for market participants, says Frost & Sullivan.

Robin Joffe Appointed as Partner-Managing Director of Frost & Sullivan Middle East, Africa, and South Asia

He brings over two decades of international business experience in market entry across various regions.

Digitalization and Innovative Business Models Key to Transformational Growth in APAC, Finds Frost & Sullivan

With digital transformation and new technologies already disrupting multiple industries, organizations must innovate for the future to create value and drive better business outcomes.

Frost & Sullivan and TERI’s Sustainability 4.0 Awards 2021 Honor Companies Embedding Sustainability with Economic Value Creation

At the 12th edition, 23 awards were presented to companies for their exemplary performance in sustainability

Smart HVAC Systems to Revolutionise Building Efficiency, Cybersecurity, and Customer Experience

Smart HVAC: The Backbone of Future-Ready, Secure, and Sustainable Buildings LONDON, 28th March 2025 – The global HVAC industry is undergoing a transformative shift, driven by the convergence of IoT, cloud computing, artificial intelligence (AI), and sustainability...

C&I Sector Decarbonisation Gains Momentum Amid Tech Advances, Regulations, and Sustainability Push

Digitalisation, climate accountability, and renewable procurement models like PPAs are transforming how commercial and industrial businesses decarbonise, with distributed solar and low-carbon solutions driving double-digit growth into 2035 LONDON, 24th March 2025 –...

Frost Radar™ Positions 15 Top Growth & Innovation Leaders in Material Recovery Facilities (MRFs)

Frost & Sullivan’s Benchmarking System Highlights Leading Companies Poised for Growth and Advancing Material Recovery Facilities LONDON, 20th March 2025 – The global Material Recovery Facility (MRF) market is undergoing significant expansion, driven by the rising...

AqVerium – World’s 1st Digital Water Bank partners with Frost & Sullivan, UK to develop the world’s 1st “Blue Taxonomy” for collective global Water Stewardship

World’s First Digital Water Bank Teams Up with Frost & Sullivan UK to Introduce “Blue Taxonomy”

Technology Convergence Driving the Development of Sustainable Crop Protection Solutions

Governments’ strategies such as proposing reducing fertilizer losses by at least 50% by 2030 drives innovation in the sustainable agrochemicals market

Global Modular Construction Market to Witness Growth as Demand for Efficient Construction Methods Rises

A shifting awareness of the use of modular buildings and the response to new socioeconomic trends have unlocked growth opportunities in the MC market

Top 50 Start-ups Bringing Innovation to the Global Homes and Buildings Industry

The homes and buildings industry is moving toward decarbonization and digitalization solutions, expecting $50.99 billion in revenue by 2028, says Frost & Sullivan

Indian WWW Treatment Market to Experience a Boom as the Country witnesses increase in Private Investments

The government implements new business models to attract private market participants in the industry and expedite its growth, says Frost & Sullivan.

Rising Industrialization and Sustainability: Why the Global Transformer Market is Growing

Distribution transformers will continue to dominate the overall transformer market growth opportunities due to rising urbanization and industrialization, says Frost & Sullivan.

Green Ammonia Market Looks Optimistic as Efforts to Boost Clean Energy Rise

The strict compliance to lower greenhouse gas emissions drives green ammonia technology adoption among ammonia manufacturers, says Frost & Sullivan.

Lighting Controls Industry Expands as Awareness of Energy Solutions Grows

The need to replace conventional lighting systems promotes global lighting controls market growth, says Frost & Sullivan.

EU Sets 100% Reduction Target in Vehicle CO2 Emissions from 2035 Onward

The European Parliament has voted to set a 100% reduction target in vehicular CO2 emissions from 2035 onward, accelerating the shift from combustion engines to electric vehicles.

Robin Joffe Appointed as Partner-Managing Director of Frost & Sullivan Middle East, Africa, and South Asia

He brings over two decades of international business experience in market entry across various regions.

Need for Infrastructure Resilience and Efficiency Fueling Demand for Digital Water Solutions, Finds Frost & Sullivan

Digital twins will experience high uptake due to their ability to optimize processes and enhance efficiencies

Transition to Net-Zero Emissions Catalyzes Asia-Pacific Utilities’ Adoption of Distributed Energy Resources

DER applications, including storage, solar, and EV charging infrastructure, will enable companies in the region to meet their sustainability goals, finds Frost & Sullivan

Global Oil & Gas Automation Market to See Positive Growth with Digitalization and New Disruptive Technologies

Spurred by technology innovation, the overall market revenue is expected to reach $24.6 billion by 2025, Finds Frost & Sullivan

Digitalization and Innovative Business Models Key to Transformational Growth in APAC, Finds Frost & Sullivan

With digital transformation and new technologies already disrupting multiple industries, organizations must innovate for the future to create value and drive better business outcomes.

Corporate Carbon-Neutral Strategies Set to Create New Revenue Streams for Companies

Development of new carbon regulatory frameworks will impact the global decarbonization goals and promote transparent messaging.

Immune-Oncology Innovations: The Future of Cancer Treatment with ICIs, CAR-T, and CAR-NK Cell Therapies

The landscape of immune-oncology (I-O) is rapidly evolving, driven by groundbreaking innovations in cell therapies and immune checkpoint inhibitors (ICIs). As the leading class of I-O agents, ICIs continue to be a foundational treatment for various cancers, while...

The Fourth Revolutionary Wave of Biologics Manufacturing: CDMOs Empower Large-scale Production of Biologics

More biologics programs have entered late clinical and commercialization stages globally. The number of FDA-approved biologics and cell/gene therapies rose from 11 in 2019 to 24 in 2023.

Are You Leveraging the Drug Discovery and Early Development Outsourcing Services Ecosystem to Accelerate Growth?

By Frost & Sullivan

Organizational-level, Unified and Vendor-neutral Enterprise Imaging and Informatics Drive Effective Digital Transformation

Scalable enterprise-level solutions leverage all data at an enterprise level and can engage with the entire unified longitudinal patient record

Women’s Evolving Healthcare Issues Require Change in Mindset as well as Holistic and Personalized Care Delivery Models

The changing landscape of women healthcare presents 10 lucrative growth opportunities by 2030, says Frost & Sullivan

In Vitro Fertilization Services Industry to be Boosted by Innovative Technologies

Global IVF services market is expected to reach $43.97 billion by 2027, registering growth at a CAGR of 20.46%

Magnetic Resonance Imaging Market to Witness Growth Due to Increasing Demand for Scans

The prevalence of cardiovascular and oncology diseases and the shortage of radiologists have boosted the development of innovative MRI technologies

Cardiac Troponin Diagnostics Market Growth Boosted by High-sensitivity Point-of-care Testing

The rise in emergency department visits due to cardiac complaints drives the demand for cTn biomarkers

Medical Device Connectivity Market Growth Helps Overcome Healthcare Professionals’ Challenges

The MDC industry will witness growth due to the rise of MedTech and the incorporation of new technologies

Prenatal Genetic Testing Market to Improve Accuracy Through Technological Advances

Rising patient awareness drives technological advances and expands marketing for prenatal genetic tests globally, says Frost & Sullivan

How to Build Next-Generation Workplaces and Empower Employee Mental Health

World Mental Health Day creates an opportunity to raise awareness of mental health issues around the world and create strategies to support it in different workplaces

How Healthcare Organizations Can Enhance a Holistic Patient and Member View by Improving Insights from Data

A future-proof enterprise content management and enterprise imaging strategy across healthcare organizations enables individualized experiences, cost-saving efficiencies, and productivity gains

Frost & Sullivan Explores the Growing Impact of the Digital Front Door on Healthcare

Digital front door helps creating a new, consumer-centric paradigm in healthcare, at the same time it can improve patient satisfaction

Top Artificial Intelligence Trends Influencing the Future of Radiology

Discover how artificial intelligence will impact the radiology field, creating new growth opportunities

Technology Solutions to Boost Employee Experience and Improve Patient Outcomes

Workforce management solutions from DXC and SAP support healthcare providers in managing their teams while focusing on employees’ well-being and ability to deliver quality care.

How Can Digitalization of Medical Devices Boost Productivity in Med-tech

The digital transformation of medical devices encourages medtech players to deliver significant value for providers and patients, says Frost & Sullivan

Innovative Business Models in Digital Health Improve Efficiency Across the Care Continuum

Digital health solutions will become inevitable to support better healthcare outcomes at lower costs, says Frost & Sullivan.

Global Pharmaceutical Market Drives Innovative Digitalization to Accelerate Drug Discovery

According to Frost & Sullivan, digitalization across the pharmaceutical value chain will improve the industry efficiency.

Vivity AI Applauded by Frost & Sullivan for Addressing Inefficiencies and Risk Mismanagement in Heavy Industry and its Market-leading Position

Vivity is expanding globally, landing customers in the United States, Southeast Asia, and the Middle East, as heavy industry customers span geographies yet work similarly around the world.

Are you leveraging circular economy strategies for growth within your manufacturing operations?

By Frost & Sullivan

TOP STRATEGIC IMPERATIVES SHAPING THE MATERIALS INDUSTRY

By Frost & Sullivan

Are You Optimizing Your Growth Strategy to Leverage Key Opportunities in the Machines Industry?

By Frost & Sullivan

The Global Non-destructive Testing Software Market to Witness Growth with Improved Safety Requirements

The NDT testing software market is expected to reach $853.7 million by 2026, registering expansion at a CAGR of 11.1%

Digital Solutions and Sustainability Prompt the Global Building Management Systems Market Growth

Increasing industry convergence and the emergence of innovative technologies revolutionize the global BMS industry, says Frost & Sullivan.

Global Robot-based Metrology Boosted by the Need to Measure without Human Assistance

The global robot-based metrology market will reach $396.2 million by 2026

Global Metrology Software Market Driven by High Demand for Quality Control

Customer preferences shifting toward in-line metrology will be a key enabler for smarter metrology solutions and software, says Frost & Sullivan

Rising Internet Penetration and Falling Smartphone Prices Propel Indian Mobile Phone Market

The government’s Production-Linked Incentive scheme is helping manufacturing companies increase their year-on-year sales, finds Frost & Sullivan

Robin Joffe Appointed as Partner-Managing Director of Frost & Sullivan Middle East, Africa, and South Asia

He brings over two decades of international business experience in market entry across various regions.

Frost & Sullivan Lauds Everbridge for its Innovative Leadership and Growth in the Command and Control Software Industry

Everbridge earns a top spot in the Frost Radar™: Command and Control Software for Critical National Infrastructure (CNI), Airports, and Safe Cities, Global, 2021

Connectivity and Advanced Technologies to Boost Growth Prospects for Global Semiconductor Devices

Increasing use of electronic content in automotive and factory automation is driving the semiconductor devices market globally, says Frost & Sullivan

Enterprises’ Need for OT Security Expertise Propels Growth of Industrial Cybersecurity Market

Revenues for buoyant global industrial cybersecurity market are likely to reach $10.2 billion by 2025, says Frost & Sullivan

Industrial Demand Creating Positive Outlook for Global Compressor Market

Major vendors and distributors must leverage new technologies such as IoT and real-time monitoring to gain a bigger market share in the global compressor market.

Computed and Direct Radiography to Boost Global X-ray Inspection Systems Market

Quality control and inspection solutions will be important to Industry 4.0-driven smart factories, creating growth opportunities.

Need for Shop Floor Metrology Solutions across Manufacturing Sectors Drives the Demand for Portable CMMs

Automotive and machine shops are expediting portable coordinate measuring machines market growth, finds Frost & Sullivan

Top 9 Growth Opportunities in the Industrials Market for 2022

Frost & Sullivan’s experts present strategic insights on key trends such as manufacturing 5.0, sustainability, and smart lifecycle services.

Automotive, Aerospace Industries Lead Demand for Stationary Coordinate Measuring Machine Market

CMM’s integration with mobile and robot-mounted systems for rapid measurement expedites global stationary CMM market growth, says Frost & Sullivan

Adopting AI: Moving Beyond the Hype to Practical Implementation

This continues the Frost & Sullivan series covering AI transformation: AI Transformation: A Business Imperative, Not Just a Technology Shift https://www.linkedin.com/pulse/ai-transformation-business-imperative-just-ijync Continuing the Journey to Unlock the ROI of...

Redefining Digital Identity and Human-AI Collaboration: Discoveries at Expo 2025 Osaka

Recently Georgia Edell had the privilege of attending Expo 2025 Osaka at the invitation of NEC Corporation, a long-standing leader in cutting-edge technology and innovation. Having collaborated with NEC and extensively researched their biometric authentication...

AI and Workspace Modernisation Propel Growth in the Global Video Conferencing Devices Sector

10.4% YoY expansion in in 2024 prompted by AI innovation and the return to in-person collaboration LONDON, 21th March 2025 - The workplace continues to undergo structural transformations, with evolving work styles, AI-powered meeting enhancements, and sustainability...

AWS Summit São Paulo 2024: AI and GenAI Take Center Stage

The AWS Summit São Paulo 2024 gathered 13,000 cloud enthusiasts to explore AI and generative AI innovations. Keynotes by AWS leaders highlighted AI’s transformative power, with solutions like Amazon Bedrock, SageMaker, and custom AI hardware showcased. Customer success stories and industry insights rounded out the event

How Are Organizations Strategizing to Overcome Growth Restraints and Navigate the Transition to Immersive Worlds?

By Frost & Sullivan

Companies to Action: Workforce Optimization Initiatives Transforming the Contact Centers Landscape

By Frost & Sullivan

Scaling Up AI Deployments: Harnessing Opportunities Sparked by Growing AI Maturity

By Frost & Sullivan

Companies to Action: Accelerating Digital Transformation with Disruptive Cloud Technologies

In the face of disruptive technologies and shifting business paradigms, being recognized as a “Companies to Action” marks a significant achievement, highlighting their ability to navigate complex landscapes and seize new opportunities with resilience and foresight.

Ascenty Awarded the 2023 Brazilian Company of the Year Award for Leading the Data Center Infrastructure across Latin America with Its Best-in-class Infrastructure

Ascenty is a trusted partner in customers’ digital transformation journey based on its extensive industry expertise, next-generation infrastructure, and outstanding services.

Gigamon Recognized by Frost & Sullivan for their Market-leading Position with the 2023 Global Company of the Year Award in Network Observability for Cybersecurity

Gigamon harnesses powerful network-derived intelligence and insights, enabling clients to enhance business agility, ensure cloud security, and minimize hybrid cloud cost and complexity.

Movers & Shakers Interview with Michal Harris, SVP Global Marketing, Beyond Now

Read our Movers & Shakers interview with Mei Lee Quah, Director, ICT Research, Frost & Sullivan and Michal Harris, SVP Global Marketing of Beyond Now

Movers & Shakers Interview with Shirin Esfandiari, Senior Director of Product Marketing, Oracle Communications

Read our Movers & Shakers interview with Mei Lee Quah, Director, ICT Research, Frost & Sullivan and Shirin Esfandiari, Senior Director of Product Marketing, Oracle Communications

Internet of Things (IoT): Top 10 Growth Opportunities for 2023

Geopolitical tensions, sustainability concerns, and supply chain disruptions are changing the IoT market perspective

Real-time Monitoring and the Ease of Data Retrieval Prompt the Adoption of Sensor Technologies

Security sensors integrated with other emerging sensor technologies provide safe and sophisticated security to critical assets

Leveraging Digital Technologies Can Help Grow Strong and Sustainable Communities

Capacity-building efforts provide the poor with sustainable tools that they can use to improve their circumstances and remove themselves from the poverty cycle

Green IoT and Communication Technologies Boost Environmental Sensor Market Growth

Sensors’ small size, low power, and communications capabilities will drive growth opportunities across industries

Identity for All Children and their Brighter Future in an Accessible Society for All

By utilizing biometrics, developing countries can effectively work with their citizens for wide-scale enrollment and expanded public service delivery

India 2023 Top 5 Trends to Watch in Information and Communication Technology (ICT) Industry

ICT has become one of the most significant growth catalysts for the Indian economy, contributing significantly to the country’s economic growth and welfare.

Exciting Times for The Augmented Connected Worker: Explosive Growth and Vast Opportunities for Innovation

A new piece of software is helping to connect frontline workers with their digital infrastructure

Frost & Sullivan Recognizes Future-Ready Companies at the India Manufacturing Excellence Awards 2022

19 awards were presented to companies for their exemplary performance at the 18th edition

Nominations for the 19th edition of the awards are open until May 15, 2023

Digital Technologies Drive Growth Across the Biomanufacturing Value Chain

Digitalization enables a sustainable, effective, cost-efficient, and error-free system for biomanufacturing.

Global Metrology Software Market Driven by High Demand for Quality Control

Customer preferences shifting toward in-line metrology will be a key enabler for smarter metrology solutions and software, says Frost & Sullivan

Robin Joffe Appointed as Partner-Managing Director of Frost & Sullivan Middle East, Africa, and South Asia

He brings over two decades of international business experience in market entry across various regions.

Frost & Sullivan and TERI to Recognize Indian Organizations Embedding Sustainability with Economic Value Creation at its Sustainability 4.0 Awards 2022

For the first time, Frost & Sullivan and TERI to bring in sustainable healthcare organizations under its India Sustainability 4.0 Awards umbrella

Corporate Carbon-Neutral Strategies Set to Create New Revenue Streams for Companies

Development of new carbon regulatory frameworks will impact the global decarbonization goals and promote transparent messaging.

India Manufacturing Excellence Awards 2022 will Identify and Recognize Future-Ready Factories

The 18th edition of Frost & Sullivan’s India Manufacturing Excellence Awards will take place on December 9, 2022.

Frost & Sullivan and TERI’s Sustainability 4.0 Awards 2021 Honor Companies Embedding Sustainability with Economic Value Creation

At the 12th edition, 23 awards were presented to companies for their exemplary performance in sustainability

Frost & Sullivan Recognizes Companies at the Forefront of Industry 4.0 Adoption at the India Manufacturing Excellence Awards 2021

The 17th edition of Frost & Sullivan’s India Manufacturing Excellence Awards honored companies at the forefront of adopting Industry 4.0. Organizations were evaluated on their manufacturing capability, extended supply chain reliability, and technology adoption.

Frost & Sullivan Reveals the Top 10 Global Economic Trends Shaping the Growth Prospects in 2021 and 2022

Discover how the 2022 economic growth outlook is set to evolve globally and potential factors impacting businesses in our upcoming growth opportunity briefing.

Frost & Sullivan Analyzes the Future of Digital Identity Management and Value Chain Compression

Join Frost & Sullivan’s webinar highlighting the impact of digital identity management and value chain compression on societies and industries on July 13th, 11 a.m. (EDT).

Seeq Lauded by Frost & Sullivan for Supporting Collaboration among Distributed Teams with Cloud-based Advanced Analytics

Seeq partners with cloud computing giants to deliver significant benefits to enterprises in era of remote working

Frost & Sullivan Commemorates Juneteenth as a Federal Holiday

The DEI Alliance at Frost & Sullivan honors the latest holiday addition with educational and celebratory resources.

Frost & Sullivan Announces New Vice President of Human Resources for Middle East, Africa and South Asia

She will be responsible for leading all human resources functions in the region and ensuring that the company continues to build a culture that attracts, engages, and develops the best teams.

Frost & Sullivan Unveils Strategic Opportunities in Digital Upskilling Shaping the Future of Work and Crowd Analytics

Various transformative trends and emerging opportunities are shaping the future of work and powering business and operational intelligence, opening up new avenues in digitalization

Frost & Sullivan Analyzes the Mega Trends Transforming the United States Through 2030

Millennials will remain the largest age group the US has ever seen (26.6% in 2030), ushering in a dramatic national shift as this population moves into leadership positions, family roles, and suburban living.

CEVA Lauded by Frost & Sullivan for Addressing the Challenges of Connected Devices with Its Smart Sensing MotionEngine™ Software

CEVA’s versatile and highly precise sensor fusion solution ensures an optimum customer experience in diverse consumer electronics and industrial markets

Automotive Sector Poised for Major Shifts Amid EV Expansion and Fiercer Competition

Strategic partnerships, expanded EV portfolios, and new production hubs set to reshape the global automotive landscape LONDON, 18th March 2025 – The global automotive industry is undergoing a significant transformation, with 2025 poised to bring new developments...

What Trump’s Election Victory Could Mean for the Future of the Automotive Industry

How emissions deregulation, protectionist tariffs, and Musk’s influence could reshape both the U.S. and the global automotive industry.

Confronted by Rising Costs, Weakening European Demand, and Increased Competition from Chinese Automakers, Volkswagen opts for Drastic Restructuring

What impact will plant closures and layoffs in Germany have on the future of Volkswagen, Germany, and the global automotive industry?

Technological Breakthroughs and Shifting Consumer Preferences Fueling Feature on Demand (FoD) Growth in Passenger Vehicles

FoD services are reflective of customer demands for enhanced connectivity, personalization, and flexibility, while offering automakers the opportunity to introduce recurring revenue streams.

Pioneering Tomorrow’s Infrastructure: Highlights from Bentley Systems’ Year In Infrastructure (YII) 2024

AI and digital twins take centerstage even as new product launches spotlight the importance of open data and collaboration.

FADA and Frost & Sullivan Launch Pioneering Customer Experience Index (CEI) Study

Empowering Auto Industry with Data-Driven Insights to Craft Superior Customer Strategies.

Anticipated Unveiling of Results Set for September 2024

Ecosystem Collaborations will be Pivotal if Kick Scooter Sharing Services Market is to Overcome Safety Concerns

Almost a year to date in April 2023, citing reckless driving, haphazard parking, and safety issues, nearly 90% of Parisiennes voted to ban e-scooter rentals in the city. By September 1, the 15,000 strong e-scooter fleet headlined by companies like Lime, Dott and Tier...

Are You Collaborating with the Shared Mobility Startup Ecosystem for Sustained Growth?

By Frost & Sullivan

Burgeoning Freight and Logistics Demands to Fuel Recovery of China’s Commercial Truck Industry

Truck electrification emerges as a major trend with electric powertrains set to reach 1 million units in 2030 on the back of technological improvements and government support. Commercial truck sales in China plunged from 3.7 million units in 2021 to 2.4 million units...

Automechanika and Frost & Sullivan Forge New Partnership for Global Impact

Frost & Sullivan, the global Growth Pipeline Company, proudly announces a significant milestone in its commitment to knowledge sharing and industry collaboration through a strategic knowledge partnership with the international Automechanika trade fair brand.

Chinese Automakers and Electromobility Trends Set to Shake Up ASEAN Passenger Vehicle Market

Competitive disruption will be evident across major markets like Indonesia, Malaysia, and Thailand as the process of transitioning to alternative powertrain solutions picks up pace and foreign companies like BYD, Great Wall Motor, LG, Hyundai and Tesla and BASF attempt to strengthen their presence.

In the Quest for Flexible, Efficient, and Sustainable Transport, Cities Turn to Technology-Driven Shared Mobility Modes

Strategic partnerships and Intelligent technologies will be crucial as a new shared mobility ecosystem takes shape.

Severing Connections: Implications of GM’s Decision to Embrace a Built-in, Native Operating System

Customers pushback over decision to abandon Android Auto and CarPlay, even as automaker looks to open up new monetization channels.

Demand for Smart City Solutions Spikes with Investments in Upgrading Telecommunication Networks

Smart city solution providers are developing new capabilities and products, expanding the ecosystem, says Frost & Sullivan

Global Demand for Autonomous Vehicles Encourages Alliances with Start-ups

Adoption of autonomous features will create new growth opportunities for start-ups, says Frost & Sullivan

Brazilian Connected Trucks Telematics Will Reach 2.59 Million Units by 2027

Carriers and insurance companies’ emphasis on risk management require telematics solutions on trucks that carry dangerous or expensive goods, says Frost & Sullivan

Engage with a Sustainable Future through Software-defined Vehicles at Frost & Sullivan’s Summit

In a two-day virtual summit, Frost & Sullivan dives into how software-defined vehicles and other key technologies will drive a clean energy future

Bankruptcy and One of the Largest Transactions Ever: the Future of SPAC Deals

Although Special Purpose Acquisition Company (SPAC) transactions have had their share of hits and misses, they continue to be instrumental in driving the electric vehicle market.

Evolution of the Smart Home Hub is the Next Growth Frontier, Finds Frost & Sullivan

Purposeful design and efficient use of space are transforming the home into a smart home hub

Frost & Sullivan’s Top 10 Trends for 2022: Metaverse and Cashless Economies to Drive Growth in Uncertain Times

Frost & Sullivan experts present strategic insights on key trends such as urban exodus, China’s technology crackdown, decentralized autonomous organization, and geopolitical instability

Mobile Medical Imaging Systems Improving Care Accessibility and Convenience for Patients

Portability and cost-effectiveness are key factors propelling the adoption of mobile medical imaging technology globally, says Frost & Sullivan

Rapid Expansion of 5G Network Rollout Drives the Global 5G Materials Market

Use of artificial intelligence technology in developing new 5G materials presents lucrative prospects for market players, says Frost & Sullivan

Frost & Sullivan Reveals How the Lights-Out Setting is Redefining Manufacturing

Companies have an opportunity to optimize their human capital and potentially save up to 20% of labor costs and generate a 30% increase in productivity output by switching to a lights-out operations model.

Frost & Sullivan Analyzes the Future of Digital Identity Management and Value Chain Compression

Join Frost & Sullivan’s webinar highlighting the impact of digital identity management and value chain compression on societies and industries on July 13th, 11 a.m. (EDT).

Frost & Sullivan Commemorates Juneteenth as a Federal Holiday

The DEI Alliance at Frost & Sullivan honors the latest holiday addition with educational and celebratory resources.

Digital Technology Advancements Propel Solar and Wind Farm Inspection Transformation

Leveraging digital technologies tp improve quality, safety, and productivity of the inspection says Frost & Sullivan

Frost & Sullivan Announces New Vice President of Human Resources for Middle East, Africa and South Asia

She will be responsible for leading all human resources functions in the region and ensuring that the company continues to build a culture that attracts, engages, and develops the best teams.

Energy Sector Illuminates with Technology Advancement and the Emergence of Prosumerism

Frost & Sullivan analysis notes distributed energy resources alongside smart analytics and energy storage to boost energy optimization.

Advanced Micro- and Nanofluidics to Revolutionize the Point-of-care Diagnostic Industry

Frost & Sullivan’s recent analysis, Advanced Micro- and Nanofluidics Revolutionizing the Point-of-care Diagnostic Industry, finds the scientific community has made tremendous progress in making microfluidics more autonomous with the integration of new powering mechanisms and sensor technologies, which can enable at-home or self-test devices.

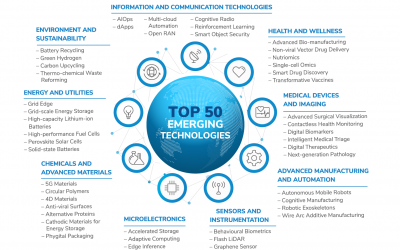

Frost & Sullivan Reveals the 50 Game-changing Technologies Transforming the Future

The webinar will highlight the top 50 technologies transforming the future and explore how these converging technologies will create unprecedented opportunities for new revenue models and innovative solutions that will transform the world.

Future of Hyperconnectivity Offers Billion-dollar Opportunities in the Connected Living Ecosystem

Frost & Sullivan’s recent analysis, Future of Connected Living, reveals that the device-to-person ratio will exceed 20 to 1 by 2030 as the world enters the era of hyperconnectivity and catapults organizations’ digital transformation.

Frost & Sullivan Unveils the Future of User Interfaces Shaping New Consumer Experiences

Frost & Sullivan’s recent analysis finds that user interface (UI) technologies have moved beyond the concept of simply representing machines to their users to enabling sophisticated and personalized interaction.

Frost & Sullivan Experts to Analyze Economic Outlook of a Post-pandemic 2021

Frost & Sullivan outlines top 2021 predictions and growth opportunities expected to transform the global economic landscape.

Freshwater Supply Challenge Stimulates Innovation in Reverse Osmosis Seawater Desalination Technology

Reverse Osmosis Seawater Desalination technology driven by rising water scarcity, widening water demand-supply gap, and demand for a reliable source of freshwater, says Frost & Sullivan

8 Global Shifts for 2021 Reshaping Industries, Governments and Society

Changes in user behavior patterns will trigger major changes in consumption and business models.

5G and Wi-Fi 6 to Disrupt Communication Protocols of Building Automation Systems

Frost & Sullivan’s recent analysis finds that 5G and Wi-Fi 6 will have a major impact on the connectivity of building technologies. 5G can provide greater accessibility when managing buildings more remotely and Wi-Fi 6 can provide faster data transfer speed between devices and enhance device performance at low energy utilization standards.

Frost & Sullivan Lauds Everbridge for its Innovative Leadership and Growth in the Command and Control Software Industry

Everbridge earns a top spot in the Frost Radar™: Command and Control Software for Critical National Infrastructure (CNI), Airports, and Safe Cities, Global, 2021

Improving Customer-facing Team Performance in the Hybrid Work Era

Productivity and efficiency will shape the era of hybrid working. Are your customer-facing teams equipped with the tools and data they need to reach their full potential?

Contract Development and Manufacturing Organizations Shifting Focus to Meet Future Demand

An integrated and agile approach enables the pharmaceutical CDMO industry to simplify manufacturing as it moves from primary care medicines to specialty medicines

How to Meet High Expectations as Customers Rapidly Shift to Self-Service

Customers’ increasing demands for self-service have pushed companies’ to reprioritize their digital roadmaps in a rush to meet customers’ expectations. Because live interactions cost companies 24 to 48 times as much as self‐service tools, improving operational efficiency by implementing self-service customer channels promises an enormous return on investment (ROI).

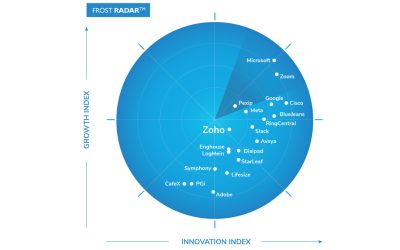

Frost & Sullivan Recognizes Zoho as a Growth and Innovation Leader in the Global Cloud Meetings and Team Collaboration Services Market

Zoho’s innovative solutions with recent technology improvements, increasing brand awareness, and smart collaboration services contribute to its market-leading position.

Frost & Sullivan Recognizes Teleperformance as Growth and Innovation Leader in the Asia-Pacific Customer Experience Outsourcing Services Market

Teleperformance continues to be a preferred partner for fast-growing and leading companies looking to redesign their CX and business processes

Red Hat Enables Energy Companies to Embrace Digital Transformation and Smart Partnerships to Adjust to Dynamic Changes

Utilities, O&G, and other energy companies adopt new technologies, capabilities, partnerships, and priorities to keep up with tectonic changes in the industry

Enterprises Adopting Intelligent Service Management Tools to Improve Employee Satisfaction

Businesses need to deploy a modern, intuitive ITSM platform to achieve faster time to value, finds Frost & Sullivan

Frost & Sullivan Recognizes MCM Telecom as a Leader in Mexico and Latin America in the Unified Communications as a Service Corporate Sector

MCM Telecom stands out for its wide range of telecommunications services that significantly increase the connectivity and productivity strategies for companies with hybrid work environments.

Frost & Sullivan Reconoce a MCM Telecom como líder en México y Latinoamérica en Comunicaciones Unificadas como Servicio para el Sector Corporativo

MCM Telecom destaca por su amplia oferta de servicios de telecomunicaciones que aumenta significativamente la conectividad y productividad de las empresas en ambientes híbridos

Leveraging the Cloud Helps Insurance Service Providers Optimize Business Processes and Improve Customer Experience

Service providers that support a variety of virtualization options can help companies become future-ready, finds Frost & Sullivan

Increasing Focus on Advancing Digital Customer Experience (CX) Transformation for Brands Boosts European Outsourcing Industry

CX outsourcers can positively affect the customer journey, helping brands deliver a consistent and appropriate digital experience

Advanced Performance Management Platforms will Enable Contact Centers to Deliver Enhanced CX

Incentivizing and engaging agents results in big leaps in performance and a subsequent rise in customer satisfaction, finds Frost & Sullivan

Retailers Offer Effective, Differentiated Customer Experience with Contact Center-as-a-Service

Digital solutions that offer deep visibility into customer journeys and supply chain ecosystems to drive superior efficiencies, finds Frost & Sullivan

Flawless Audio Boosts Effective Collaboration and Equal Opportunity in Hybrid Work

Frost & Sullivan and Shure’s latest white paper reveals that teams are less accepting of audio disruptions that derail their meeting agenda, make them less productive, or appear unprofessional.

Tailored Digital Platforms Help Banks Enhance the Customer Experience throughout the Customer Journey

Banks use technology partners to spread risks while raising customer service levels, finds Frost & Sullivan

Healthcare Providers to Gain a Holistic View of the Patient by Employing an Integrated Content Services Platform

A unified enterprise strategy that includes both clinical content and medical imaging is critical for delivering efficient and quality care, finds Frost & Sullivan

Aggressive Cyber Threats Drives Organizations to Adopt Extended Detection and Response Solutions

Extended detection and response (XDR) solutions are effective for adapting to a constantly evolving threat landscape.