This blog is based on Frost & Sullivan’s analysis Megatrends in a Post-tariff World, by Sukriti Mahana, from the TechVision Megatrends team.

Global Transformation Overview

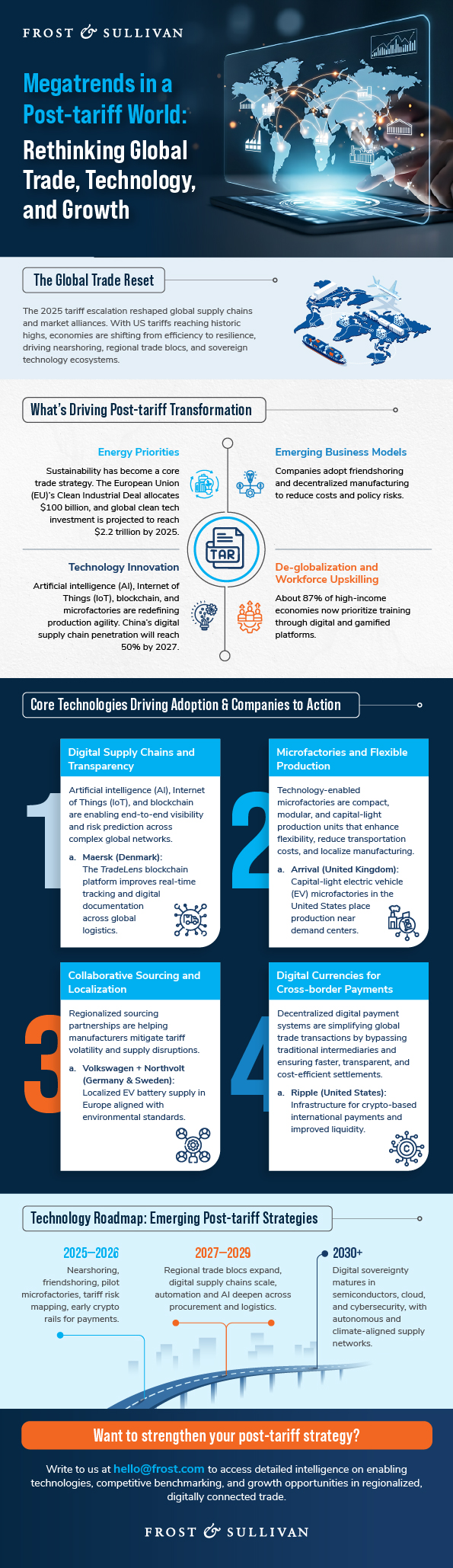

In 2025, the sharp escalation of United States tariffs triggered one of the most significant global trade realignments in modern history. Supply chains once optimized for efficiency have been restructured around resilience, localization, and digital transparency. Businesses are now navigating a world defined by regional alliances, technology-enabled manufacturing, and sustainability-driven policies.

How is your organization adapting to the forces reshaping trade and innovation in the post-tariff world?

Download Frost & Sullivan’s sample to explore strategy alignment and industry foresight.

Transformative Megatrends Influencing the Post-tariff Era

- Energy Priorities: Sustainability is emerging as a cornerstone of trade competitiveness. The European Union’s Clean Industrial Deal, backed by USD 100 billion, and global clean tech investments projected at USD 2.2 trillion by end-2025, highlight the transition toward green manufacturing and energy diversification.

- Emerging Business Models: Organizations are adopting decentralized manufacturing networks, friendshoring collaborations, and personalized banking to increase financial agility and manage geopolitical risk. These models support faster decision-making and localized innovation.

- Technological Innovation: Digital supply chains, microfactories, and advanced technologies such as artificial intelligence (AI), Internet of Things (IoT), and blockchain are enabling transparent, automated trade systems. By 2027, China’s digital supply chain penetration is expected to reach 50%, underscoring how technology is reshaping production and logistics.

| Future Scenarios of Global Tariff Evolution

· Resurgence of Trade Wars: Extended tariff cycles disrupt supply chains, raise costs, and strain global trade stability. · New Trade Blocs: Regional alliances form to reduce reliance on US markets and strengthen intra-regional trade. · Strategic Trade Agreements: Negotiated tariff reductions rebuild cooperation, transparency, and economic predictability. · Techno Blocs: Innovation drives resilience as automation, AI, and digital supply chains offset tariff risks. Which trade pathway will shape your organization’s growth strategy? |

- Rise of De-globalization: Protectionist sentiment is growing. Around 87% of firms in high-income countries now prioritize workforce upskilling, leveraging digital and gamified learning platforms to enhance competitiveness.

- Supply Chain Shifts: With US imports falling 23% since 2025, companies are moving toward nearshoring, regional manufacturing, and China + Many strategies to reduce tariff exposure and ensure business continuity.

How are your teams embedding digital resilience into their global operations?

How Businesses Are Reinventing Operations in the Post-tariff Era

- Emerging Business Models in the Post-tariff World: Friendshoring, reshoring, and decentralized manufacturing (DM) are reshaping industrial strategy. These approaches allow companies to build smaller, interconnected production hubs that respond faster to market disruptions.

Which manufacturing model aligns with your regional growth strategy?

| Companies to Action

· Nobi (Netherlands): Relocated assembly from China to Belgium, trading short-term cost savings for supply chain control and agility. · Inditex (Spain): Repositioning manufacturing to Turkey and Morocco to mitigate geopolitical risks and cut logistics costs. · Arnott’s (Australia): Adopted decentralized manufacturing, improving operational uptime by 89% and reducing transportation costs. |

| [Request a sample to evaluate how leading organizations are reinventing supply networks through decentralization. Write to us at [email protected]] |

- Economic Shifts and New Trade Alliances: Tariff-driven protectionism has sparked economic recalibration. As imports drop, nations are forming collaborative sourcing frameworks and cross-border alliances to stabilize procurement.

How are you diversifying your supplier network to safeguard against policy-driven volatility?

| Companies to Action

· Volkswagen (Germany): Partnered with Northvolt to build European electric vehicle (EV) battery facilities, ensuring localized supply and compliance with sustainability regulations. · Apple (United States): Shifting iPhone production to India by 2026 under its China + Many strategy, aiming to produce 60 million units annually while reducing geopolitical dependency. |

- Technology Advancements Defining the Post-tariff Landscape: The tariff disruptions have accelerated digital adoption and automation across industries. Businesses are investing in smaller, technology-enabled microfactories and blockchain-driven logistics to achieve visibility and flexibility.

Where does your organization stand in the race toward AI-driven trade and digital supply networks?

| Companies to Action

· Arrival (United Kingdom): Deploying EV microfactories in the United States, cutting capital expenditure from USD 1 billion to USD 50 million per facility. · Ripple (United States): Providing blockchain-based cross-border payment infrastructure for faster, transparent international transactions. · Maersk (Denmark): Using the TradeLens platform to enable real-time cargo visibility and document automation, reducing manual delays by up to 40%. |

Growth Opportunity: Digital Sovereignty

Digital sovereignty has become a strategic growth pillar as countries localize semiconductor, cloud, and AI infrastructure. With an opportunity exceeding USD 1 billion within three years (base year 2025), this shift strengthens national security, data control, and technological independence.

Growth Indicators:

- Opportunity Size: Over USD 1 billion (3 years)

- Key Focus: Semiconductors, Cloud, Cybersecurity, AI Platforms

- Regions: North America | Europe | Asia-Pacific | Middle East | Latin America

Is your organization positioned to capture the advantages of digital sovereignty in the post-tariff decade?

Want to Dive Deeper?

Connect with us to explore how these insights can strengthen your trade innovation and digital transformation strategy. Schedule a Growth Pipeline Dialog™ with Frost & Sullivan’s experts to identify tailored growth opportunities in global trade, technology, and manufacturing ecosystems.

[Access the Full Analysis] | [Download a Sample] | [Contact [email protected]]