Besides increasing its geographic footprint, Chinese automaker’s strategic playbook to pivot around vertical integration, cost leadership, localization, and technological innovation.

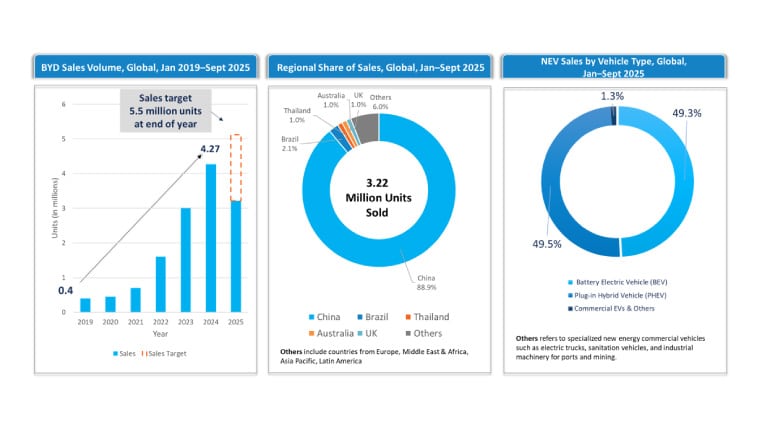

Chinese automaker BYD emerged as the global leader in electric vehicle (EV) sales in 2025, overtaking Tesla for the first time. This milestone was driven by strong domestic demand in China alongside rapid international expansion, particularly in Europe and emerging markets, and was backed by a robust product portfolio that combined affordability with proprietary battery and fast charging technologies. BYD reported that sales of its battery electric vehicles (BEVs) increased nearly 28% year-on-year to more than 2.25 million units in 2025, marking a decisive shift in the global EV leadership landscape.

BYD’s rise reflects its transformation from a battery manufacturer into a globally dominant new energy vehicle (NEV) automaker. Central to its success has been its deep vertical integration and scalable business model. Unlike most competitors, the company controls nearly every critical element of the EV value chain, including batteries, power electronics, semiconductors, electric motors, and vehicle platforms. This structure has enabled cost control, stable margins, and faster rollout of new technologies and models across markets. While manufacturing scale and battery leadership have underpinned the competitiveness of BYD’s vehicle offerings, it has also promoted a growing energy storage and third-party battery supply business.

Equally important has been BYD’s approach to localization. Rather than relying primarily on exports, the company invests early in local assembly, partnerships, and supplier ecosystems. This reduces exposure to tariff volatility, shortens supply chains, and allows vehicles to be tailored to local regulations and customer preferences.

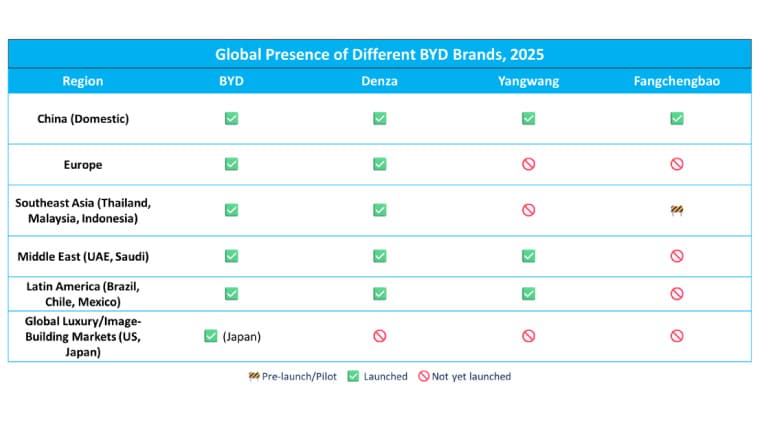

BYD’s broad product strategy reinforces these advantages. The company’s offerings span the passenger vehicle spectrum, from affordable mass market Dynasty and Ocean models to premium and performance-oriented brands such as Denza, Fangchengbao, and Yangwang. This breadth has boosted both volume growth and brand perception as BYD expands globally.

While BYD remains heavily China-centric today, its growth roadmap is increasingly global, with core overseas markets across Southeast Asia, Europe, Latin America, and Australia. Its expansion model emphasizes competitively priced market entry, early scale through fleet and dealer partnerships, and progressive localization via CKD/SKD assembly and full manufacturing facilities. This approach is already visible in markets such as Thailand, Brazil, Hungary, and Uzbekistan.

Technological differentiation reinforces this strategy, allowing BYD to retain its edge amidst a slowing global EV market. Core innovations, including the Blade Battery, e-Platform 3.0 and 3.0 Evo, DM-i hybrid systems, and the Super ePlatform with ultra-fast charging, have been designed to address cost, safety, and charging barriers. By tightly integrating vehicles, batteries, and charging architecture, BYD is creating a technology gap that is difficult for competitors to replicate rapidly at scale.

Core Strengths and Growth Opportunities

Currently, intense domestic competition and pricing pressure in the Chinese market, which accounts for nearly 90% of BYD’s NEV sales, continue to challenge the company. Internationally, BYD is still building its brand. At the same time, a volatile trade and tariff landscape poses risks to sustained growth.

Nevertheless, BYD appears to be on solid footing due to its vertically integrated operating model and its leadership in battery technology that has opened up a lucrative parallel business as a cell supplier to other global OEMs. Moreover, global electrification targets, supportive policies in emerging markets, and rising demand for affordable EVs align well with BYD’s capabilities.

Competitive Landscape

BYD operates in an extremely competitive environment, facing pressure from established global OEMs, aggressive Chinese rivals, and pure-play EV companies like Tesla. What differentiates BYD is its vertically integrated supply chain and the consistency and scale of its execution across diverse price points and powertrains. Its balanced mix of BEVs and plug-in hybrids allows it to adapt to varying levels of infrastructure readiness and regulatory frameworks across regions.

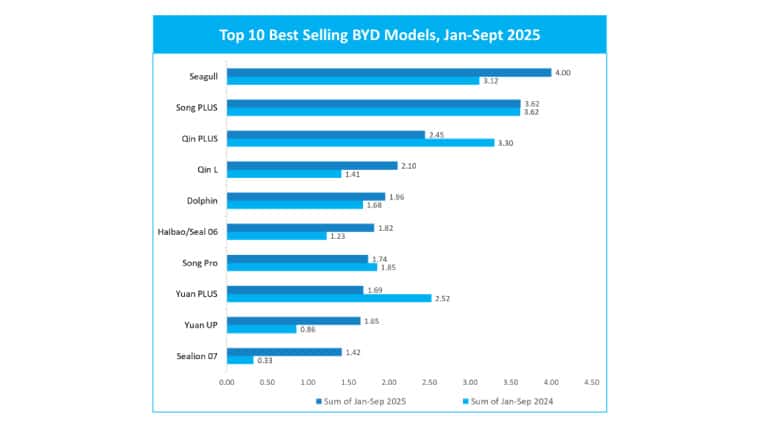

In 2025, a strong performance by its high-volume models such as the Seagull, Qin Plus, and Song Plus highlighted BYD’s leadership in global EV volumes even as Tesla struggled with an aging portfolio. Meanwhile, legacy automakers continued to juggle internal combustion, hybrid, and electric strategies in contrast to BYD’s targeted focus on electrification.

That said, price wars and rapid innovation from domestic rivals have resulted in slimmer margins and the need to accelerate overseas growth. This will be challenging since it requires BYD to compete against well-established brands that have better dealer coverage and enjoy customer loyalty. This will emphasize the importance of rapid scale-up and effective implementation of localization initiatives.

An Evolving Roadmap

In 2025, BYD’s business remained heavily anchored in China, both in terms of sales and manufacturing. Although growing quickly, overseas volumes still represented a small share of total production, with most international plants operating as assembly hubs reliant on Chinese-sourced core components. BYD’s brand positioning was strongest in the mass and mid-range segments, with premium offerings largely concentrated in the domestic market.

By 2030, this profile is set to change. BYD is targeting roughly half of its vehicle sales to come from outside China, with overseas revenues likely exceeding this share due to higher pricing in markets such as Europe. Manufacturing is expected to become more distributed, with several overseas facilities upgrading from assembly to fuller production capabilities.

In addition, the product portfolio is also set to change. While entry-level vehicles will continue to drive volume, BYD is looking at international expansion of its premium and luxury brands with a view to improving margins and brand equity. This transition over the next five years will mark BYD’s strategic shift from a China-led exporter to a globally embedded automaker.

Regional Highlights

Europe represents one of BYD’s most strategic long-term markets. The company plans to establish significant local production capacity while sourcing non-core components from regional suppliers. This approach supports cost competitiveness while aligning BYD with stringent regulations in the region.

In Southeast Asia and Latin America, BYD has achieved early leadership by combining competitive pricing with rapid localization. Thailand has emerged as a key regional hub, driving strong sales growth and serving as a template for expansion across ASEAN markets. In Latin America, BYD is deepening vertical integration and targeting high local content to support both vehicle and battery production.

Access to North American markets remains restrained due to prohibitive tariffs and policy barriers. BYD has indicated that it has no near-term plans to enter either the US or Canada. Instead, it is prioritizing regions whose electrification policies and cost structures align with its strengths.

The Future

Looking ahead, BYD’s success will depend on how effectively it can implement its global transition. Penetrating underdeveloped EV markets in Africa, Southeast Asia, and secondary Latin American economies offers significant advantages. However, this will require clear go-to-market models, strong local partnerships, and careful pricing strategies.

Expanding battery manufacturing beyond China represents another growth opportunity. Localizing cell and pack production will strengthen BYD’s regional supply chains and allow it to become a major third-party battery supplier to other OEMs, fleets, and energy operators. This diversification could offset potential slowdowns in vehicle demand, while creating new revenue streams.

To learn more, please see: Strategic Profiling of BYD, Global, 2025, or contact [email protected] for information on a private briefing.