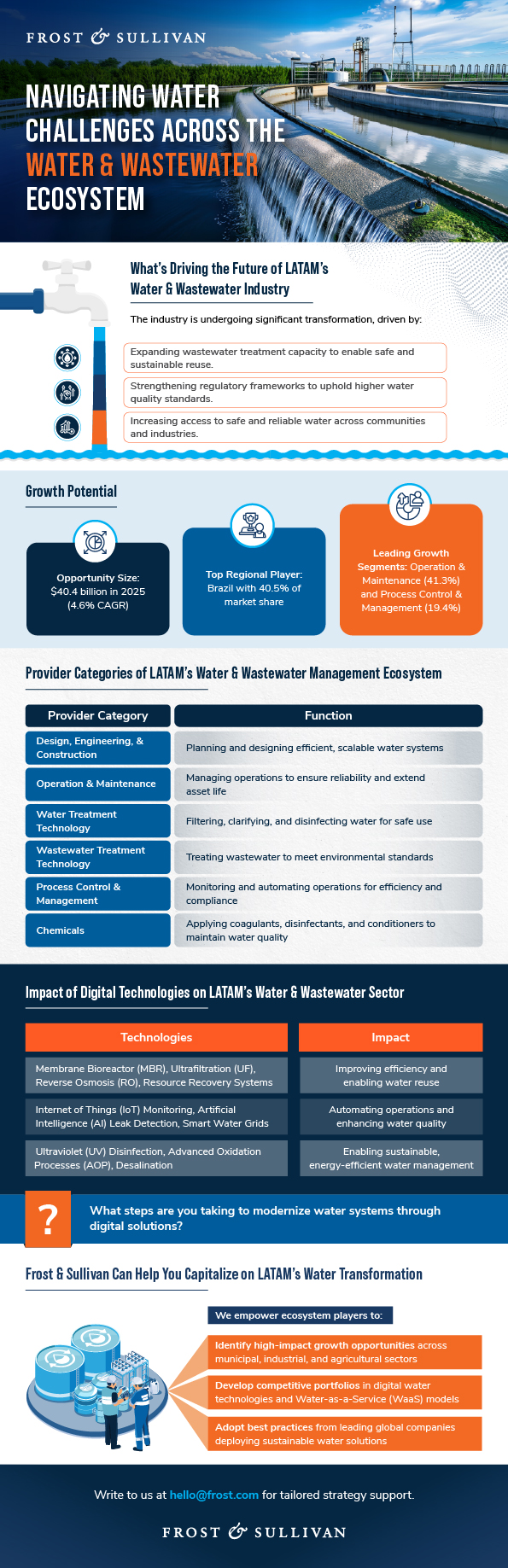

The Latin American water and wastewater market is steadily expanding, projected to reach $40.4 billion by 2025, growing at a CAGR of 4.6%. This momentum is fueled by municipal infrastructure expansion, industrial demand, and a growing focus on sustainable water solutions.

While conventional systems still dominate, digital water technologies such as Internet of Things (IoT)-enabled monitoring, AI-powered leak detection, and smart water management grids are improving operational efficiency and water quality. At the same time, circular water economy solutions like reuse systems and desalination technologies remain underutilized due to funding constraints and public health concerns.

Is your organization ready to harness digital water technologies to build long-term revenue pipelines?

Listen to our Growth Podcast episode on LATAM’s water and wastewater systems

Key Forces Transforming Water and Wastewater Management in Latin America

These imperatives are helping utility providers build a future-ready water ecosystem:

- Disruptive Technologies: Innovative water treatment solutions, including reuse and resource recovery, enhancing operational efficiency and circularity while mitigating emerging pollutants.

- Internal Challenges: High capital and operational costs, along with a limited skilled workforce, are slowing the adoption of smart water management.

- Transformative Megatrends: Climate change, water scarcity, and urbanization are driving the region toward adaptive water digitalization systems.

Are you adopting the right growth strategies to thrive amid these transformative forces?

Latin America’s Water Ecosystem at a Glance

Companies to Action: Delivering Sustainable Water Solutions Across Latin America

These forward-looking companies are optimizing water utilities through digital water technologies and strategic planning:

- Veolia: Accelerating decarbonization, decontamination, and resource regeneration through its GreenUp 2027 Strategic Plan.

- Solenis: Offering sustainable chemical solutions that boost efficiency, product quality, and environmental performance for water-intensive industries.

- Ecolab: Providing digital water management, hygiene, and process optimization solutions across mining, power, food and beverage (F&B), and municipal sectors.

Are you equipped with right tools to partner with the trailblazers transforming water and wastewater industry?

Regional Growth Rates Driving Water & Wastewater Investments

As Latin America upgrades its water and wastewater infrastructure, regional dynamics dictate where providers can maximize growth potential:

- Brazil (4.7%): Leading the region with investments in membrane bioreactor (MBR), ultrafiltration (UF), and reverse osmosis (RO) systems to meet CONAMA Resolution 430/11.

- Mexico (4.7%): Expanding water reuse and closed-loop systems in northern states to support semiconductor and automotive clusters.

- Argentina (4.6%): Showing moderate growth, driven by oil & gas and F&B sectors investing in water efficiency.

- Chile (4.7%): Advancing through mining-led demand for RO, zero liquid discharge (ZLD), and desalination technologies.

- Colombia (4.5%): Upgrading effluent treatment and monitoring systems in response to Decree 050/2023.

- Peru (4.6%): Investing in sludge dewatering, RO, and MBR systems for mining and agriculture water reuse.

Are you applying best practices to maximize ROI in fast-growing regions?

Emerging Growth Opportunities in Latin America’s Water and Wastewater Industry

These high-impact opportunities are driving smart and sustainable water transformation:

- Water Digitalization

Rising strain on freshwater resources is giving rise to operational inefficiencies in water utilities. Non-revenue water losses average 40%–45% due to aging infrastructure, leaking pipes, and incomplete metering. To successfully implement water digitalization, providers and governments are:

- Deploying IoT and AI in water utilities to collect, integrate, and analyze water data in real time.

- Implementing smart metering to detect leaks, reduce commercial losses, and improve efficiency.

- Strengthening regulatory frameworks that mandate smart metering adoption to ensure accurate billing and detect unusual consumption patterns.

- Water-as-a-Service (WaaS)

High costs and limited technical capacity often hinder adoption of advanced water treatment. As a result, utilities and industries are embracing the WaaS model for end-to-end, subscription-based solutions. To capture this opportunity and expand coverage, providers are:

- Expanding access to underserved rural and peri-urban areas using modular, scalable treatment units.

- Offering desalination technologies for high-demand industries to reduce freshwater dependency

- Facilitating adoption of modular wastewater systems to expand proportion of treated wastewater

- Biogas Generation

Latin American countries are increasingly recognizing the untapped potential of sewage sludge as a renewable energy source. Despite its high organic content, only a few advanced wastewater treatment plants are currently harnessing it for biogas production. So, to scale biogas generation, stakeholders are:

- Installing anaerobic digesters to convert sludge into biogas, reducing energy costs and emissions.

- Promoting closed-loop wastewater management to minimize landfill waste and support greenhouse gas (GHG) reduction goals.

- Introducing policy incentives for methane capture and renewable energy integration in treatment plants.

How will you prepare your organization to capitalize on these emerging growth opportunities?

Unlock best practices for next-gen water and wastewater solutions.

Charting a Sustainable Future for Latin America’s Water Ecosystem

The convergence of digital water technologies, the circular water economy, and strategic investment are redefining the Latin America water and wastewater industry. However, addressing growth barriers such as funding gaps, regulatory complexity, and skills shortages remains critical. To stay ahead, providers should align with transformative megatrends and adopt smart water management systems.

Which business models and partnership strategies will help your organization make the most of this transformation?

Ready to Lead the Transformation?

- Book a Growth Strategy Session: Align your growth roadmap with Frost & Sullivan’s visionary Growth Pipeline™ Dialog.

- Engage with Growth Experts: Co-design AI-enabled, data-driven operating models that scale industry-specific and commercial impact.

- Share Your Transformation Story: Position your organization as a transformation leader through Frost & Sullivan’s Transformational Growth Leadership platform.

- Join the Growth Council: Collaborate with industry leaders shaping the future of your ecosystem.

- Nominate for the Best Practices Recognition: Be recognized for excellence in growth strategy, execution, and customer impact.

- Demonstrate Industry Positioning on the Frost Radar™: Benchmark your growth performance and innovation strength against industry competitors.

- Activate Brand & Demand Growth: Accelerate awareness, engagement, and revenue growth through integrated brand and demand generation strategies.