A new natural gas pricing mechanism approved by the Indian government earlier this year is set to provide fresh impetus to the demand for compressed natural (CNG) in the passenger vehicle (PV) segment. The resultant reduction in CNG prices by nearly Rs 8/kg will lead to a reduction in TCO, making CNG vehicles more attractive than petrol and diesel powered vehicles.

At the same time, adoption will be boosted by a range of perceived advantages, including lower operating costs, greater fuel efficiency, and a proven green profile. This is set to be reinforced by expanded CNG fueling infrastructure, triggering renewed interest in consumers and automotive manufacturers alike. So, what is the outlook for CNG in India’s automotive landscape?

To learn more, please see our recent report on the Indian Passenger Vehicle Outlook, 2023 or contact sathyanarayanak@frost.com for information on a private briefing.

Our Perspective

Favored for use in taxis and fleets, CNG is now gaining rising appeal among consumers for private usage. Frost & Sullivan expects the share of CNG powertrains to increase from 9.4% in FY23 to between 11% and 13% in FY24. Falling prices, growth in fueling stations, stricter emissions regulations, evolving consumer preferences, and new model launches will support robust demand for CNG vehicles over the next 2-3 years.

Following multiple price hikes throughout 2022, the government revised its pricing policy for domestically produced natural gas in April 2023, paving the way for a significant cut in CNG prices. In Delhi, for example, prices have fallen from Rs. 79.56 to Rs 73.59 and in Mumbai from Rs 87 to Rs 79. To support anticipated demand, the government has declared its intention to establish close to 18,000 CNG stations by the end of the decade.

CNG is also benefiting from the Indian government’s focus on shifting to a clean energy economy. Tightening emissions regulations, such as Real Driving Emission (RDE) norms, are set to affect the prospects of diesel powertrains. Their share is poised to fall over the next 1-2 years as OEMs phase out diesel car production. Petrol vehicles, which currently account for over 60% share in the Indian PV market, are set to lose popularity due to the constant hike in petrol prices across the country. CNG vehicles are projected to capture market share from their diesel and petrol counterparts.

From a consumer perspective, the appeal of vehicles powered by conventional fuels, including petrol and diesel, has waned in parallel to their surging prices. Indeed, CNG is now considerably cheaper than petrol and diesel, underlining its benefits in terms of lower operating costs. This, together with CNG’s superior fuel efficiency means that higher initial purchase costs vis a vis petrol/diesel vehicles are offset over the long-term by substantially lower total cost of ownership.

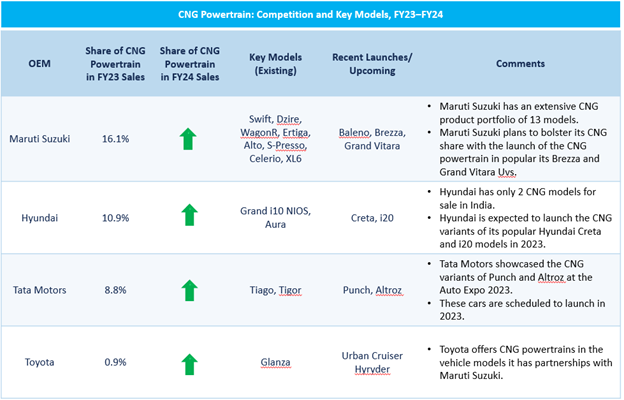

Such positive trends are being strengthened by OEMs through the introduction of factory fitted CNG powertrain options. Market leader in India’s CNG powertrain market, Maruti Suzuki has close to 70% market share and offers 15+ CNG variants, including in its popular Grand Vitara, Swift, and Brezza models. More recently, it has introduced two CNG variants of its Fronx model. Hyundai and Tata Motors have also been launching CNG options in their popular vehicle models to cater to the demand. As the country transitions towards clean fuels, major OEMs are poised to ramp up their CNG product portfolios.

Frost & Sullivan, 2023

It is clear from multiple perspectives – policy, regulatory, environmental, infrastructural, consumer, and vehicle manufacturer, among others – that CNG fueled PVs are set to experience buoyant uptake in India.