This blog is based on Frost & Sullivan’s recent analysis, “Directed Energy Weapon Systems Market, 2025–2027,” authored by Wayne Shaw, from the Aerospace & Defense practice area.

From drone swarms and hypersonic missiles to low-altitude rocket attacks, modern threats are evolving faster than conventional interceptor systems can respond. The answer lies in directed energy weapons (DEWs) that neutralize targets at the speed of light with unmatched precision and cost-efficiency.

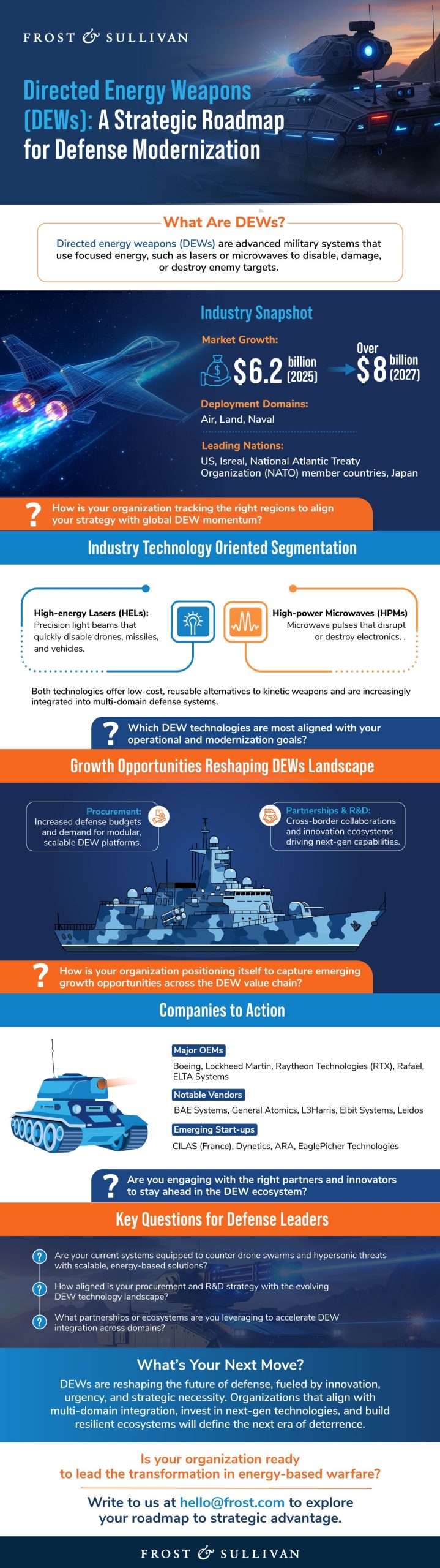

Reusable, precise, and cost-efficient defense, DEWs are rapidly transitioning from experimental platforms to operational assets across global militaries. Nations such as the United States, Israel, and North Atlantic Treaty Organization (NATO) allies are now embedding high-energy lasers (HELs) and high-power microwaves (HPMs) into next-generation missile defense, airbase protection, and naval systems.

Discover what’s fueling global momentum in directed energy weapons and where the next wave of defense innovation will emerge.

How is your organization advancing its defense strategy with DEW to outpace emerging threats?

Download the full analysis or contact us at [email protected]

Growth Drivers and Restraints Shaping the DEW Landscape

As global defense modernization accelerates, the DEW industry is gaining momentum but also facing critical implementation challenges.

Key Growth Drivers

- Changing Nature of Warfare

Drone threats, hypersonic missiles, and loitering munitions are transforming the battlefield. These fast, low-altitude threats demand rapid, precise, and scalable countermeasures, an area where DEWs excel by neutralizing multiple targets almost instantly and at minimal cost per engagement. - Economic Efficiency and Sustainability

Traditional interceptors carry high procurement and lifecycle costs, while directed energy systems operate on electricity, offering reusable, low-maintenance, and cost-effective scalability. This operational cost advantage is driving strong investment interest among Western defense establishments. - Technological Breakthroughs

Advances in AI-enabled tracking, adaptive optics quantum technologies, and beam stabilization are overcoming historical power and precision limitations, making DEWs increasingly viable across air, land, and naval domains.

How is your organization responding to the shifting dynamics driving growth in the directed energy weapons market?

Key Restraints

- Power and Cooling Limitations

High-energy lasers systems require robust power generation and thermal management architectures. Current size, weight, power, and cost (SWaP-C) constraints currently limit deployment on smaller or mobile platforms. - Environmental Factors

Weather conditions such as fog, rain, dust, and humidity can scatter or attenuate laser beams, adversely reducing their range and effectiveness in open-air engagements. - High Development Costs

While long-term operational costs are lower, upfront research, development, testing, and evaluation (RDT&E) expenses remain a major barrier to adoption, demanding sustained funding and long procurement cycles.

How is your organization strategizing to overcome deployment barriers and accelerate the directed energy weapons adoption?

To discover how DEWs can transform your defense strategy, download the full analysis, or connect with us at [email protected] to start a conversation

Key Strategic Imperatives Reshaping the DEWs Industry

- Geopolitical Chaos: Ongoing conflicts and shifting power dynamics are driving rapid DEW adoption to enhance missile defense, deterrence, and tactical readiness.

- Competitive Industry: A diverse mix of defense giants, technology providers, and emerging start-ups is accelerating innovation, capability development, and time-to-deployment.

- Descriptive Technologies: Breakthroughs in AI, modular design, and system integration are transforming DEWs from laboratory prototypes to fully operational assets.

How is your organization aligning its strategy to capture leadership amid the transformative shifts reshaping the DEW landscape?

Emerging Growth Opportunities in the Directed Energy Weapons

Growth Opportunity: 1. Procurement

Defense agencies worldwide are boosting investments in laser and microwave-based platforms across land, air, naval domains, and space domains. The US Department of Defense (DoD) and NATO are accelerating operational deployment, while Israel and Japan are scaling national programs to reinforce multi-layered air and missile defense architectures.

Vendors delivering modular, easily integrated DEW systems are best positioned to capitalize on the global surge in procurement and modernization programs.

Want to explore other growth opportunities in DEWs industry? Download the full analysis here

Why This Analysis Matters

For defense ministries, aerospace OEMs, and technology investors, understanding the DEW ecosystem is critical to shaping modernization strategies. Frost & Sullivan’s analysis on Directed Energy Weapon Systems delivers:

- Data-backed insight into market drivers and restraints

- Strategic guidance on defense procurement and partnership opportunities

- Benchmarking of global leaders and emerging innovators

- Forecasts to inform R&D, investment, and go-to-market decisions

The Future of Defense Is Energy-based

DEWs are redefining deterrence, enabling militaries to act faster, smarter, and at lower cost. Those investing today in scalable, AI-integrated DEW solutions will set the standard for future operational superiority.

How is your organization preparing to lead this transformation?

Access the Full DEWs Analysis or schedule Growth Pipeline Dialog™ with our Aerospace & Defense experts to get tailored strategies for your transformation journey.