From thermal regulation and moisture management to contaminant filtration and aesthetic impact, today’s architectural coatings are engineered to address the full spectrum of building performance challenges. Leveraging breakthroughs in nanotechnology, biopolymer science, and ultraviolet (UV)-curing, manufacturers are creating paints and coatings that resist weathering, inhibit microbial growth, and even break down airborne pollutants.

Complemented by AI-driven color visualization and seamless digital ordering platforms, these innovations not only streamline project timelines but also minimize material waste and onsite labor.

In an era of stringent environmental regulations and rising end-user expectations, industry leaders who champion integrated, high-performance coating systems will define the next generation of sustainable, resilient architecture.

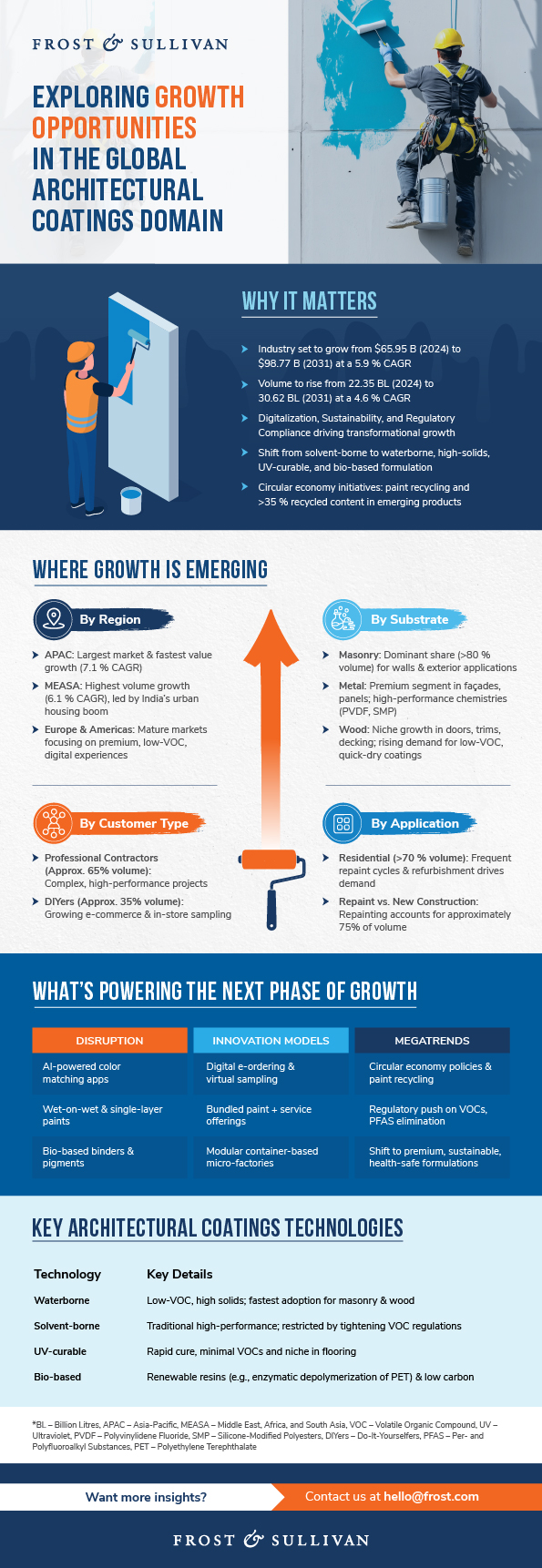

Against this backdrop, understanding how substrate type (masonry, wood, metal), end-use (new construction vs. repaint) and purchasing behavior (online vs. offline) intersect with emerging megatrends has never been more critical for anyone seeking to capture the next wave of growth in this $100 billion-plus industry.

How is your organization orchestrating digital, sustainable, and regulatory capabilities to future-proof its coatings strategy?

Reimagine Growth in Architectural Coatings

Explore how digitalization, sustainability, and regulatory compliance are transforming the global architectural coatings market.

Download Frost & Sullivan’s latest analysis on the Global Architectural Coatings Market to explore how companies are advancing eco-friendly formulations, integrating digital tools, and capitalizing on new construction and repainting trends. Also, uncover the strategic growth opportunities driving the industry forward.

Key Industry Drivers

Premiumization & Innovation: Customers increasingly demand high‑performance, low‑volatile organic compound (VOC), and multi‑functional coatings spurring product development in self‑cleaning, air‑purifying, and rapid‑dry formulations.

Construction Growth & Refurbishment: A projected 4.6% volume CAGR through 2031 is driven by new builds in APAC and MEASA and accelerated repainting cycles in mature markets.

Regulatory & Sustainability Imperatives: Eliminating per- and polyfluoroalkyl substances (PFAS) and reducing carbon footprints are reshaping formulation chemistries, while paint‑recycling initiatives and bio‑based binders open circular‑economy pathways.

Key Imperatives Powering Growth in the Architectural Coatings Sector

| Strategic Imperative | Why | Frost Perspective |

|---|---|---|

| Disruptive Technologies | Tight build schedules demand faster application and fewer coats Repainting projects require simple, color-rich solutions | Peelable, single-layer and wet-on-wet systems simplify application. Real-time simulation and color matching tools accelerate customer decisions. |

| Transformative Megatrends | Indoor-air-quality and health concerns elevate low-VOC/solvent-free needs Global bans on PFAS, chromates and toxic additives | Shift to waterborne, high-solids and radiation-cure chemistries. Development of bio-based binders, air-purifying and energy-efficient coatings. |

| Industry Convergence | Growing paint-waste and landfill burden Demand for a closed-loop, circular-economy model | Collaboration with recyclers and certifiers to reclaim and refine used paint. Launch of up-to-35% recycled-content formulations (e.g., AkzoNobel). |

Having laid out the strategic imperatives, let’s turn our focus to the growth opportunities energizing the architectural coatings industry.

Growth Opportunity 1: Adopt a Wider View of Sustainability

The architectural coatings space is expanding its sustainability focus beyond VOC reduction to include carbon dioxide (CO₂) emission control, renewable raw materials, toxic chemical elimination, waste management, and leftover paint reuse. Paint formulators are also developing solutions that purify air and boost energy efficiency in buildings.

Technologies like photocatalytic paints and reflective roof coatings exemplify how coatings can actively improve indoor and outdoor environmental conditions. Tailoring solutions to cultural practices such as using infrared-reflective pigments in dark roof paints can further localize impact.

Takeaway: Formulators that embed sustainability across design, production, and performance through air-purifying tech, energy-efficient coatings, and recycled inputs will lead the shift toward environmentally aligned, premium-grade coatings that meet evolving compliance and market expectations.

Growth Opportunity 2: Pursue Digitization & eCommerce

As demand for architectural coatings rises, digitization is becoming essential to ensure timely delivery, precise color matching, and enhanced customer convenience. Digital platforms ranging from eCommerce solutions for seamless paint dispatch to color-matching software and analytical tools are transforming how paints are ordered, produced, and selected.

Companies like PPG and DROMONT S.p.A are already advancing this shift with mobile-based ordering platforms that integrate demand, production, and delivery.

Takeaway: Embracing digital solutions from eCommerce integration to spectrophotometer-based color matching offers paint formulators and distributors a competitive edge through operational efficiency, customization, and a superior customer experience in an increasingly on-demand market.

Growth Opportunity 3: Bundle Services & Elevate the Customer Experience

Architectural paints are evolving from stand-alone products to comprehensive service offerings. This shift includes value-added features such as color matching, simulation tools, online booking, and end-to-end contract management.

In regions like MEASA and APAC, where painting is largely driven by professional contractors, formulators can enhance customer experience by partnering with service providers to offer integrated, on-demand painting solutions. Simultaneously, offering paint can collection and recycling services enables companies to support circularity and reduce waste.

Takeaway: Paint companies that broaden their role from product suppliers to service orchestrators and sustainability partners will gain a competitive edge, unlock new revenue streams, and meet customer demand for convenience, digital engagement, and responsible consumption.

Are you aware of how growth opportunities are shifting toward performance-based coatings that serve both functional and environmental objectives?

Conclusion & Next Steps

The architectural coatings industry is no longer about commodity paint. It’s a dynamic ecosystem where sustainability, digital transformation, and customer‑centric services intersect. Companies that pivot quickly investing in green chemistries, digital channels, and service partnerships will not only survive the coming transformation but thrive as growth generators in a close to 100-billion-dollar market by 2031.

Ready to Reimagine Your Strategy?

Connect with our experts to explore how your organization can lead in a rapidly evolving coatings market through tech-driven solutions and eco-aligned strategies.

Write to us at [email protected]

*This article is based on Frost & Sullivan’s latest analysis of the Global Architectural Coatings Market and is authored by Soundarya Gowrishankar (Industry Principal at Frost & Sullivan).