This blog is based on our analysis — Growth Opportunities in the Indian Industrial Water and Wastewater Infrastructure Market, 2025–2030, authored by Frost & Sullivan’s Growth Expert, Paul Hudson, from the Environment & Water team.

India is rapidly emerging as one of the world’s fastest-growing industrial economies, led by food and beverage, microelectronics, chemicals, pharmaceuticals, textiles, and metallurgy. As these domains expand, demand for reliable industrial water access and efficient industrial wastewater treatment is intensifying.

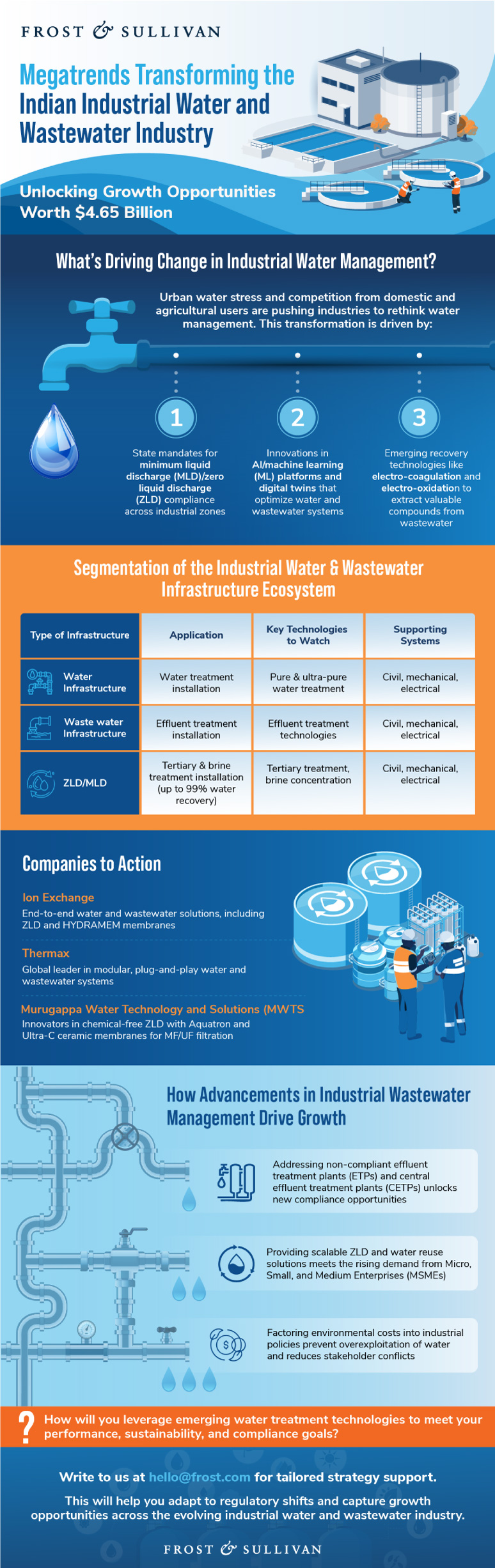

To address this challenge, regulators are tightening effluent discharge norms, encouraging industries to adopt recycling, reuse, and industrial effluent treatment solutions, including advanced zero liquid discharge (ZLD) systems. This trend is reflected in investment strategies, with industrial water treatment and wastewater filtration infrastructure projected to grow from $2.87 billion in 2024 to $4.65 billion by 2030.

Explore how transformative megatrends, disruptive technologies, and innovative business models are reshaping India’s industrial water and wastewater infrastructure.

For leading water treatment companies, this evolving landscape is creating multiple opportunities across advanced treatment technologies, circular reuse strategies, and closed-loop water systems.

What growth strategies will your organization adopt to thrive in India’s evolving industrial water landscape?

Capitalize on emerging shifts in industrial wastewater treatment.

Growth Avenues in India’s Water Infrastructure

What’s Shaping India’s Industrial Water and Wastewater Industry?

These imperatives are pushing enterprises to rethink industrial effluent treatment, optimize operations, and invest in sustainable infrastructure:

- Transformative Megatrends: Intensifying water scarcity, compounded by droughts, heat waves, and industrial and sewage pollution, is forcing manufacturing and thermal power plants to suspend operations in urban centers.

- Disruptive Technologies: High cost of advanced industrial water treatment systems, coupled with inconsistent regulatory enforcement, is limiting adoption and underinvested in the industrial wastewater treatment infrastructure.

- Innovative Business Models: Inefficient plant operations and a shortage of skilled personnel are causing many facilities to fail compliance standards and reduce overall system performance.

How will your organization respond to these imperatives?

Explore investment strategies and growth levers in industrial water solutions.

Companies to Action

These industry leaders are driving India’s water-positive future with innovative technologies and advanced industrial wastewater treatment systems:

- Ion Exchange – Driving End-to-end Water Management

- Delivering tailor-made zero liquid discharge (ZLD) and HYDRAMEM systems for maximizing resource recovery.

- Streamlining plant operations with real-time monitoring and the AI-powered IonSite Digital Twin.

- Executing flagship projects like the $80M IOCL Panipat Refinery industrial effluent treatment facility.

- Thermax – Modular, High-purity Systems

- Deploying plug-and-play modular systems for seamless integration.

- Recovering up to 95% of industrial water with innovative ZLD units.

- Serving multiple sectors, from pharma to food & beverage, with scalable solutions.

- Gradiant – Advanced Solutions for Complex Effluents

- Reducing CAPEX and OPEX with carrier gas extraction technology.

- Maximizing water recovery up to 100% through nature-inspired processes.

- Optimizing operations using the SmartOpsAI platform.

Do you have the tools to benchmark performance and align with the right providers driving industrial wastewater treatment innovation?

See how leading water treatment companies are transforming India’s industrial water future.

Growth Opportunities in Industrial Water Management

- Water Circularity in Semicon, Pharma, and Chemicals

Rapid industrial expansion is prompting enterprises to turn industrial wastewater into a valuable resource through circular water strategies. As a result, providers are:

- Implementing advanced brine treatment systems to maximize industrial water and chemical recovery.

- Leveraging technologies like Memsift’s TS-30 for high-efficiency thermal membrane separation.

- Adopting digital platforms such as BioPetroClean’s Pure BI to optimize and automate ZLD and brine management.

How will your organization convert industrial wastewater into a strategic resource through circular water solutions?

- MLD/ZLD with Resource Recovery

Stricter discharge regulations and seasonal water scarcity are driving the adoption of cost-efficient minimum liquid discharge (MLD)/ZLD systems. Companies are responding by:

- Offering low-energy MLD/ZLD systems to enhance adoption in price-sensitive sectors.

- Deploying high-recovery or selective membrane solutions (reverse osmosis [RO]/nanofiltration [NF], membrane distillation) for brine treatment.

- Providing innovative technologies like Gradiant’s carrier gas extraction for efficient ZLD and resource recovery.

Which advanced MLD/ZLD technologies will your organization adopt to ensure compliance and unlock resource recovery?

- Modular and Plug-and-play Solutions

Urban space constraints and increasing compliance demands are accelerating adoption of modular, scalable industrial water treatment systems. This is pushing providers towards:

- Offering modular/containerized systems with scalable capacities (10–500 kiloliters per day [KLD]) to meet evolving operational needs.

- Integrating plug-and-play automation and remote monitoring to minimize operational costs and downtime.

- Partnering with smart monitoring and analytics platforms to deliver insights on performance and system health.

How will your organization leverage modular systems to optimize industrial water treatment in space-constrained facilities?

Unlock high-impact opportunities in water and wastewater solutions.

Building Water-positive Operations in India’s Industrial Sectors

India’s industrial sector has rebounded strongly, with manufacturing, mining, and electricity growing at 5.5%, 7.5%, and 5.1% respectively in 2023–24, signaling substantial growth potential despite global headwinds. This is pushing organizations to adopt circular strategies, modular systems, and digital optimization platforms, enabling compliance while transforming industrial wastewater management for the decade ahead.

What bold moves will your business make to lead the future of India’s industrial sector?

Looking to prioritize the right investments, explore regional opportunities, or benchmark your approach against sustainable water treatment solutions?

Get in touch with our Environment & Water Growth Experts to know more.