This blog is based on our analysis – Rental Gensets Industry, Global, 2024–2034 and Impact of President Trump’s Administration on the Energy Industry, United States, 2024–2030, authored by Frost & Sullivan’s Growth Expert, Lucrecia Gomez, from the Power & Energy team.

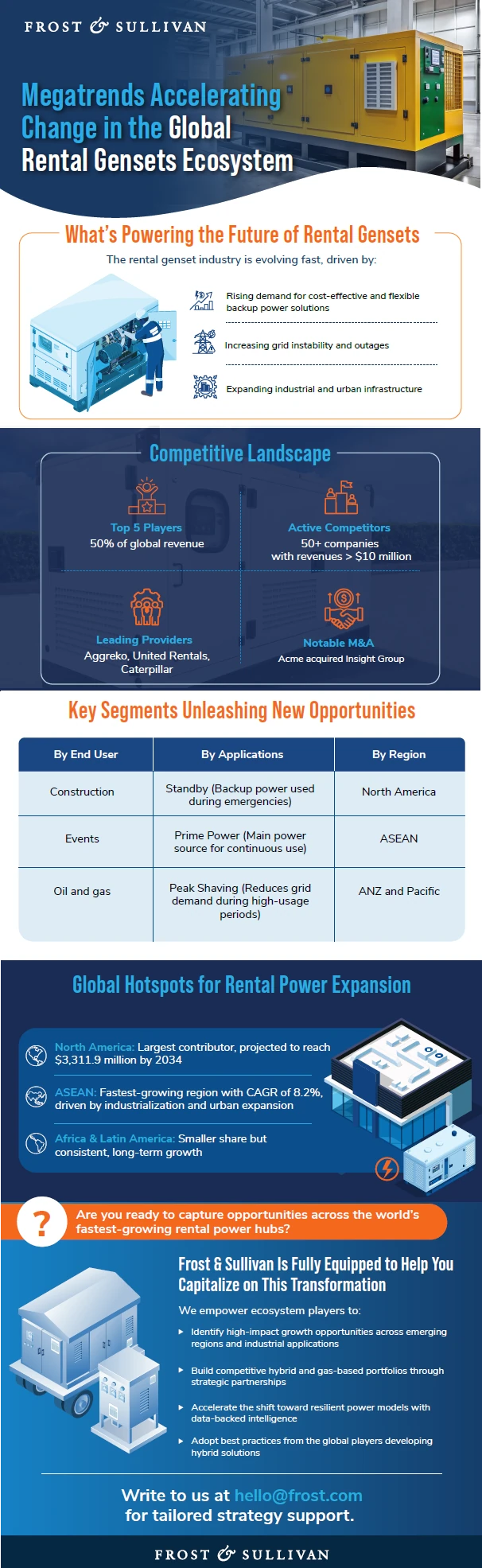

The rental genset industry is expanding steadily, projected to surpass $11 billion by 2034. This growth is fueled by rapid infrastructure development, industrial expansion, and the rising demand for reliable backup power across construction, oil & gas, utilities, and event sectors.

While diesel generators still dominate most rental fleets, tightening emission regulations and sustainability goals are accelerating the shift toward cleaner energy alternatives such as natural gas and hybrid power systems. At the same time, digital technologies like telematics and remote monitoring enable real-time tracking and maintenance.

Explore the transformative megatrends, disruptive technologies, and competitive forces in the global rental gensets industry.

To stay competitive, providers are investing in hybrid technologies and more resilient power solutions to capture new opportunities in an evolving energy landscape.

Is your organization leveraging energy transition technologies to stay ahead in this space?

Growth Avenues in Rental Gensets Industry for 2026 and Beyond

Top Strategic Imperatives Driving Growth in the Rental Genset Industry

These forces are redefining fleet strategies and accelerating the shift toward sustainable power solutions:

- Disruptive Technologies: Connectivity, 5G, and predictive applications are enhancing operational and capital efficiency by improving genset monitoring and utilization.

- Competitive Intensity: Industry fragmentation, high capital costs, and rising demand from data centers and infrastructure projects are intensifying competition. Companies are responding by expanding fleets, deploying digital monitoring systems, and offering low-emission options.

- Transformative Megatrends: The global push for net-zero emissions is driving the transition from diesel to gas and hybrid gensets, with integrated photovoltaic (PV) and battery systems leading sustainable growth.

Are you adopting the right growth strategies to thrive amid these transformative forces?

What’s Slowing Progress in the Rental Genset Industry

Despite steady demand, several growth barriers continue to impact scalability and profitability in the rental genset industry:

- Fuel Cost Volatility: Increasing operational expenses are forcing customers to consider more energy-efficient and hybrid alternatives.

- Supply Chain Constraints: Delaying fleet modernization due to shortages of engines, alternators, and control units.

- Hybrid and Battery Competition: Reducing demand for traditional diesel generators as cleaner, quieter power options gain traction.

- High Capital Requirements: Limiting smaller players from upgrading fleets and competing with large providers.

- Regulatory Uncertainty: Creating fragmentation in developing regions due to inconsistent safety and compliance standards.

Are you implementing best practices to overcome these growth barriers?

Companies to Action Leading the Shift Toward Cleaner Energy Alternatives

These frontrunners set new benchmarks in low-emission generators and sustainable power delivery:

- Aggreko: Leading the energy transition with diesel, gas, and hybrid fleets backed by strong digital monitoring system and global project expertise.

- Caterpillar: Delivering emissions-compliant, fuel-efficient gensets with advanced CAT Connect systems and a robust dealer network.

- Cummins: Expanding hybrid and hydrogen-based solutions through deep vertical integration and a global support network.

Do you have the right tools to benchmark performance and collaborate with next-gen energy leaders?

Growth Opportunities Shaping the Future of Rental Gensets

These high-impact opportunities are enabling power solution providers to strengthen competitiveness, sustainability, and profitability:

- Hybrid and Sustainable Power Solutions

The growing urgency to decarbonize operations is accelerating the adoption of hybrid power systems across rental fleets. To capture this shift, providers are:

- Investing in hybrid-ready fleets that integrate diesel, gas, battery, and solar PV technologies.

- Collaborating with technology partners to deliver turnkey, low-emission power solutions.

- Positioning hybrid systems as cost-efficient, sustainable alternatives for industrial and urban applications.

- IoT as a Service

As digital transformation accelerates, Internet of Things (IoT) integration in asset tracking is generating valuable data insights. So, as part of their digital strategy, companies are:

- Deploying IoT-enabled systems for real-time tracking, predictive maintenance, and energy optimization.

- Collaborating with cloud and AI partners to deliver fully managed, data-driven service models.

- Enhancing reliability through continuous security upgrades and flexible digital offerings.

- Strategic Partnerships and Collaborative Ecosystems

Geopolitical tensions and the COVID-19 pandemic have disrupted global supply chains and dampened industrial power demand. In response, companies are strengthening their position by:

- Forming alliances that combine global technology expertise with local market knowledge.

- Leveraging joint ventures and co-development models to expand access to government projects and localized production.

- Enhancing business continuity and supply chain resilience through diversified regional partnerships.

How will you prepare your organization to capitalize on these emerging growth opportunities?

Are You Ready to Lead the Hybrid Power Transition?

The convergence of hybrid systems, digital intelligence, and strategic collaborations is redefining how companies deliver reliable, low-emission, and flexible power solutions.

Providers that proactively invest in hybrid-ready fleets, strengthen local partnerships, and embed digital monitoring capabilities will not only meet emerging compliance standards but also secure a decisive competitive edge in an increasingly dynamic energy landscape.

What actions will you take now to shape the future of low-emission and hybrid power generation?

Looking to prioritize investments, explore new opportunities, and benchmark your strategy against leaders in the rental genset ecosystem?