This blog is based on our analyses, Stationary Batteries Industry, Global, 2025–2035, authored by Frost & Sullivan’s Growth Expert, Manoj Shankar, from the Power & Energy team.

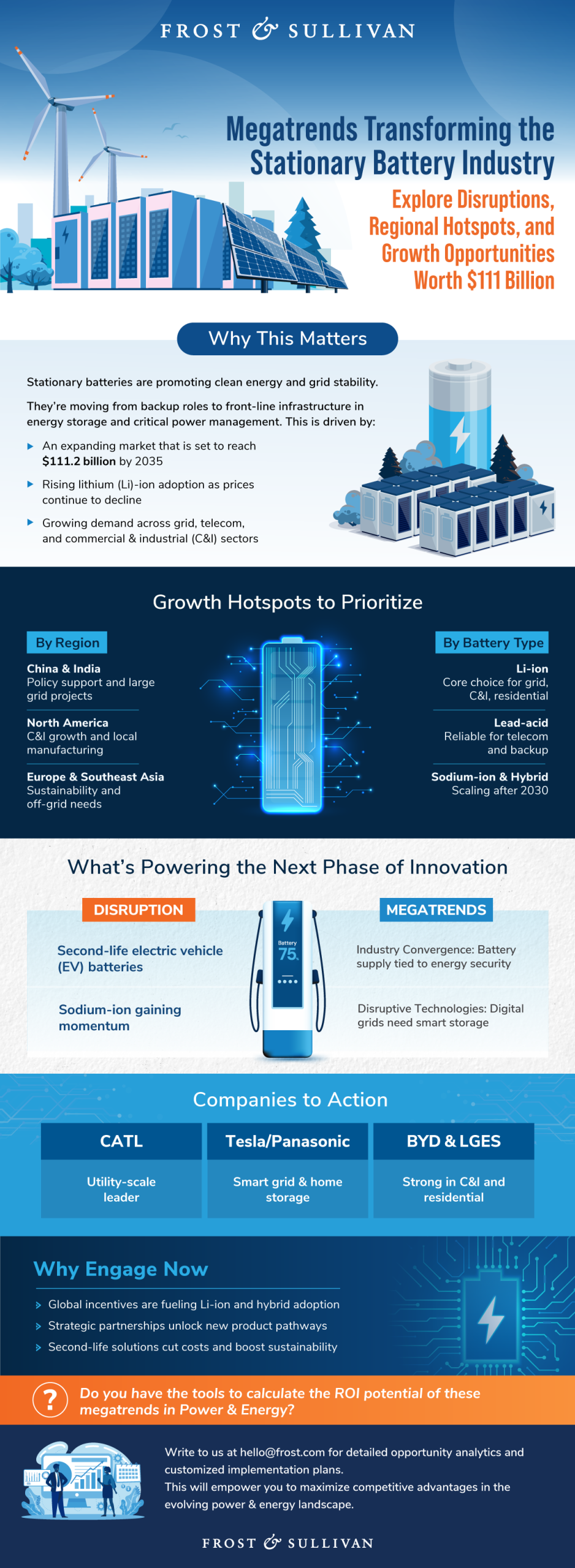

Governments and businesses are pouring resources into solar photovoltaics (PV) and wind energy to cut down on carbon emissions and lessen our reliance on fossil fuels. However, the unpredictable nature of renewable energy generation is highlighting the urgent need for supportive grid solutions, especially stationary batteries.

These storage batteries not only help stabilize the grid but also opens new revenue streams for commercial, residential, and utility-scale users. Lithium (Li)-ion batteries are leading the charge, while lead-acid batteries continue to hold ground in telecommunications and industrial backup. As Li-ion becomes more affordable and policy incentives increase, the landscape of battery options is changing rapidly.

Are you still viewing batteries merely as backup solutions? How will you transition to harness them as more strategic assets?

Top Growth Avenues in the Stationary Battery Ecosystem

Are your teams in sync with the accelerating pace of battery innovation?

Access the full guide to identify growth areas and innovation hotspots.

Strategic Imperatives Shaping the Future of Battery Usage

Three significant forces are influencing how, where, and why stationary batteries are being embraced across various industries. These changes are reshaping energy strategies, accelerating innovation, and broadening use cases around the globe.

- Transformative Megatrends

As renewable capacity expands, countries are turning to batteries for grid stability and to replace fossil-fuel-based backup systems.

- North America, Europe, East Asia, and Australia/New Zealand were early movers in storage deployments.

- China and India are now emerging as key growth centers with extensive renewable projects.

- Industrial and tech companies are investing in onsite storage to reduce diesel dependence and meet clean energy goals.

- Industry Convergence

Electric vehicles (EVs) are lowering Li-ion battery costs and making them more accessible for stationary use.

- In 2024, Li-ion prices dropped by 15% due to the new production capacity.

- Ongoing EV demand is pushing innovation that also benefits stationary applications.

- In Asia, utility-scale storage is accelerating the shift to high-capacity and alternative chemistry.

- Disruptive Technologies

New technologies are transforming battery deployment and integration with renewable sources.

- Sodium-ion batteries, still in early stages, are expected to scale post-2030.

- Hybrid storage systems are becoming the norm.

- 5G towers are replacing lead-acid with Li-ion; 6G infrastructure will require even more energy-dense solutions.

Which technologies and partnership strategies will help you adapt to these imperatives?

What’s Driving the Demand for Storage Batteries

The rise in renewables, EVs, and electrification across various sectors is creating an unprecedented demand for battery storage. These key growth drivers are expanding the ecosystem in utility, commercial, and residential areas:

- Renewable energy growth is generating a need to store excess solar and wind power.

- Telecom, industrial, and data centers are investing in high-density backup power for 5G and modular systems.

- Industrial users are deploying large batteries to manage peak loads and support onsite renewable energy.

Are you aligned with the growth drivers reshaping storage or catching up?

Where the Biggest Growth Opportunities Are Emerging

With demand increasing, companies are scaling faster, innovating rapidly, and unlocking new value in battery reuse and recycling. These three opportunity areas offer the strongest potential for long-term growth:

- Consolidation and Geographic Expansion

- Advancing local manufacturing, to keep up with regulations that treat energy supply as a national security issue.

- Forging trade agreements and regional M&A initiatives to reduce costs in battery manufacturing.

- Partnering with the right policymakers for higher funding and to build regional supply chains.

- New Product Development

- Advancing modular uninterruptible power supplies (UPS) and hybrid generators to meet backup power needs.

- Partnering with automotive OEMs and Internet of Things (IoT) firms to accelerate compact, AI-ready storage.

- Bundling battery systems with solar PV platforms for integrated, cost-effective energy solutions.

- Second-Life Batteries for Storage

- Repurposing EV batteries for grid-scale storage as a sustainable, cost-effective solution.

- Securing government incentives to scale battery recycling infrastructure.

- Collaborating across automotive and storage sectors to build regional reuse supply chains.

How will you prepare your organization to capitalize on these growth opportunities?

Download the full guide for tactical moves to gain a competitive edge

Next Steps: Power the Future with Stationary Storage

To sum it up, with advancements in Li-ion technology, supportive regional policies, and innovative second-life battery applications, the next ten years will hinge on how swiftly businesses can adapt.

Whether you’re in manufacturing, investing, or working with the grid, now is the perfect moment to focus on growth areas, localize your operations, and take the lead in battery innovation.

What bold steps will your organization take today to lead tomorrow’s energy ecosystem?

Want to dive deeper into storage technologies, explore regional opportunities, or benchmark against competitors?

Get in touch with our Power and Energy Growth Experts to know more.