Exploring Market Trends and Innovations for a Connected Future with Breakthroughs from Japanese OEMs, Global Players, and Suppliers Driving the Next Mobility Revolution

The Japan Mobility Show (JMS) 2025 has officially opened its doors. The biennial event has already drawn significant attention with a wide range of announcements from Japanese OEMs and prominent international brands. Highlights include BYD’s unveiling of a Kei car developed specifically for Japanese market standards, Sharp’s entry into the electric vehicle (EV) segment with its LDK+ model, and Hyundai’s return after 12 years, showcasing both its EV lineup and its all-new NEXO fuel cell electric vehicle (FCEV). Additionally, Kia Motors is making its first-ever appearance at JMS, further amplifying interest ahead of the official opening.

This year’s JMS brings together over 517 participating companies and organizations, an increase of 8.8% from the 475 participants in the JMS 2023 edition. The event also highlights an 82.6% increase in the number of international exhibitors, up from 19 in the previous iteration to 42 in the ongoing show. And while JMS is primarily centered around Japanese automakers, the presence of international brands, although limited, adds meaningful diversity and global perspective. Among the global brands showcasing at JMS 2025 are BMW, BYD, Hyundai, Kia, Mini, and Mercedes-Benz.

Before diving into the specifics of JMS 2025, it is worth briefly reviewing the current state of the Japanese automotive market. This context helps highlight the unique dynamics of Japan’s mobility landscape and underscores the significance of this year’s event.

Automotive Market Trends in Japan

Japan remains a global leader in automotive manufacturing, home to major automakers such as Toyota, Honda, Nissan, Suzuki, Mazda, Mitsubishi, Subaru, and Daihatsu. As an automotive powerhouse, Japan ranks fourth globally in vehicle sales and third in vehicle production.

The Japanese automotive market is dominated by domestic OEMs, which hold more than 90% market share, making it challenging for foreign manufacturers to enter and expand. However, recent trends indicate a gradual increase in imported vehicle sales. In 2024, imported vehicles accounted for 7.3% of total sales, and by comparing this with cumulative data from January to September 2025, the share has already reached 7.6%, surpassing the previous year’s total with three months still remaining.

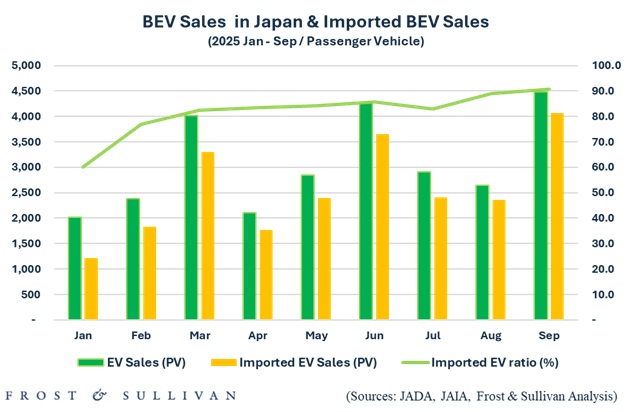

As Japanese OEMs have yet to make a complete transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs), growth in imported vehicle sales (based on passenger cars) has driven a noticeable increase in the market share of battery electric vehicles (BEVs). Analyzing data from 2025, when EV sales surged, reveals that imported vehicles accounted for a significant portion of EV sales. For instance, in September alone, over 90% of EVs sold in Japan were imported (Graph 1).

(Graph 1)

Japanese OEMs have focused more on hybrid vehicles (HVs) than on a full shift to EVs. This strategy, leveraging Japan’s advanced hybrid technology, has resulted in hybrids dominating the domestic market (based on passenger vehicles). Japan’s market is so heavily skewed toward HVs that it could aptly be called a “hybrid paradise,” with gasoline, diesel, plug-in hybrids (PHVs), BEVs, and FCVs trailing behind.

Japanese OEM Highlights

Leading Japanese brands, including Toyota, Lexus, Century, Daihatsu, Honda, Nissan, Mitsubishi, Mazda, Subaru, Hino, and Isuzu, were present in full force at this year’s JMS. Reflecting the event’s theme, each company’s presentation showcased its heritage, current innovations, and vision for the future.

Under the motto “TO YOU TOYOTA,” Toyota presented a vision centered on people, society, and the future. The brand’s stage reflected its ambition to build a culture that appeals not only to car enthusiasts but also to those who may not traditionally be drawn to automobiles.

Highlights included innovative mobility solutions designed for daily convenience, kid mobility concepts, and the much-anticipated Corolla concept model introduced by CEO Koji Sato. Toyota opened the show alongside its group brands, Lexus, Century, and Daihatsu, each presenting on dedicated stages. The next-generation Corolla, in particular, represents Toyota’s “FOR ALL” philosophy, signaling a commitment to developing multiple powertrain options.

Nissan’s CEO, Ivan Espinosa, unveiled the new Elgrand, delivering a presentation that bridged the company’s past and present while emphasizing its future direction. His message underscored Nissan’s dedication to revitalization under its “Re:Nissan” initiative.

At Honda’s booth, CEO Toshihiro Mibe introduced a diverse lineup that included the Super-ONE PROTOTYPE, the Honda Micro EV, and the e-MTB Prototype, demonstrating the brand’s innovative approach to mobility.

Suzuki showcased the Vision e-Sky, a compact passenger EV designed for daily commuting, shopping trips, and occasional weekend outings. This concept model aims to become an EV that truly complements customers’ lifestyles, with mass production scheduled to begin in 2026.

International OEM Highlights

Among the six international OEMs participating in JMS 2025, BYD’s presentation captured the spotlight on Press Day. The session opened with remarks from Liu Xueliang, President of BYD Japan, followed by an engaging overview of BYD’s journey in the Japanese automotive market, from passenger vehicles and commercial vehicles to its broader vision for the future. The company announced a remarkable 1,605,903 cumulative global EV sales from January to September 2025 and introduced the Sealion 6 equipped with BYD’s DM-i powertrain for the Japanese market. Additionally, BYD unveiled Racco, an EV developed specifically for Japan’s Kei-car segment.

Hyundai Motor returned to a Japanese mobility event for the first time in 12 years, showcasing its flagship EV, the IONIQ 5, alongside its FCEV, the all-new NEXO. While Hyundai’s EV sales in Japan remain modest compared to leaders like Tesla and BYD, the company continues to strengthen its presence through targeted marketing and consumer-focused strategies. Between January and September 2025, Hyundai recorded cumulative sales of 759 units in Japan, surpassing last year’s total of 618 units.

Suppliers Driving the Next Mobility Revolution: EVs, Rare-Earth-Free, and Software-Defined Vehicles (SDVs)

Sharp made a notable appearance at JMS 2025, unveiling plans to enter the market with its EV concept, the LDK+. First introduced at SHARP Tech-Day ’24 “Innovation Showcase”, the LDK+ returned in a more advanced form for its global debut at JMS 2025. Initially conceived around the insight that cars spend far more time parked than driven, the concept evolved from “Park at your home” to “Part of your home,” emphasizing seamless integration with everyday living.

Astemo unveiled its first rare-earth-free motor, featuring a ferrite magnet for the main drive and a magnet-free configuration for the auxiliary drive, optimized with oil cooling to enhance efficiency and stability. The company also presented next-generation mobility solutions, including an in-wheel motor that reduces environmental impact while improving ride comfort, and a compact e-Axle for small motorcycles.

Another highlight was Tier IV, a Japanese deep-tech startup specializing in autonomous driving technology. Tier IV is best known for developing Autoware, the world’s first open-source software for self-driving vehicles. As software-defined vehicles (SDVs) gain prominence, Tier IV’s role in the evolving mobility ecosystem has become increasingly significant. Interestingly, the company participated without its own booth, instead showcasing its autonomous driving technologies through collaborations at partner booths. This approach was a creative demonstration of how deeply such technologies, intangible though they may be, are already embedded in modern mobility solutions and our daily lives.

Technology and Innovation in Harmony with Collaboration and Coexistence

Perhaps it could best be described as a flood of innovation. Technological progress is always driven by human curiosity and the desire to solve seemingly insurmountable challenges. And, from such efforts come solutions. When those solutions make our lives more comfortable, safer, and richer, that is the true essence of innovation.

What began as a means of transportation has evolved from being a mere vehicle to an asset, and now into a stylish, connected device for convenience and enjoyment. It has gracefully transcended company and industry boundaries, united by shared goals of safety and sustainability.

While issues surrounding EV and ICE demand and supply will continue to emerge, steady progress is expected as both countries and corporations advance toward ESG-driven objectives. It will be fascinating to see how the innovations showcased at JMS 2025 and the spirit of collaboration and coexistence displayed by participants resonate with Japanese consumers in the coming years.

Amid unpredictable global shifts related to tariffs and geopolitical uncertainty, Japanese OEMs are expanding their global strategies, including overseas production and reverse imports. Meanwhile, foreign OEMs continue to enter the Japanese market, seeking to boost brand recognition and market share.

From an international business perspective, the pursuit of diversified growth and the execution of strategic initiatives by these automakers offer a compelling case study that one will need to observe closely as they unfold in the dynamic global market landscape.

The Japan Mobility Show 2025 will be held from October 30 to November 9 at Tokyo Big Sight.