Push for compact, affordable, low-emission vehicles in cities is creating significant growth potential for microcars but major obstacles related to high manufacturing costs and lack of standardization remain.

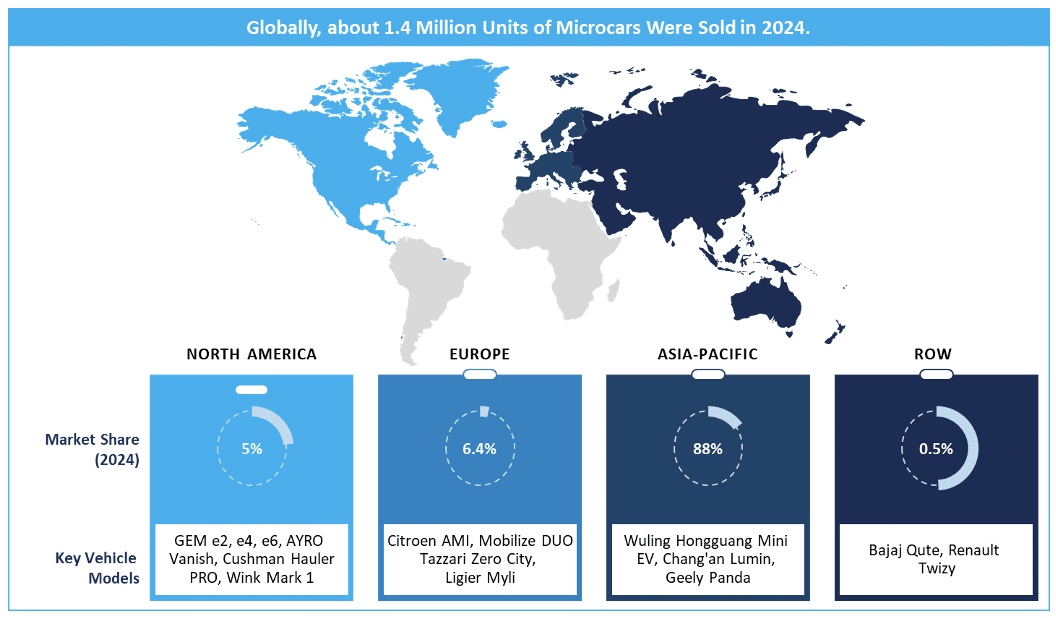

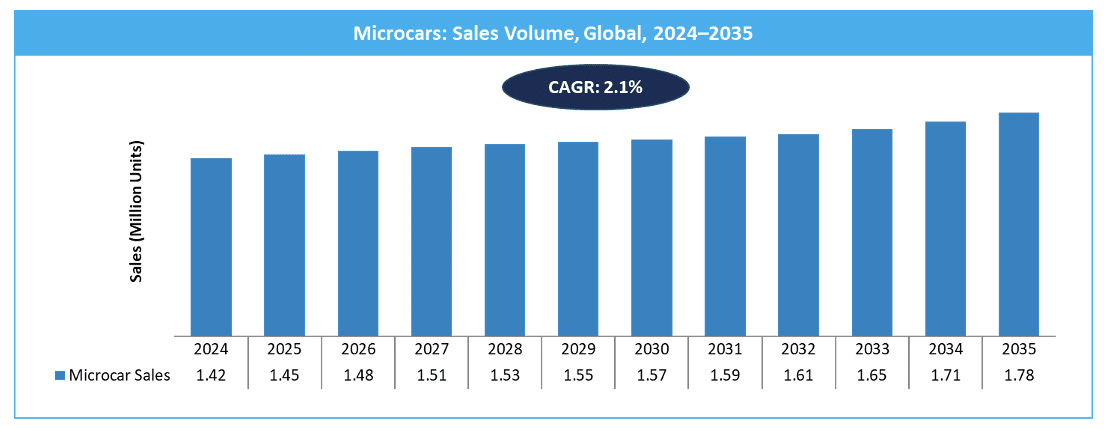

Worldwide, cities are struggling with congestion, limited parking space, and rising emissions. Microcars have emerged as a viable solution because of their advantages like compact size, affordability, low operating and maintenance costs, ease of parking, and low carbon footprint. Growing demand from daily commuters and cost-conscious consumers, reinforced by an expanding range of uses, will propel the global microcar market to reach nearly 1.78 million units by 2035. Simultaneously, OEMs are strategically looking at microcars as an accessible entry point into the electric vehicle (EV) market, particularly in dense cities and emerging economies where traditional cars are expensive to own and operate.

Source: Frost & Sullivan, 2025

While growth projections are optimistic, hurdles remain. High manufacturing costs, especially for battery electric microcars, are likely to limit their profitability in price-sensitive markets. Varying standards and approval criteria present another concern. For instance, regulations differ from Federal Motor Vehicle Safety Standards (FMVSS) rules in the US to light quadricycles (L6e) and heavy quadricycles (L7e) classifications in Europe, and new energy vehicles (NEV) legislation in China. This lack of standardization will hinder efforts at scalability and international expansion. Restricted highway access in most countries, compounded by consumer apprehensions over safety and performance, will further impede adoption of microcars.

Gaining the Edge

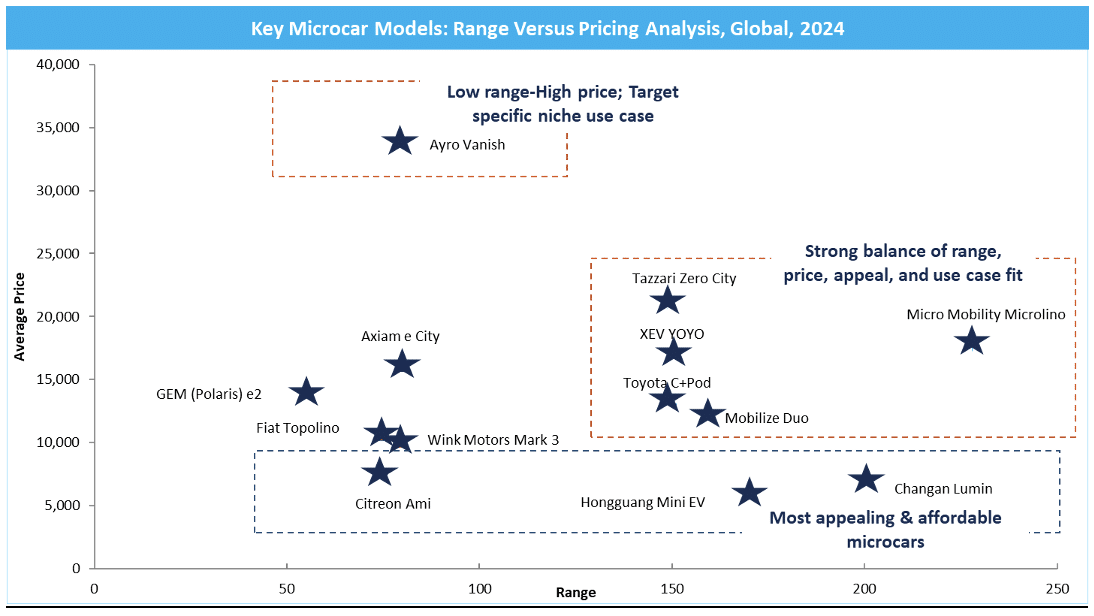

The intensifying push for affordable, zero-emission vehicles is creating a highly competitive space, where microcars, compact cars, and Japan’s Kei cars are pitted against each other. Each segment offers distinct advantages. Price remains microcars’ strongest differentiator, with most models, including quadricycles, bubble cars, and mini pods, costing less than even the base version of a compact car. They are therefore attracting first-time car owners while weaning existing private four-wheeler, two-wheeler, and public transport users.

Concurrently, compact cars, despite their higher price, have broader global appeal because of the wider range of available models, larger passenger and cargo capacity, and superior safety profile. Kei cars occupy a unique middle ground. Built under Japan’s well established regulatory framework, they provide a balance of performance, safety, and day-to-day usability.

At present, OEMs are positioning microcars as low-risk, low-cost, environment-friendly offerings for short-distance urban mobility. Over the next decade, however, they are set to evolve from low-cost mobility tools into digital micro-EV platforms that support connected, shared, and software-enabled use cases. Ultra compact mobility (UCM), A00, and quadricycle formats will support more software-driven features such as over-the-air (OTA) updates and better integration with shared mobility services. Moreover, increasingly stringent emission mandates and policy incentives will position microcars as a critical element in rapidly transforming urban mobility ecosystems.

Regional Markets: Developing at Different Speeds

China is expected to continue its dominance of the global microcars market over the next decade, fueled by the surging adoption of micro NEVs, including the A00-class micro EVs, in passenger and commercial transport. Driven by affordability, government subsidies, and compact design, models like the Wuling Hongguang Mini EV illustrate the potential for successful scalable adoption. However, market participants in China face a dual threat: firstly, of buyers shifting toward larger yet still affordable A0-segment EVs, such as the BYD Seagull, and secondly, of struggling to achieve profitability since margins tend to be thin in the micro EV segment.

Source: Frost & Sullivan, 2025

Meanwhile, Japan is likely to continue promoting UCM vehicles such as the Toyota COMS and KG Mobility Mobit. These vehicles work well in hyper-local settings, including for elderly mobility, community transport, and small municipal operations. However, regulatory silos and low awareness among private customers remain a deterrent.

Similarly, the microcar market in Europe is confronted by both growth opportunities and challenges. On the one hand, the market is picking up momentum because of zero-emission zones, government incentives, and relaxed licensing rules for younger drivers. Quadricycles such as the Citroën Ami and models from Ligier and Aixam are becoming increasingly common in shared mobility programs, such as Free2Move and YOYO. On the other hand, concerns over safety and the segment’s niche positioning are dampening its mainstream appeal.

While interest in microcars is on the uptick in the US, adoption levels remain slow. Low-speed vehicles (LSVs) like GEM and Club Car are mostly limited to campuses, gated communities, resorts, and municipal fleets because federal rules prevent them from operating on highways. Consequently, the microcar market in the US is highly localized and mainly commercial.

India is emerging as a promising market with low-cost offerings such as the Bajaj Qute which has entered both passenger and shared mobility fleets.

Across all these regions, it is clear that microcars, with slower speeds and limited crash protection, will not replace full-sized cars for long-distance or highway travel. Instead, their future lies in short, safe, urban trips.

Competition Intensifies with Expansion in Use Cases

Source: Frost & Sullivan, 2025

Competition is intensifying among more than 60 OEMs and specialist brands active in the microcars market. Leading players include Citroën with the Ami, SAIC-GM-Wuling with the Mini EV, Bajaj, Ligier, Microlino, Suzuki (Alto as a Kei model), Daihatsu, and Chery (QQ Ice Cream). Competition is being fought on cost, battery technology, compliance, licensing, brand reliability, and the ability to deploy vehicles at scale in fleet environments.

Applications are expanding rapidly. They are already being used in tourism, leisure travel, senior transport, and first- and last-mile connectivity. They are playing increasingly important roles in carsharing and micromobility networks. Their use across corporate, educational, and hospitality campuses, as well as in municipal patrol operations is steadily expanding. Logistics is a fast-growing segment, with microcars being deployed for parcel delivery, food delivery, and short-distance cargo movement in dense city centers. In Europe and Japan, well-structured regulations around L6e, L7e, and UCM categories are helping define clear use cases, while China’s A00 segment continues to push commercial and passenger adoption at scale.

Maximizing Growth Opportunities

Microcars will be in the spotlight amidst worsening congestion, expanding ultra-low-emission zones, and spiraling fuel and parking costs in cities. While OEMs and mobility operators will need to align their offerings with city regulations, city authorities, on their part, can encourage adoption by offering parking benefits, relaxed permits, or dedicated micro-EV lanes. The market will also benefit from investments in shared micro-EV fleets.

Microcars also offer a significant opportunity to advance affordable electrification in developing countries. Localizing manufacturing can help OEMs offer affordable products, while policymakers can offer financing models and incentive programs that encourage uptake.

Logistics applications will continue to expand, especially for LSVs and Kei-based cargo variants. Accordingly, developing purpose-built microcars will help OEMs strengthen their presence in commercial segments. Bundled maintenance and telematics packages will make micro fleets more attractive to operators, while partnerships with municipal bodies will help unlock new use cases in public services.

To learn more, please see: Microcars Market, Global, 2024–2035