Competitive success to hinge on developing domestic manufacturing capabilities, affordable telematics offerings, and alternative fuel portfolios.

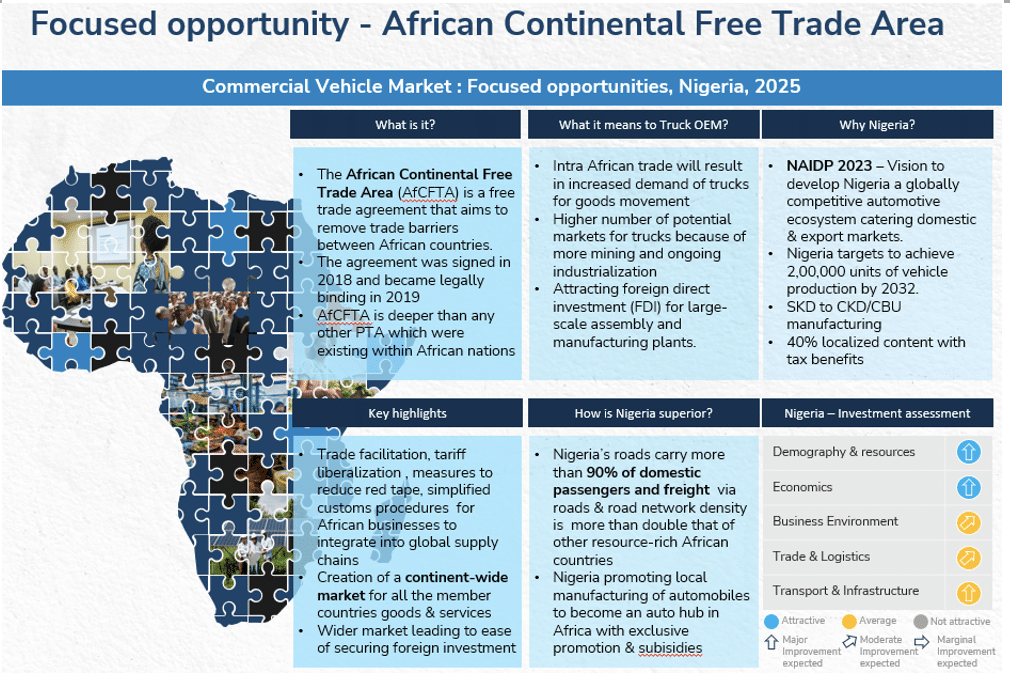

Nigeria’s commercial vehicle market is set for steady, long-term growth driven by economic diversification, major infrastructure upgrades, and rising trade flows. At the same time, government-backed reforms and logistics modernization are accelerating fleet development to meet the needs of industries like agriculture, manufacturing, eCommerce, and construction. The outlook is being further strengthened by regional initiatives such as the African Continental Free Trade Area (AfCFTA) and the Trans African Highway (TAH).

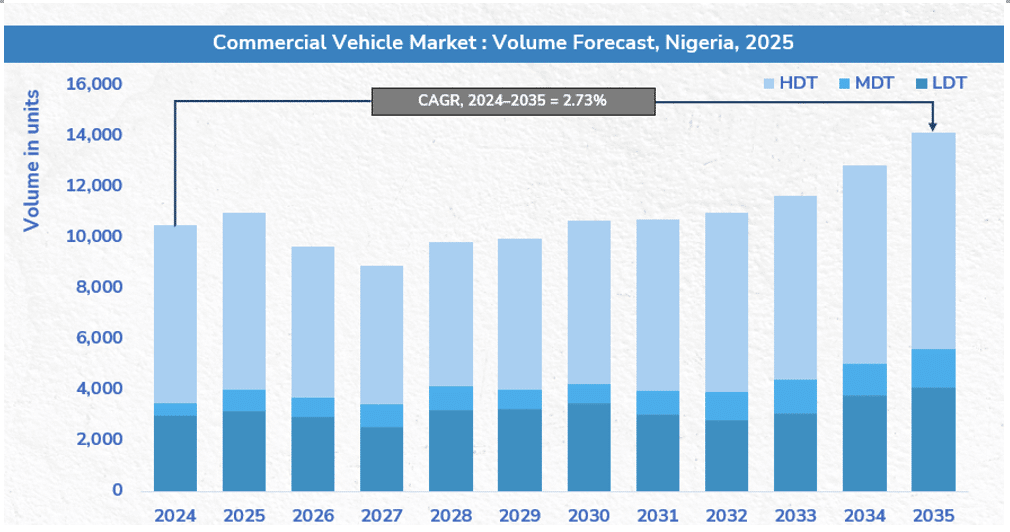

Accordingly, Frost & Sullivan estimates that Nigeria’s commercial vehicle market, spanning light-duty (LD), medium-duty (MD), and heavy-duty (HD) trucks, will grow across all segments and record a 2.7% CAGR from 2024 to 2035. Investments in road and port infrastructure, the expansion of transport corridors, and rising demand for reliable logistics to support both domestic and cross-border trade will sustain this momentum.

Meanwhile, the National Automotive Industry Development Plan (NAIDP) 2023, which promotes domestic assembly and higher local content, is energizing local vehicle manufacturing. Another notable trend is the rising adoption of commercial vehicle telematics, driven by the need for safer, more efficient fleet operations and better compliance with road safety regulations.

Sustainability is also gaining prominence as Nigeria explores cleaner fuels and vehicle electrification. Although regulatory frameworks are still evolving, policies to tighten emissions standards, together with improved fuel quality and incentives for low-emission vehicles, are expected to shape the future of commercial transportation.

Catalysts and Challenges

AfCFTA is boosting intra-African trade by reducing tariffs and opening new markets across West and Central Africa. The resulting increase in cross-border commerce is set to drive demand for long-haul trucks and fleet services. Rising industrial and mining activity, along with strengthening regional value chains, continues to create growth opportunities for Nigerian logistics companies. At the same time, major road and urban development projects like the Lagos–Ibadan Expressway, Eko Atlantic City, Apapa Port access roads, and sections of the Trans-West African Highway are increasing freight movement. Such trends present OEMs with strong truck sales prospects.

Nigeria’s strategy to reduce dependence on oil is underpinning expanding activity in agriculture, manufacturing, and services sectors. Government programs such as NATIP and Central Bank of Nigeria credit initiatives are boosting agricultural production and exports. This, in turn, is creating new logistics demand in both domestic and regional markets with positive ripple effects being felt in greater demand for commercial vehicles.

Fleet modernization imperatives are spurring the adoption of commercial vehicle telematics. The Federal Road Safety Corps (FRSC) push for safer transport operations is encouraging fleet operators to integrate GPS tracking, driver monitoring, and telematics systems. Long-haul HDT operators are increasingly using telematics to optimize routes and enhance asset security

Another defining trend is the thrust on local manufacturing under NAIDP 2023. Nigeria aims to significantly expand local assembly volumes, increase local content to 40%, and transition from SKD to CKD/CBU production.

The plan also targets 30% electric vehicle (EV) output, with a view to gradually shifting toward sustainable mobility and aims at building resilient automotive supply chains. Indeed, with government incentives and NAIDP’s target of 200,000 locally produced vehicles per year, OEMs are strengthening assembly capabilities and investing in EV-ready platforms.

This aligns with the overall shift toward fuel-efficient, CNG, and electric trucks in response to rising diesel prices. The Presidential Compressed Natural Gas Initiative (PCNGI), which aims to convert 1 million vehicles to CNG by 2027, is a major driver of the transition to alternative fuels. Fleet operators are replacing older vehicles with more economical models to reduce operational costs. This transition is creating opportunities for OEMs with alternative fuel vehicle portfolios.

The National Automotive Design and Development Council’s $20 million credit fund is facilitating the adoption of new, locally assembled trucks. It is helping reduce reliance on used imports and enabling SMEs to acquire modern fleet assets.

While these are promising signs, fluctuating oil prices remain an immediate concern since Nigeria’s commercial vehicle market is still dominated by ICE vehicles. Additional anxieties relate to the slow implementation of NAIDP 2023 and inconsistent enforcement of axle-load regulations. These hurdles could affect fleet profitability and OEM investment planning.

HD Trucks to Gain Momentum Post 2028

Nigeria’s commercial vehicle market is dominated by HD trucks. The HD segment will experience slower growth in the near term but is expected to gain momentum after 2028. Replacement of Nigeria’s aging long-haul fleet, combined with the increasing availability of CNG and other alternative fuel HD trucks, will create significant modernization opportunities. The segment will also benefit from strengthening AfCFTA corridors and improved regional road connectivity.

MD trucks are positioned for strong double-digit growth, supported by rising mid-range logistics demand, construction activity, and the expansion of manufacturing and agribusiness sectors. LD trucks will continue to benefit from growing last-mile and urban delivery demand related to retail, FMCG distribution, and eCommerce in major cities like Lagos, Abuja, and Port Harcourt.

In other notable market trends, telematics adoption is increasing across all three segments, enabling improved fleet operations and regulatory compliance. NAIDP 2023 and the National Electric Vehicle Development Plan are further encouraging investments in local manufacturing, EVs, and advanced vehicle technologies.

Import-Driven Competitive Landscape Set to Change

Nigeria’s commercial vehicle landscape remains largely import-driven. However, it is transforming as government initiatives promote local manufacturing and assembly partnerships.

Currently, FAW Jiefang and SinoTruk collectively account for over 50% market share, supported by robust dealer networks and expanding local assembly operations. Foton Daimler Auman Trucks and Shacman (Shaanxi HD) offer diversified portfolios with well-developed localized assembly capabilities. SAIC Hongyan and MAN Truck & Bus have strengthened their presence through exclusive distribution agreements and local partnerships, and by targeting expanding urban and industrial sectors. JAC Group continues to expand through partnerships with Elizade Autoland and other distributors.

Local manufacturers such as Innoson and Stallion Group, are widening their presence. However, they remain smaller players compared to their global counterparts.

Key competitive factors center on product innovation, financing support, telematics integration, and the ability to meet evolving emissions and safety standards. OEMs aligned with the Nigerian government’s emphasis on localization and electrification are best positioned for long-term success.

Looking Ahead

Fleet replacement and modernization will present significant growth potential as Nigeria’s truck fleet is old, costly to maintain, and fuel inefficient. OEMs can capture substantial demand by offering durable, affordable, and fuel-efficient trucks tailored to local operating conditions.

Nigeria’s participation in AfCFTA is positioning the country as a regional automotive hub. Leveraging its local manufacturing base and extensive logistics network will allow OEMs to export competitively priced trucks to West and Central African markets. Moreover, Nigeria’s role as a regional logistics hub will generate sustained demand for commercial vehicles. In particular, improved connectivity along the Trans-West African Highway will create demand for long-haul transport, creating new service opportunities for fleet operators.

To capitalize on such developments, OEMs will need to accelerate local manufacturing and partnership models. They should leverage NAIDP incentives to expand SKD/CKD production, increase localization of components, and collaborate with Nigerian suppliers.

A strategic priority should be the development of cost-competitive telematics solutions wherein OEMs should integrate affordable, reliable telematics offerings into their models to support fleet monitoring, safety compliance, and predictive maintenance.

Government incentives are creating opportunities for OEMs to expand their portfolios with CNG, hybrid, and low- and zero-emission electric offerings. Collaborating with infrastructure developers, energy companies, and policymakers will be crucial to building an enabling ecosystem.

Given the dominance of SMEs in logistics, OEMs should introduce flexible credit programs with a range of leasing, subscription, and SME-friendly financing models. This will increase the adoption of new trucks by an important customer segment.

To learn more, please see: Nigeria Commercial Vehicle Market Forecast 2035 or contact [email protected] for information on a private briefing.