Introduction: A Defining Moment for Legacy Automakers

Chinese electric vehicle (EV) makers are redefining affordability and performance, reshaping consumer expectations in global markets. As BYD, SAIC, and other Chinese OEMs accelerate exports, legacy automakers are under mounting pressure to respond. Ford’s answer? A new Universal EV Platform that underpins a $30,000 electric vehicle, designed to combine cost-efficiency with scale. The stakes are high: if Ford succeeds, it could become the first legacy automaker to confront China’s battery electric vehicle (BEV) dominance head-on.

But the question is: Can a legacy automaker move fast enough to out-innovate Chinese competitors who have scale, agility, and cost leadership on their side?

Ford’s Strategic Response

In 2023, Ford Motor Company formed a dedicated “skunkworks” team in California to develop a flexible, low-cost EV platform. Led by Alan Clarke, a former Tesla engineering leader, the team recruited talent from Tesla, Rivian, and Apple with a singular mandate: design a high-volume platform that could support multiple models, achieve profitability within months of launch, and include a midsize pickup truck appealing to both retail and commercial customers.

This strategy is backed by a $5 billion investment in two key projects: BlueOval Battery Park in Marshall, Michigan, to anchor domestic lithium iron phosphate (LFP) battery production, and a retooled Louisville Assembly Plant in Kentucky, where Ford’s Universal Production System will be deployed. The first tangible outcome: an affordable four-door midsize electric pickup with an expected $30,000 sticker price.

Will this skunkworks-style approach allow Ford to innovate with the speed and flexibility of a startup while leveraging the resources of a global giant?

Ford’s Universal Production System

Perhaps the most radical innovation lies in Ford’s Universal Production System (UPS). Breaking from its century-old reliance on conveyor belts, Ford now envisions assembling vehicles from three sub-assemblies: a front unicast, a rear unicast, and a structural battery pack with interior modules. This modular approach reduces complexity and enables:

- 20% fewer parts, 25% fewer fasteners, and 40% fewer workstations.

- 15% faster production cycles, creating a benchmark for efficiency.

- Integration of custom kits containing parts, tools, and fasteners, reducing assembly time and error rates.

UPS not only improves production speed but also complements human expertise with automation, setting a precedent for future auto manufacturing systems.

Could this model become the new benchmark for global automotive production, reshaping how vehicles are built worldwide?

Technology Innovation: Batteries and Materials

At the core of Ford’s $30,000 EV push is LFP battery chemistry. Compared to nickel cobalt manganese (NCM) cells, LFP offers:

- 30% lower cell costs.

- Pack-level cost reductions of 40–50% through structural integration.

- Greater thermal stability and safety, eliminating heavy protective modules.

LFP’s lower energy density has historically been a drawback. But Ford’s structural battery pack design offsets this, freeing up 30–40% more usable space for cells. The result: range and performance comparable to many NCM systems, without losing cost and safety advantages.

Material innovations add further momentum. Aluminium alloys in mega castings for front and rear sections simplify builds while lowering weight. Meanwhile, zonal electrical engineering reduces wiring complexity and enhances the ability to roll out new features via over-the-air updates.

Will Ford’s integration of cost-saving technologies and advanced materials be enough to overcome its scale disadvantage against Chinese EV leaders?

Competitive Dynamics: Confronting China’s EV Makers

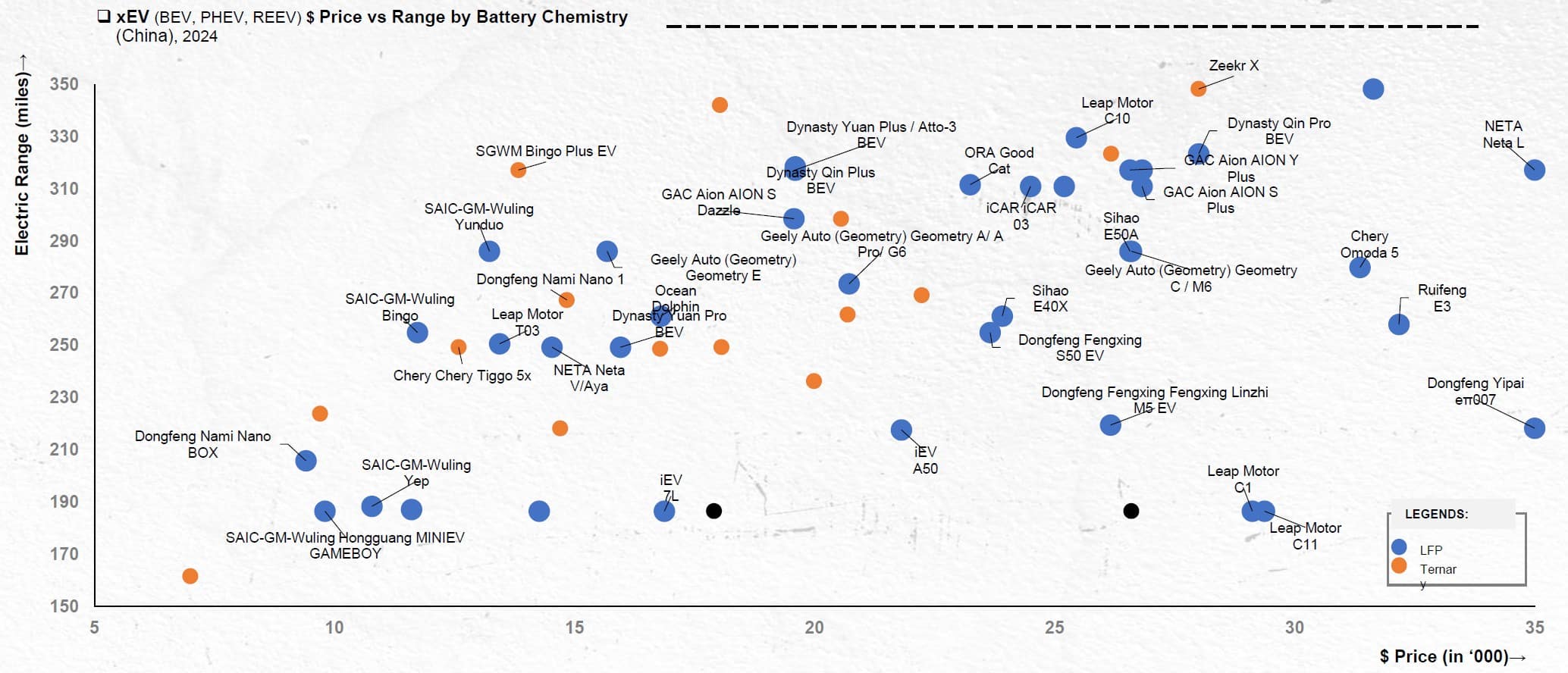

Frost & Sullivan analysis shows most affordable Chinese EVs under $25,000 use LFP batteries and deliver 230–300 miles of range. In contrast, Ford is positioning itself in the $25,000–$30,000 bracket, where fewer models currently compete. By offering 280–320 miles of range and emphasizing U.S.-made quality, Ford hopes to differentiate itself as a viable alternative to Chinese imports.

However, Chinese automakers hold critical advantages in scale, vertically integrated supply chains, and cost discipline. For Ford to close the gap, it must:

- Secure affordable domestic raw materials.

- Master high-volume LFP production.

- Ensure seamless execution of large-scale manufacturing transitions.

The big question: Can Ford replicate the speed and cost precision of Chinese players while building within the constraints of the U.S. industrial base?

Source: Frost & Sullivan

Strategic Implications: Ford vs. the Rest

By betting big on affordable EVs, Ford sets itself apart from U.S. competitors GM and Stellantis, who remain more focused on premium or hybrid strategies. Ford’s integrated approach combines:

- First-mover advantage among legacy OEMs in the affordable EV space.

- Domestic supply chain resilience, reducing dependence on imports.

- Risk-mitigated innovation, thanks to the skunkworks team’s mandate to experiment outside Ford’s traditional structures.

Comparisons to GM’s Saturn initiative highlight key differences: Saturn was an independent brand built to compete with Japanese imports, while Ford’s Universal EV Platform is an internal transformation strategy designed to future-proof the company against fast-moving global rivals.

Will this internal transformation approach allow Ford to sustain long-term competitiveness, or will legacy constraints hold it back?

Frost Perspectives: The So-what

- Universal Production System: Streamlines processes, reduces costs, and creates scalable efficiency benchmarks for the industry.

- LFP Battery Advantage: Provides affordability and safety while matching range and durability requirements.

- Strategic Positioning: The underserved $25,000–$30,000 segment offers Ford a foothold against Chinese EV giants.

Is Ford’s combination of technology innovation, strategic positioning, and production reinvention enough to reset the rules of the EV game?

Conclusion: A Defining Test for Ford

Ford’s Universal EV Platform is more than an engineering project; it’s a test of whether a legacy automaker can reinvent itself to compete with China’s BEV leaders. If Ford succeeds, it won’t just launch an affordable EV; it will redefine manufacturing systems, reset cost expectations, and reclaim ground in the global electric mobility race.

Closing Thought: Ford’s $30,000 EV strategy is about more than affordability, it’s about re-establishing legacy automaker relevance in a global market increasingly defined by innovation, speed, and value.

But ultimately, will Ford’s bold $30,000 EV become a turning point for legacy automakers or a cautionary tale in the relentless march of Chinese BEV powerhouses?

For more information on EV, write to us at [email protected]