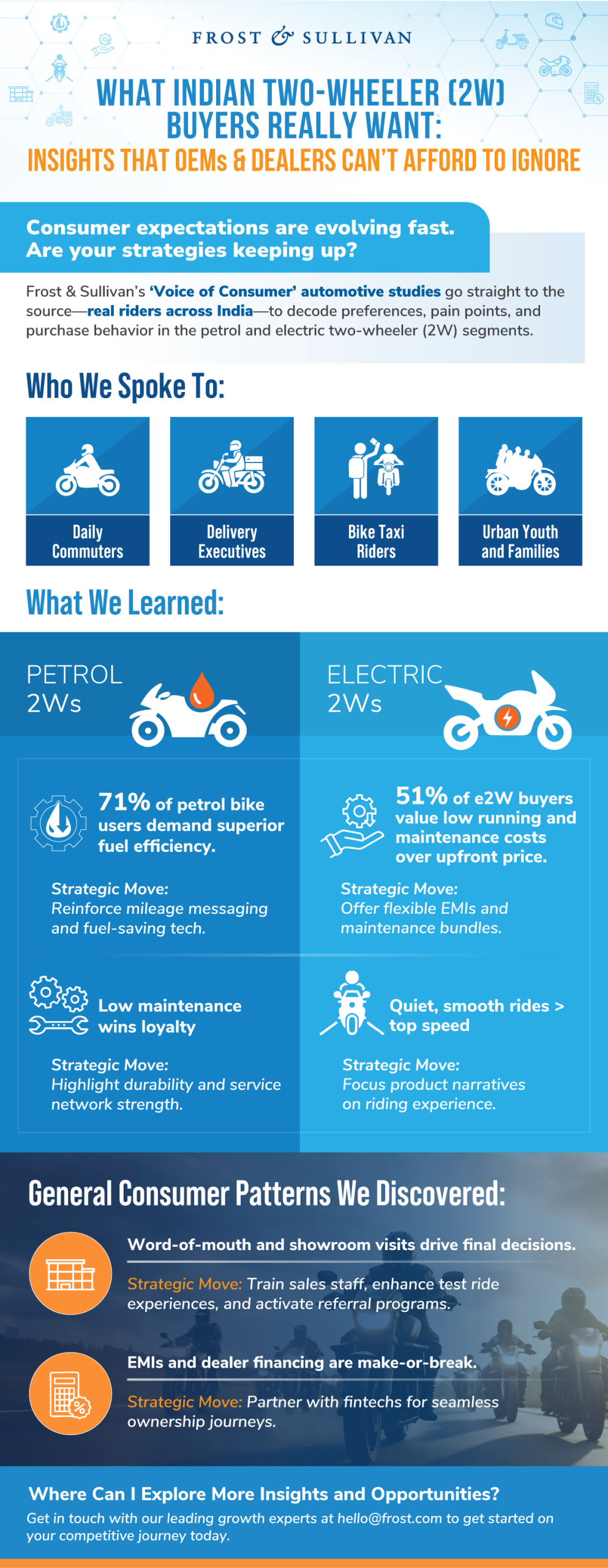

The Indian two-wheeler (2W) market isn’t just evolving — customer preferences are changing too. With electric vehicle (EV) adoption accelerating and petrol-powered bikes still dominating city roads, OEMs, marketers, and mobility stakeholders need to understand one thing clearly: What truly drives consumer choices in this fast-changing landscape?

At Frost & Sullivan, we went straight to the source—the Indian 2W buyers themselves—through two in-depth Voice of Consumer studies that reveal exactly how petrol and electric two-wheeler buyers think, choose, and ride. And the results will surprise you.

Unlocking the Mind of the Indian 2W Consumer

Whether you’re targeting urban commuters, delivery drivers, or young eco-conscious riders, our findings show that no single strategy fits all. Customer preferences are nuanced and data-backed insights are critical to capturing attention—and market share.

- 71% of petrol two-wheeler owners value fuel efficiency above all. Are your models truly delivering?

- 51% of electric 2W buyers say low maintenance costs, not upfront price, is the key decision factor. Does your value proposition reflect that?

This is just the tip of the iceberg.

Our Voice of Consumer reports dissect buyer behaviors across cities, demographics, and psychographics to help you build winning strategies in both petrol and electric segments. Access them here.

Petrol Two-Wheelers: The Familiar Favorite Still Packs a Punch

Petrol two-wheelers remain the lifeline of urban and semi-urban mobility in India. Our research highlights:

- In-person showroom visits still drive decisions for 72% of buyers.

- Peer recommendations and relatives influence 67% of purchase decisions.

- TV ads and social media exposure play a crucial supporting role in visibility and brand recall.

Strategic imperative: OEMs and dealers must double down on dealer-led financing, EMI plans, and aftersales support to build trust and retention. In the showroom, personalized experiences and financing flexibility can be powerful conversion tools.

Electric Two-Wheelers: Rising Star with Unique Buyer Expectations

India’s electric 2W revolution is gaining traction, but it’s not without challenges. Buyers are drawn to:

- Low running and maintenance costs (51%)

- Low noise, low vibration rides (47%)

- Positive reviews and peer experiences (47%)

Yet, price sensitivity, range anxiety, and lack of charging infrastructure still hold many back.

Strategic imperative: Brands must educate customers, build awareness around long-term savings, and highlight subsidies while offering smart EMI schemes and battery-swapping solutions.

A Visual Glimpse Into India’s Two-Wheeler Mindset

Want the full picture? Download report samples now to access the complete buyer journey insights, strategic takeaways, and ecosystem-level trends.

Why These Insights Matter More Than Ever

Between the rise of gig economy riders, growing urban congestion, and government-backed EV policies, the stakes have never been higher for India’s 2W riders.

- Petrol bike users are making more daily trips than ever—up to 17 a day, mostly for work.

- Electric vehicle buyers are younger, more eco-conscious, and keen on sustainable mobility—but hesitant due to cost and range concerns.

Across segments, personal influence, ease of financing, and after-sales support remain critical touchpoints.

Turn Data Into Dominance!

Whether you’re an OEM looking to design your next model lineup, a marketing strategist refining your positioning, or a policymaker defining incentives—these insights are your competitive edge.

Download the report samples today and equip your team with what real Indian 2W buyers are actually thinking.

Wondering how your company can capitalize on the transformation of automotive fuels? Schedule a Growth Dialog™ with our automotive experts to uncover tailored opportunities and strategic pathways for success in the alternative fuels ecosystem.