Market is transforming amidst competition between OEMs vs independent aftermarket vendors, adoption of hand-held diagnostic tools vs PC-based software tools, and dynamics of product-oriented vs services-driven business models.

By Mugundhan Deenadayalan, Research Manager – Mobility

The North American Electronic Service Tools (EST) market for medium- and heavy-duty commercial vehicles is poised for transformation due to an aging vehicle parc, increasingly stringent emissions regulations, and the rise of connected vehicle technologies. This is being reinforced by demand from fleet managers and technicians for faster, more accurate diagnostics to stay ahead of regulatory and operational requirements.

Beyond compliance, EST is proving instrumental in enhancing vehicle uptime, fuel efficiency, and fleet optimization. Remote diagnostics capabilities are enabling real-time insights, while cloud-based platforms are streamlining service management. However, these benefits are accompanied by challenges related to high upfront investment, software integration, and maintenance costs. These continue to be pain points, particularly for smaller players and legacy fleets.

Despite such challenges, growth momentum is strong. In 2024, the combined EST market for medium- and heavy-duty trucks in North America was estimated at $249 million, with the PC-based software tools segment accounting for an estimated $199.4 million in revenues and handheld diagnostic devices contributing the remainder. Although PC-based software tools will remain dominant in market size, handheld tools are projected to grow at a faster pace through 2030, driven by their mobility and affordability.

To learn more, please access: Medium and Heavy-duty Commercial Vehicle (CV) Electronic Service Tools (EST) Market, North America, 2025–2030, Commercial Vehicle (CV) Predictive Maintenance Industry, North America, Europe, and India, 2024–2029, or contact [email protected] for information on a private briefing.

Aftermarket Innovation and OEM Shifts

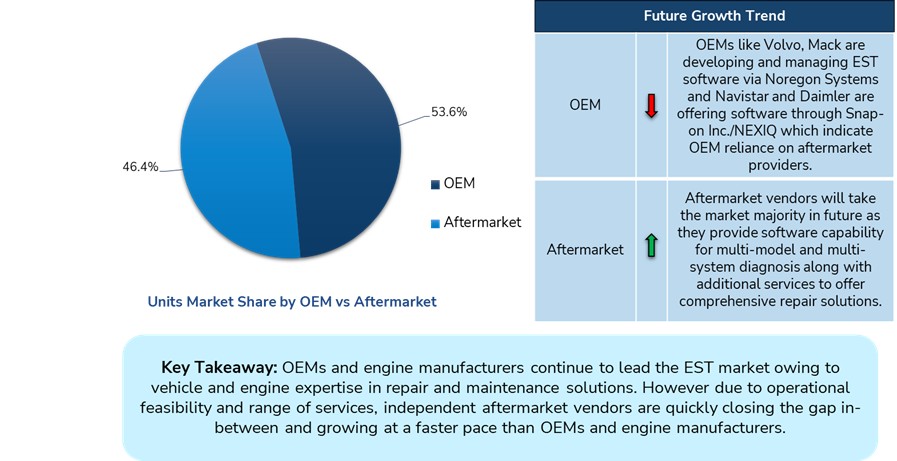

The EST market continues to be defined by the interplay between OEMs and independent aftermarket vendors. As of 2024, OEMs accounted for just over half the market, but this balance is shifting. Aftermarket players, with their focus on multi-brand compatibility and innovation, are set to take the lead by the end of the decade.

For aftermarket providers, integration with telematics platforms has become vital. Companies like Noregon Systems have pioneered partnerships with ZF, CalAmp, and Motive, enabling remote diagnostics and maintenance through intelligent data capture. This has helped fleets reduce downtime and create smarter maintenance schedules.

Product bundling strategies have emerged as a key differentiator in the aftermarket. For instance, Cojali USA offers comprehensive packages that merge diagnostics, repair instructions, and parts lookup into one user interface. Meanwhile, Snap-on Inc. is capitalizing on technician shortages with its emphasis on portable tools and easy-to-use interfaces designed for independent and mobile workshops.

OEMs, on the other hand, face both opportunities and challenges. While they dominate large fleets and dealerships, their market share is being challenged by the “Right to Repair” movement, which demands greater access to diagnostic information for independent workshops. In addition, the advent of electric trucks is further pressuring OEMs to develop new diagnostic protocols, particularly for high-voltage systems, inverters, and battery management.

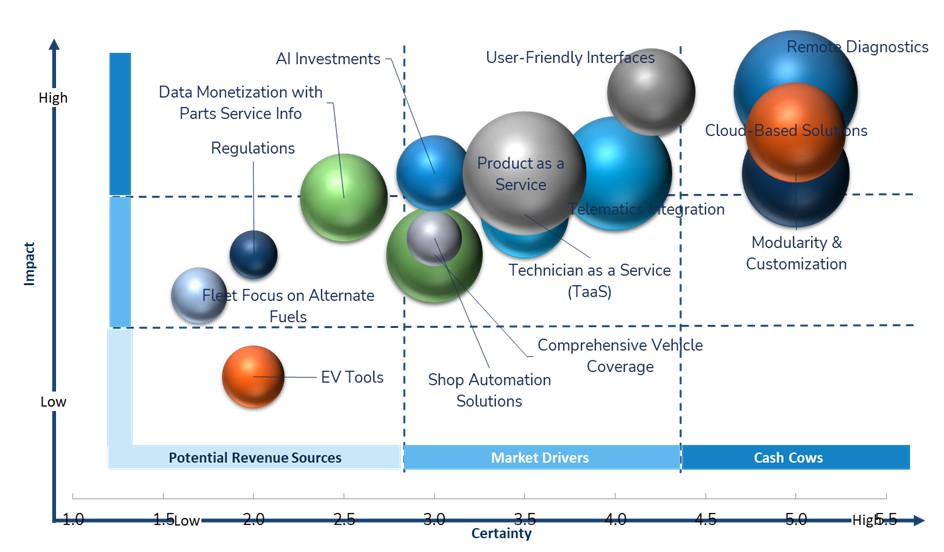

Key Trends Shaping the Future of EST

The EST market is undergoing a structural shift, moving from standalone diagnostic devices to fully integrated, service-centric ecosystems. One major trend is the adoption of cloud-based diagnostics paired with user-friendly dashboards that allow real-time, visual performance monitoring. As engine complexity rises, intuitive interfaces are becoming essential for both experienced technicians and new entrants.

Telematics integration continues to be a key growth catalyst. EST-enabled real-time data analytics is enabling remote fault detection, predictive maintenance, and operational efficiency. Advanced analytics is turning diagnostic data into actionable insights, thereby reducing repair times and minimizing vehicle downtime.

Another significant development is the emergence of new business models such as Technician as a Service (TaaS) and Product as a Service (PaaS). Intensifying technician shortages are motivating service providers to offer remote and mobile technician solutions on a pay-per-use or subscription basis. These models are filling workforce gaps, while creating entirely new revenue streams.

Looking forward, AI and machine learning will play pivotal roles. As EST solutions incorporate neural networks and leverage GPU/DSP acceleration, diagnostics will become faster, more precise, and increasingly automated. Integration with shopfloor automation tools such as job scheduling, inventory management, and automated work orders will further enhance workshop productivity and customer satisfaction.

Shifting Competitive Dynamics

The competitive landscape features a mix of OEMs, Tier I suppliers, and aftermarket players. Leading OEMs such as Navistar, Daimler, Volvo, and Paccar continue to provide proprietary EST solutions, often in collaboration with established vendors like Snap-on and Noregon. On the aftermarket side, Snap-on, Cojali USA, Texa, and Autel are actively expanding their product portfolios to capture market share with multi-system, multi-brand capabilities.

Key customers for EST include dealerships, fleet repair shops, and independent workshops. Together, fleet and independent repair shops comprise around 95% of North America’s service infrastructure. With more trucks aging out of warranty, and with the need to provide services in remote and underserved areas, fleets are turning to independent repair shops that offer faster, more flexible, and often more affordable services.

Independent workshops are also redefining the service model by embracing mobile repairs. These shops are deploying vans equipped with handheld ESTs and onboard connectivity, allowing technicians to perform diagnostics and minor repairs at fleet yards or breakdown sites. This mobile approach is especially valuable for Department of Transportation (DOT) compliance checks and emergency breakdowns.

While OEMs still hold an edge in expertise and access to proprietary systems, their market dominance is waning. Aftermarket vendors offer broader service coverage and more adaptable tools that are key considerations as fleets grow more diverse and complex.

Our Perspective

The North American EST market stands at a pivotal crossroads with several key opportunities set to define the market’s next evolution. Telematics integration will become critical and will require EST providers, both OEM and aftermarket, to deepen their collaboration with telematics service providers. These partnerships will be essential for delivering real-time diagnostics, improving uptime, and offering predictive maintenance. As fleets demand tighter operational control, telematics-enabled ESTs will become the gold standard.

Integrating EST diagnostic tools with a more extensive range of shopfloor automation features will become crucial. Here, services could include automated job scheduling, reporting, and inventory management, among others. Vendors that bundle these services with their EST software will gain a competitive edge by providing a one-stop solution for fleet workshops and service centers.

In an environment plagued by technician shortages, TaaS will be an attractive business model that offers scalable expertise, flexible delivery, and cost-effective maintenance solutions. Subscription-based access to certified mobile or remote technicians could become a game-changer, particularly for smaller fleets or rural operators.

Ultimately, the EST market is evolving from a product-based industry into a service-driven ecosystem. With rising vehicle complexity, aging fleets, regulatory compliance, and labor shortages as key drivers, EST solution providers that can combine diagnostics with data, mobility, and automation will define the future of commercial vehicle maintenance in North America.

With inputs from Amrita Shetty, Associate Director, Communications & Content – Mobility