As Donald Trump embarks on his second term, the world watches with bated breath as tariffs once again become a central feature of his economic playbook. In a post-pandemic and post-war landscape, these trade policies carry significant geopolitical weight and potential consequences.

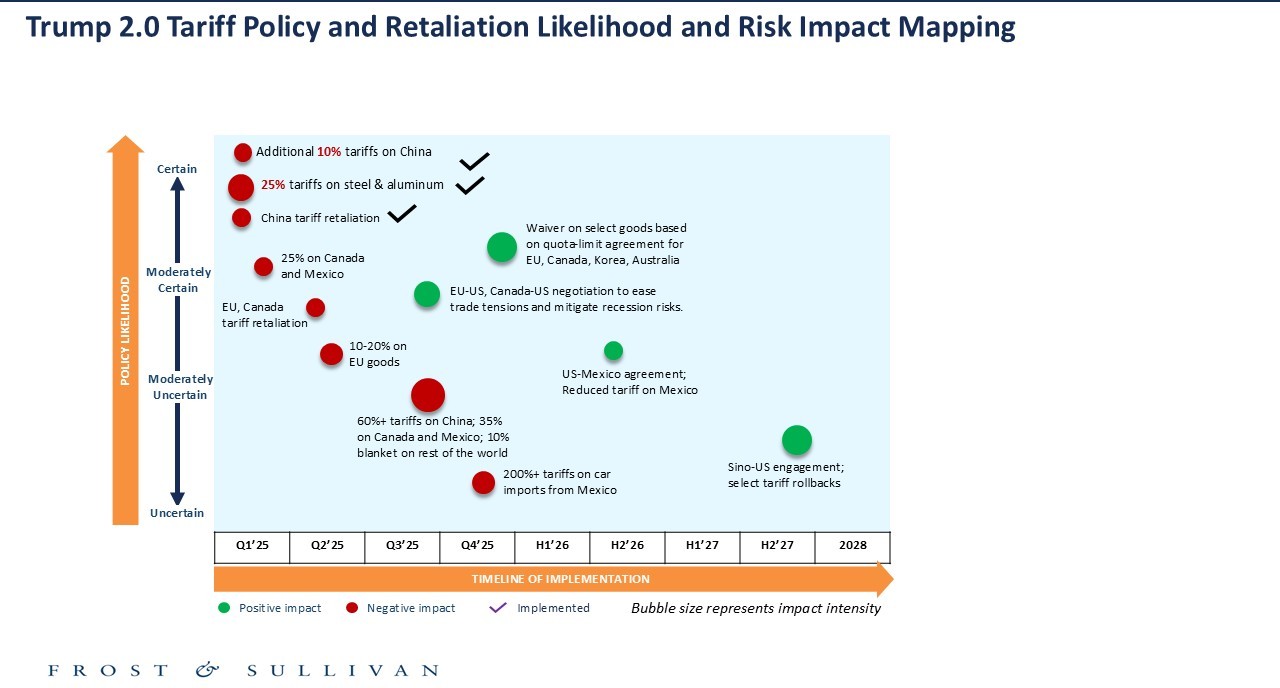

The implementation of sweeping tariffs by President Trump, including a 10% levy on Chinese imports and a 25% tariff on steel and aluminium, has sent shockwaves through the global economy. A proposed 25% tariff on Mexican and Canadian goods, excluding Canadian energy products, which face a reduced 10% rate, is also in the pipeline. These measures affect nearly 50% of total US imports, pushing the effective US tariff rate over 4 percentage points in 2025 from just 1.54% in 2022. Retaliatory tariffs from China—and potentially from Canada and the EU—have further exacerbated global trade tensions.

Macroeconomic Shockwaves: Plummeting Growth, Currency AND Inflation Spiral Could Reverse Rate Cut Strategy

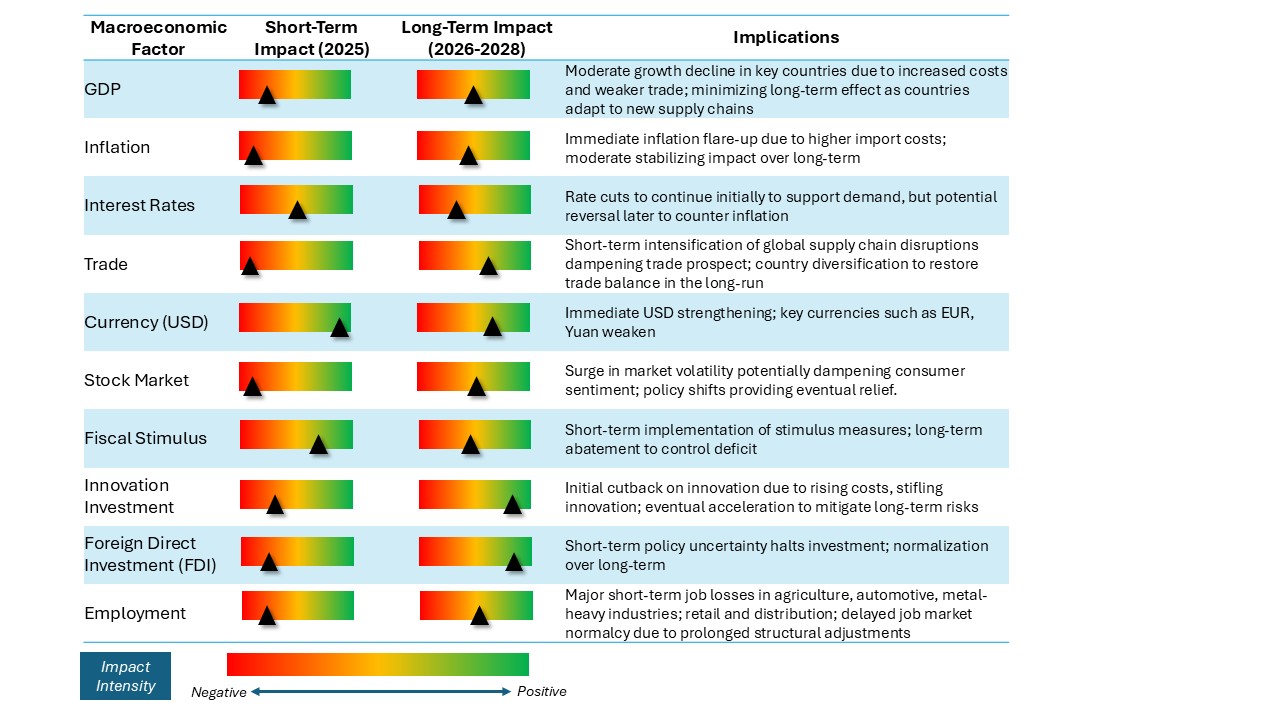

Below is a snapshot of tariff measures on key macroeconomic parameters.

Exhibit 1: Short and Long-term Macroeconomic Impact of Tariff Measures, Global

Higher value for inflation is considered as a negative impact. Source: Frost & Sullivan

Higher value for inflation is considered as a negative impact. Source: Frost & Sullivan

While tariff policies aim to bolster domestic manufacturing, they may push 2025 inflation closer to 5.0%, up from Frost & Sullivan’s December 2024 projection of 4.4%, due to higher import costs and economic uncertainty. This could potentially lead to job losses in key industries such as automotive, metal-using industries, retail and distribution.

Despite these headwinds, global GDP isn’t expected to decline drastically from 2024 levels, driven by strong economic performances in emerging markets such as India, ASEAN nations, the UAE and Saudi Arabia. We also expect that early negotiation opportunities and eventual tariff waivers for some key countries, helping to dispel the initial blow. The Americas, as it stands, are facing divergent growth trajectories, with the US slowing and Canada and Mexico teetering on the brink of recession.

- United States: Slower Growth, Higher Prices; No Immediate Recession

The tariff-induced supply shock could push US inflation to nearly 5% in Q1 2025, raising costs for manufacturers. Notably, January 2025 CPI inflation was already recorded at 3.0%, marking a steady four-month rise since October 2024. The Federal Reserve may delay further rate cuts, straining private consumption. However, with the assumption of no additional tariffs beyond the first half of the year, medium-term inflation may stabilize.

Net-net, a growth slowdown appears inevitable. The extent of the downturn depends on how tariff revenues are redirected (whether towards pro-growth policies) and on the scale of retaliatory measures. Estimates from Frost & Sullivan suggest a 0.2–0.4 percentage point hit to US GDP growth, reducing growth from 2.8% in 2024 to 2.2% in 2025. A full-blown recession remains unlikely.

- Canada: Looming Recession Could Spread Beyond 2 Quarters

Canada, as the largest supplier of steel and aluminium to the US, stands to be significantly impacted by the tariffs. These tariffs could effectively double the duties on Canadian metals, leading to a potential recession lasting two quarters or more. The Canadian economy could face a challenging year, with inflation surpassing the Bank of Canada’s 2% target and unemployment rising above 7%.

Canada is actively negotiating exemptions, and a favorable resolution in H2 2025 could prevent this extreme scenario.

- Mexico: 2025-2026 Contraction in the Making

Mexico, deeply integrated into US supply chains, is highly vulnerable to US tariffs. With its exports to the US exceeding $500 billion (28% of GDP), a pause in the proposed 25% tariffs provides a temporary reprieve, but if enacted, these tariffs could push Mexico into a 2-3 quarter recession.

Nearshoring initiatives and a weaker peso might mitigate some of the fallout, but higher input costs could restrict monetary policy options. Even if a last-minute deal averts the tariffs, the prolonged uncertainty could dampen investment—particularly ahead of the 2026 USMCA review.

- China: Short-Term Growth Trough; Long-term Resilience Expected

The silver lining for China is that the 60% tariff initially floated by Trump has been scaled down to 10% on Chinese goods. However, additional measures could be introduced following a US-China economic review set for April 1, 2025.

A weaker yuan to boost exports could offset some of the impact, but ongoing structural challenges—such as the property sector downturn and demographic shifts—may limit China’s ability to absorb these shocks. Moreover, steel and aluminium producers will find it challenging to reroute shipments via third countries, given the blanket nature of the tariffs.

In the short run, these pressures could push China’s GDP growth closer to 4.0% in 2025 from 5.0% in 2024. Over the longer term, China is expected to adapt by strengthening regional supply chains and continuing to reduce dependency on US trade. While this shift will stabilize markets eventually, it requires significant investments in infrastructure, technology, and workforce development, making the transition costly and slow.

Exhibit 2 outlines the likely and implemented tariffs for 2025-2028, along with tariff implications.

Exhibit 2: Trump 2.0 Tariff and Retaliatory Tariffs, Tariff Policy Likelihood and Impact, 2025-2028

Shifting Sands of global Trade: Opportunities Amidst Protectionism

As the US leans into protectionist policies, the global trade landscape is realigning. Countries are seeking alternatives to mitigate their exposure, and certain regions stand to gain from these shifts in supply chains.

Exhibit 3: Key Drivers and Growth Opportunities Arising from Tariff Measures, 2025 and Beyond, Global

Final Thoughts: Adapt, Innovate and Stay Resilient

Trump’s tariff policies in his second term are reshaping the global trade landscape, with potential long-term implications. While North America faces immediate challenges, Asia could emerge as an economic powerhouse, benefiting from the polarization of global trade. As we navigate this new economic order, the question remains: Will these aggressive tariff policies yield short-term gains or sow the seeds of long-term economic instability? Only time will provide the answer, but for global businesses, the imperative is clear: adapt, innovate, and stay resilient.