Lithium-sulfur, sodium-ion, and solid-state batteries emerge as new generation replacements for conventional lithium-ion batteries in electric vehicle applications. The US Department of Energy predicts a five to ten-fold increase in global electric vehicle (EV) battery demand by 2030. Accordingly, battery manufacturing companies are accelerating their focus on advanced new battery technologies that overcome the limitations of current offerings. In the quest to develop highly efficient and economical EV batteries, the spotlight has fallen on lithium-sulfur, sodium-ion, and solid-state batteries (SSBs). While these battery technologies, along with metal-air batteries (aluminum-air and lithium-air) are still in the nascent stage, automakers and battery manufacturers are looking at them as new generation replacements for conventional lithium-ion batteries. Their appeal lies in their high energy density, light weight, better thermal stability, and cost-effectiveness.

And while challenges related to safety, cost, and performance still need to be addressed, these technologies are on course to be adopted for EV applications between 2025-2030.

To learn more, please access Global Growth Opportunities for Advanced Lithium Batteries for EVs and the Adoption of Future Battery Chemistries, Strategic Analysis of Disruptive EV Start-ups, 2023, and the forthcoming Giga Factory Strategies of Global Automotive OEMs Li-ion Battery Production, Forecast to 2030, or contact sathyanarayanak@frost.com for information on a private briefing

Automakers Attracted by Multiple Benefits of New Battery Technologies

Today, a host of automakers, traditional battery manufacturers, technology companies, start-ups, and component suppliers are involved in developing future battery technologies. In a sign of the market’s strong growth potential, the number of EV battery manufacturers is expected to increase from an estimated 50-60 to more than 100 over the next 4-5 years.

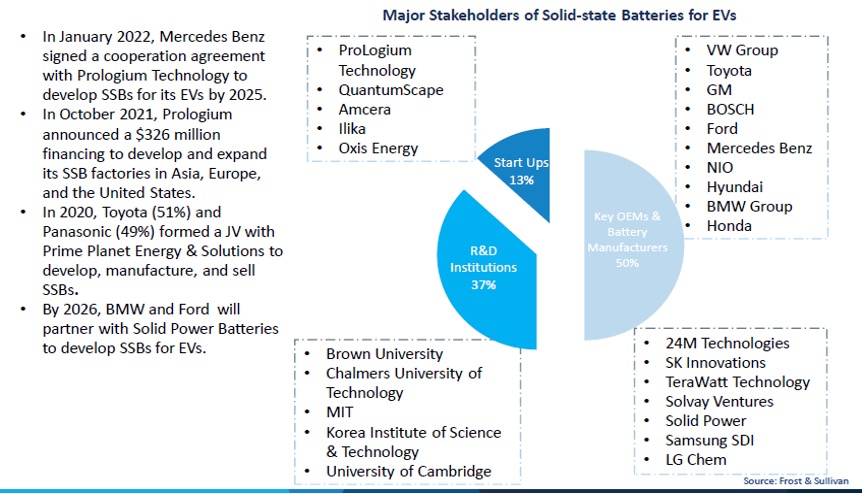

How do the competing battery technologies stack up and what is their likely growth trajectory? Automakers like Toyota which has pioneered this battery technology, along with others like General Motors, Volkswagen, NIO, Stellantis, Mercedes-Benz, Honda, Hyundai, BMW, Toyota, and Ford, have made significant investments in SSBs. Such initiatives are being reinforced by leading SSB manufacturers like Quantumscape, Oxis Energy, and Prologium.

Evolving Ecosystem of Solid-state Batteries

The interest around SSB derives from its high energy density, long life cycle, and enhanced thermal stability and safety. Prototypes are in the development stage, with mass production likely from 2026 onwards. High costs will mean that SSBs are initially anticipated to be used primarily in premium EVs before costs drop and their use is extended to more mass market models. At present, China is the leader in the SSB patent space. Overall, over 9,000 patents have been registered across all levels of the value chain (electrolyte, electrode, cell, pack, and systems).

Meanwhile, lithium-sulfur batteries also offer similar benefits in terms of high energy density, long life cycles, and enhanced safety and have the added advantage of being low cost. Under development for over a decade, they are expected to be commercialized post 2027. Many major automakers such as GM, BMW, Hyundai, VW, and Daimler as well as start-ups are collaborating on R&D into lithium-sulfur applications for EVs.

Alternative battery technologies—sodium-ion, lithium-air, and aluminum-air—are also gaining attention. Sodium-ion batteries are seen as a potential game changer in the EV space because of their cost-effectiveness. Investments and R&D are fast tracking their development as they increasingly emerge as an alternative to lithium-ion batteries due to their low price, safety, widespread availability, sustainability, and improved performance at wide operating temperature ranges. The technology is likely to be ready for mass production post 2025.

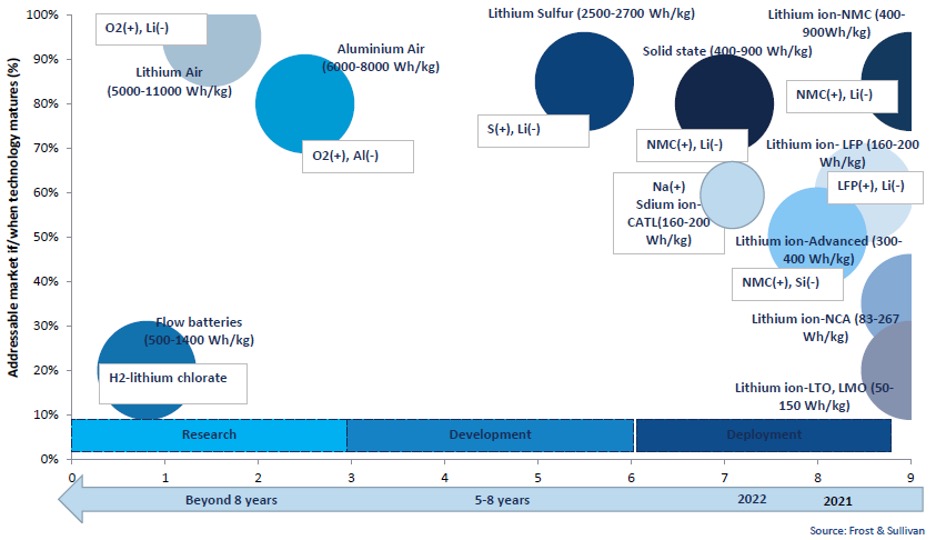

Technology Readiness Level by Battery Chemistry

Lithium-air batteries are attractive to EV OEMs as energy storage devices due to their high energy and power density. Besides longer life cycles, light weight, and enhanced safety attributes, lithium-air batteries are expected to transform the EV space because of their superior energy capacities compared to lithium-ion batteries. Currently in the early research stage, the expected timeline for commercialization is beyond 2030.

Aluminum-air batteries represent another breakthrough battery technology; the raw material is easily available and the batteries themselves are light weight and inexpensive. They also offer high energy densities that are almost nine times higher than lithium-ion batteries, supporting improved driving range. However, recharging remains a major challenge with mass production anticipated after 2030.

As the EV market leader, Tesla is the largest consumer of nickel-manganese-cobalt (NMC) and lithium-iron-phosphate (LFP) cells. It is also planning to build 10-20 gigafactories that can manufacture both cars and batteries for EVs. The gigafactory strategy is being embraced by a host of other leading EV OEMs who are keen to achieve rapid scale up. In terms of battery manufacturers, CATL, followed by LG Chem and Panasonic account for over half the market share of EV batteries.

Looking to The Future

Although some of these battery technologies such as SSB and sodium-ion are in the early stages of development, vehicle, battery, and component manufacturers should all build capabilities in this emerging space. Towards this end, long-term investments in advanced battery production capacity expansion will be crucial. This will not only boost output to match surging demand for EV applications, it will also be critical to lowering production costs.

Partnerships across the value chain among key stakeholders—automakers, R&D companies, battery /component manufacturers, start-ups, and technology companies, among them—will accelerate commercialization. Rather than target a single battery chemistry, battery manufacturers should focus on a broad portfolio that includes SSB, sodium-ion, and lithium-ion offerings.

A focus on safety, thermal management, performance, and cost will drive the adoption of future battery technologies. This, in turn, will boost EV uptake since advanced battery tech will address consumer concerns related to thermal runaway, range anxiety, and high costs.

With inputs from Amrita Shetty – Senior Manager, Communications & Content, Mobility