Seismic technological shifts are being accompanied by a competitive shakeup as Chinese automakers dominate, and European OEMs move to ramp up their electrification roadmaps.

This year’s International Mobility Show Germany or, as it is better known, IAA Mobility 2023, was held in Munich, Germany from 5th to 10th September 2023. Touted as the world’s largest mobility event, it brought together leading CEOs and industry veterans from the automobile, mobility, and tech sectors. Prominent guests also included international politicians, ambassadors, ministers from federal and state governments, and policy makers. For those as interested in celeb spotting as they were in the cars, Oscar-winner Natalie Portman and Mars mission candidate Alyssa Carson featured among the elite list of speakers.

The event began on a slightly fractious note with the inauguration by German Chancellor Olaf Scholz marred by protests from environment and climate activists. Barring this, the event proceeded smoothly and was deemed a resounding success with myriad displays of innovative technologies targeting vehicle electrification, autonomous driving, and sustainable mobility.

Apart from the main event halls, event organizers gave the general public a chance to get in on some of the action with IAA Open Space. Exhibitors and automotive OEMs showcased their sustainable, intelligent, connected mobility solutions directly at the city’s most prominent locations, thereby giving the public a first-hand opportunity to learn about new, innovative mobility concepts.

IAA Mobility in numbers

Official figures indicate that the event featured around 750 exhibitors drawn from 38 countries, attracted more than 500,000 visitors, and was covered by over 3,700 journalists from 82 countries. A slew of visitors, including me, caught a glimpse of the more than 300 world premieres and innovations, even as more than 100,000 people visited the IAA Open Space. The event also hosted over 500 international top speakers at the IAA Conference who provided exclusive insights into topics like decarbonization, circular economy, generative artificial intelligence, alternative fuels, affordability of EVs, and digital services, among others.

Focus on Chinese Automakers

For a significant part of its history, IAA events have primarily showcased German automotive companies, who have been unrivaled in the realm of combustion engines, boasting cutting-edge technologies and impeccable design. However, in the latest edition, a notable shift in focus occurred, with Chinese automakers grabbing the spotlight.

Chinese vehicle manufacturers might not have the storied pedigree of their German counterparts, but what is clear is their emergence as formidable contenders, not only in terms of affordability but also design and technological prowess. Their superiority is evident, particularly in battery performance, software innovation, and the agility they display in bringing products to market swiftly. Key to their growing ascendancy has been the ability to adapt rapidly to customer demands and exhibit flexibility – areas where they outshine their European counterparts.

This year at IAA, the focus shifted toward this dynamic Chinese presence, marking a notable departure from the traditional German dominance. The conspicuous Chinese presence at the event is probably a sign of their intention to enter the European market with all guns blazing. Indicative of this is BYD’s stated ambition of capturing around 10% market share of the European market over the next few years, in comparison to the current share of Chinese OEMs in Europe which stands at around 8%.

As can be deduced from various press talks, European OEMs are counting on the brand value and loyalty that they have enjoyed among customers for decades to slow down the march of the Chinese juggernaut. The brand loyalty of German customers, for instance, will be put to test when they are increasingly presented with the choice of domestic offerings vs foreign made vehicles that come with increased technical performance at significantly lower price points.

Frost & Sullivan Perspective

What were some of my takeaways from IAA Mobility this year?

Firstly, European manufacturers must prioritize reducing the production costs of electric vehicles (EVs) to narrow the price differential with Chinese competitors. This will be critical to ensuring their continued competitiveness and relevance in the European market.

Secondly, fast charging technologies must be rapidly deployed to eliminate range anxiety and boost sales of battery EVs (BEVs) and plug in hybrid EVs (PHEVs) against conventional internal combustion engine (ICE) vehicles. Improving suburban charging infrastructure should be another top priority for EU governments. At the event, German Chancellor Olaf Scholz announced the introduction of a law “requiring operators of 80% of all service stations to provide fast charging options with at least 150 kilowatts for electric cars” which reiterates the importance of fast charging infrastructure not only in urban markets but also in suburban geographies.

Thirdly, a critical aspect for European manufacturers, as well as suppliers, tech firms, and startups within the sustainable mobility ecosystem, must be to prioritize making EVs both affordable and sustainable.

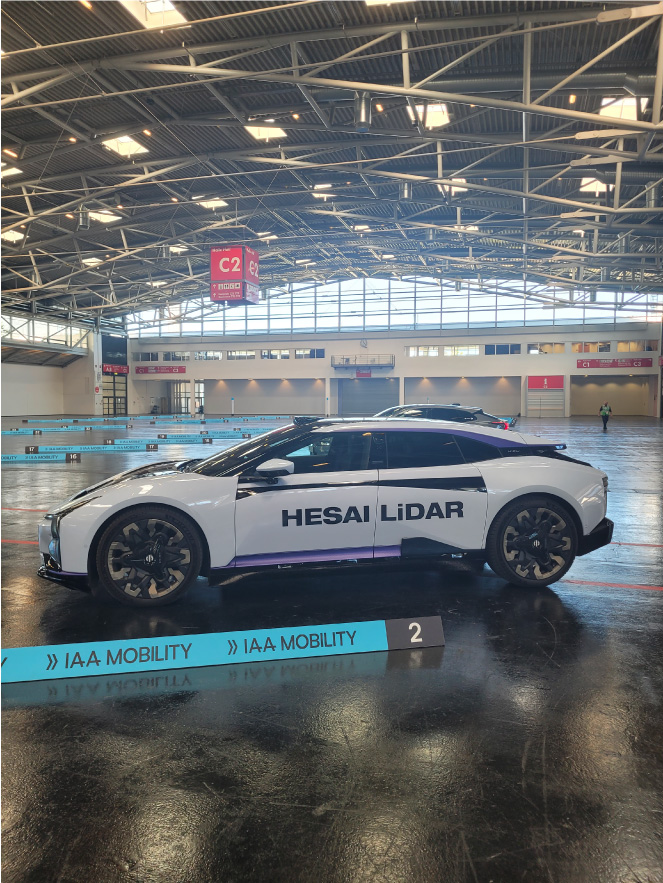

Fourthly, there is a growing emphasis on advancing autonomous driving capabilities and enhancing the overall customer experience, as evidenced by the numerous lidar, radar tech providers, and autonomous technology companies exhibiting at the event.

Fifthly, the industry is witnessing pivotal developments in software-defined vehicles, in-vehicle software systems, electric powertrain systems, charging solutions, e-bikes, and e-scooters. This, coupled with innovative urban and micromobility concepts, will significantly shape the future of the automotive industry.

To summarize, the most important takeaway is the need for Europe to catch up on EVs. The German automotive industry appears confident and determined to take on this new challenge. With discussions around sustainability, cost efficiency, and digital car technologies playing out repeatedly over the course of the event, the European automotive industry has a fight on its hands as it sets out to prove its mettle.