This blog is based on the recent Frost & Sullivan analysis, “Oncology Biomarker Diagnostics, Global, 2024–2030,” authored by Chandni Hussain, Industry Analyst, Healthcare & Life Sciences Practice.

The Future of Cancer Diagnostics Is Here

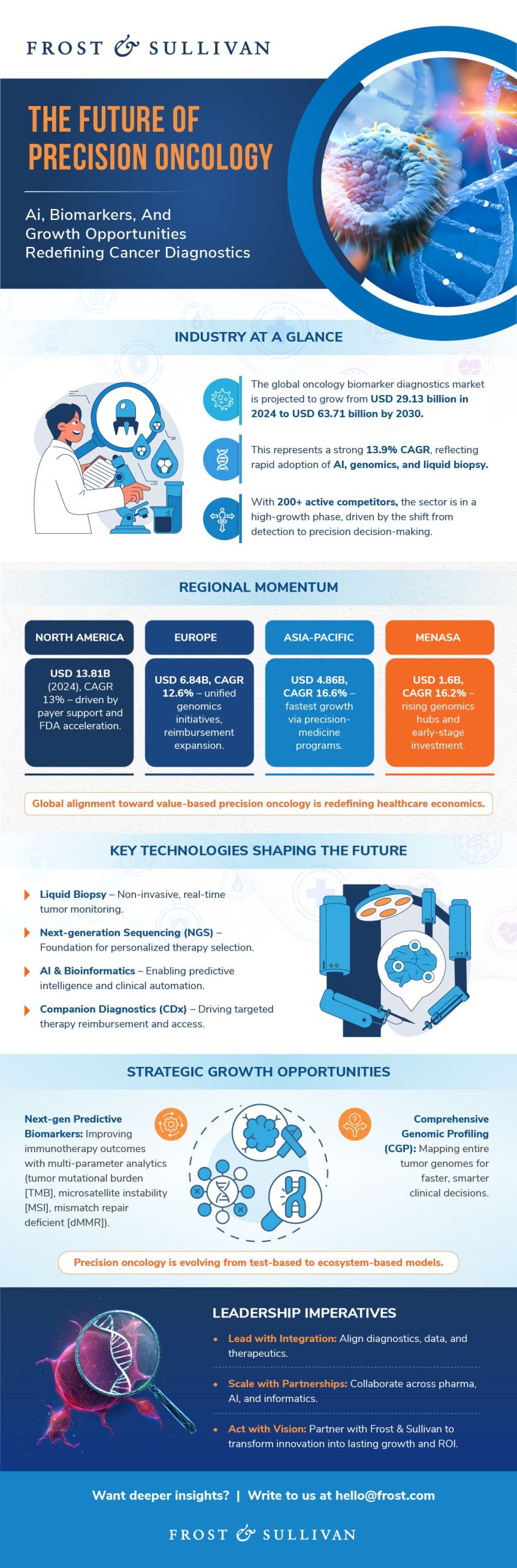

The global oncology biomarker diagnostics industry is at a defining crossroads. What was once a specialized segment of clinical testing has become the strategic core of precision oncology, driven by AI, genomic profiling, and liquid biopsy breakthroughs.

According to Frost & Sullivan’s latest analysis, the market was valued at USD 29.13 billion in 2024 and is forecast to reach USD 63.71 billion by 2030, growing at an impressive 13.9% CAGR. This expansion is powered by one clear shift: technology convergence.

Download Frost & Sullivan’s Executive Whitepaper to explore the full opportunity landscape and shape your precision oncology strategy today.

Diagnostics are no longer about detection, they are about prediction, personalization, and proactive care.

Technology Convergence: The New Growth Catalyst

AI, digital pathology, and next-generation sequencing (NGS) have moved cancer diagnostics beyond the microscope. These technologies now decode disease at the molecular level—transforming raw biological data into real-time, therapy-guiding insights.

Liquid biopsy represents one of the most powerful examples of this convergence. Using circulating tumor DNA (ctDNA), tests like Guardant360® CDx deliver actionable insights in days, not weeks. Meanwhile, AI-driven platforms such as Tempus and FoundationOne CDx are using data analytics to refine mutation detection, enhance therapy prediction, and improve clinical decision support.

The convergence of AI and genomics is not just accelerating accuracy, it’s creating an entirely new oncology care model where diagnostics drive therapy design and treatment success.

Global Momentum: A Market in Transformation

Regional markets are showing synchronized but distinct growth patterns.

- North America remains the largest market, generating USD 13.81 billion in 2024, supported by regulatory alignment and payer coverage.

- Europe continues to expand at 12.6% CAGR, fueled by genomics initiatives and national cancer strategies.

- Asia-Pacific is the fastest-growing region, with a 16.6% CAGR, reflecting major investments in precision medicine infrastructure.

- MENASA markets are emerging strong at 16.2% CAGR, with genomic research hubs and evolving reimbursement models driving adoption.

Together, these regions illustrate a global transformation, where healthcare systems are aligning innovation with access to bring precision oncology to every patient, everywhere.

Evolving Competition: Integration as the New Advantage

With over 200 companies active in the oncology diagnostics space, competition is fierce—but the game is changing.

The top five players—Roche, Thermo Fisher, Exact Sciences, Illumina, and Agilent—hold nearly half the market, but disruptors like Grail, Caris Life Sciences, and Natera are redefining early detection through multi-omic and liquid biopsy innovation.

Partnerships are becoming the defining currency of success. A notable example is Roche’s $1.5 billion acquisition of Poseida Therapeutics, signaling that integration across diagnostics, therapeutics, and AI is now essential for sustained growth.

The next phase of leadership will belong to companies that unify diagnostics, data, and delivery into a single ecosystem of patient-centered innovation.

Growth Opportunity 1: Predictive Biomarkers for Immunotherapy

Predictive biomarkers are revolutionizing how clinicians select immunotherapies.

While early breakthroughs like HER2 and EGFR set the stage, only a fraction of patients achieve durable responses to checkpoint inhibitors. The next wave of growth lies in multi-parameter biomarkers, including TMB (tumor mutational burden), MSI (microsatellite instability), and dMMR (mismatch repair deficient), which enable clinicians to identify responders more accurately.AI-powered tools such as Novigenix’s LITSeek and MSKCC’s SCORPIO are already outperforming conventional assays in predicting immunotherapy response.

As biomarker-driven therapies advance, partnerships between diagnostics and pharma companies will become vital to ensure both efficacy and reimbursement success.

Growth Opportunity 2: Comprehensive Tumor Genomic Profiling (CGP)

Comprehensive genomic profiling is unlocking a new generation of personalized oncology care. By mapping the full tumor genome, CGP helps clinicians detect drug-resistance mutations early and refine treatment plans dynamically.

Organizations like Caris Life Sciences are leading this transformation, using genomic intelligence to enable faster clinical-trial enrollment and smarter drug development.

Earlier CGP adoption has been shown to improve survival rates and quality of life, underscoring its value as a core pillar of precision medicine.

The Leadership Imperative: From Innovation to Ecosystem

Frost & Sullivan’s Visionary Growth Pipeline outlines three imperatives shaping the oncology diagnostics future:

|

Pillar |

Strategic Focus |

|

Innovation |

AI, liquid biopsy, and NGS for predictive accuracy |

|

Transformation |

Cross-sector collaboration between diagnostics, pharma, and digital health |

|

Growth |

Scaling adoption through payer alignment and global market access |

Leaders who embrace these imperatives will not just capture revenue; they will define how cancer is prevented, detected, and treated in the next decade.

From Insight to Action

The oncology diagnostics revolution is here, and it demands decisive leadership.

In an ecosystem where innovation, integration, and intelligence define success, the question isn’t whether change is coming, but who will lead it.

Download Frost & Sullivan’s Executive Whitepaper to explore the full opportunity landscape and shape your precision oncology strategy today.