This blog is based on the recent Frost & Sullivan analysis, “Digital Surgery Devices Market, Global, 2024–2029,” authored by Dr. Bejoy Daniel, Senior Industry Analyst, Healthcare & Life Sciences Practice.

Digital Surgery Devices: Pioneering the Future of Precision Medicine

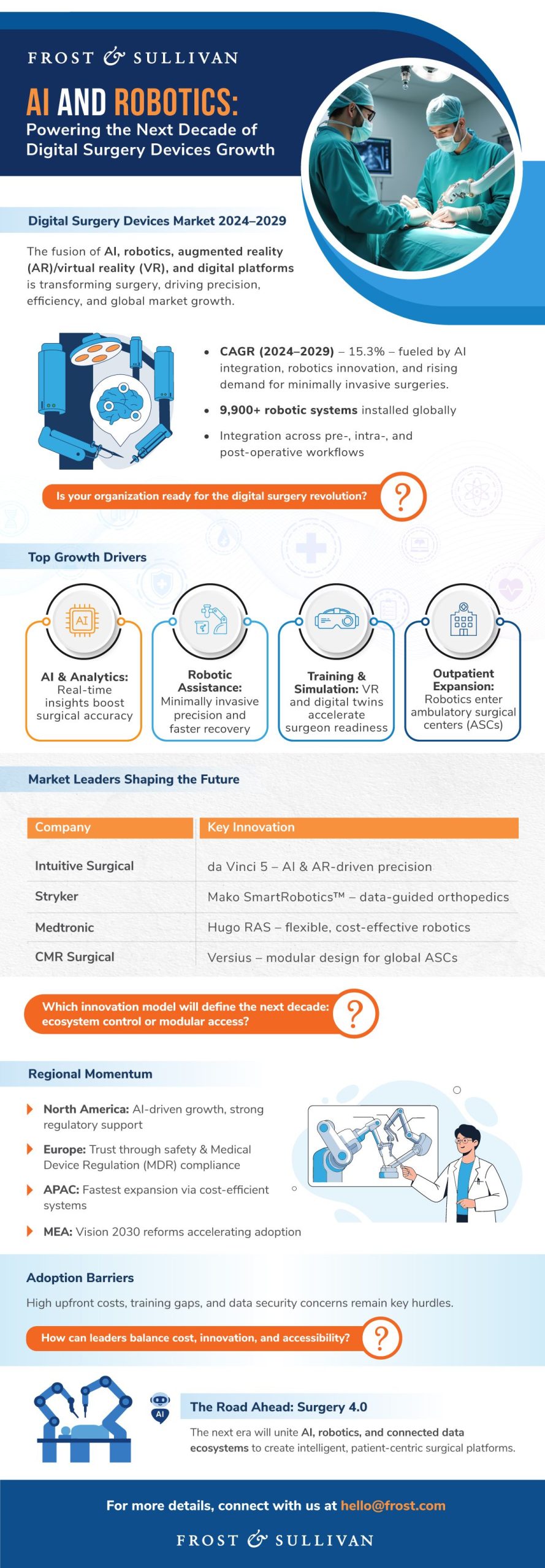

Healthcare is entering a new era: one where artificial intelligence (AI), robotics, and digital platforms converge to redefine how surgeries are performed, optimized, and experienced. According to Frost & Sullivan’s latest study, “Global Digital Surgery Devices Market, 2024–2029,” this transformation is not just incremental; it’s revolutionary.

The digital surgery devices market is poised for exponential growth, driven by the adoption of robotic-assisted systems, augmented reality (AR) and virtual reality (VR), intraoperative imaging, and AI-based analytics. Together, these technologies promise to enhance precision, reduce recovery times, and improve patient outcomes while reshaping the economics of surgical care.

Download the full analysis to gain access to detailed forecasts, competitive benchmarking, and strategic opportunities in the digital surgery devices landscape

What Is Driving the Digital Surgery Revolution?

The key drivers behind this transformation are clear and compelling:

- Rising demand for minimally invasive surgeries (MIS): Patients seek faster recovery and reduced trauma, propelling adoption of robotic and navigational systems.

- Technological breakthroughs: AI and machine learning (ML) now enable real-time decision support, surgical guidance, and predictive insights.

- Integration across the care continuum: From preoperative planning to intraoperative execution and postoperative analysis, digital platforms are connecting every stage of the surgical journey.

- Global accessibility: Modular and portable systems are extending advanced surgical capabilities to outpatient and resource-limited settings.

Is your organization leveraging digital innovation to deliver smarter, safer, and more accessible surgical care?

The Competitive Landscape: Who’s Leading the Charge?

The global landscape of surgical robotics and digital platforms is rapidly evolving, with key players shaping the industry’s direction:

- Intuitive Surgical continues to dominate with its da Vinci ecosystem, now boasting over 9,900 installations worldwide. Its fifth generation da Vinci 5 integrates enhanced AI analytics, AR overlays, and expanded procedural support, setting the benchmark for “Surgery 4.0.”

- Stryker is leveraging its Mako SmartRobotics™ platform to expand beyond orthopedics into spine and shoulder applications, combining preoperative data modeling with intraoperative analytics for personalized precision.

- Medtronic is advancing its Hugo RAS system, focusing on affordability and scalability, while CMR Surgical’s Versius system brings modular, portable robotics ideal for ambulatory surgery centers (ASCs).

Each company represents a different strategic path: ecosystem dominance, modular innovation, or cost democratization but the shared goal remains the same: to make surgery smarter, safer, and more connected.

Which innovation model — ecosystem control, affordability, or modularity — will define the next leader in digital surgery?

Emerging Trends and Growth Opportunities

Frost & Sullivan’s analysis reveals that the digital surgery devices market is expanding not just in size but also in scope. The most exciting trends include:

- AI and Predictive Analytics: Intelligent algorithms that guide surgical navigation, reduce errors, and enhance decision-making.

- Surgical Simulation and Training: Digital twins and VR-based training tools that accelerate surgeon skill development.

- AR/VR Integration: Immersive visualization that helps surgeons navigate complex anatomies with enhanced precision.

- Out-of-hospital Adoption: ASCs are embracing robotics for faster, cost-effective same-day surgeries.

These innovations are blurring the line between technology and human expertise — creating what Frost & Sullivan calls “The Intelligent Operating Room.”

How will intelligent, data-driven operating rooms redefine surgical collaboration and decision-making?

Barriers to Adoption: Cost, Complexity, and Compliance

Despite its promise, digital surgery faces challenges that must be addressed for sustainable growth:

- High upfront costs: Robotic systems can add $3,000–$6,000 per procedure, limiting adoption in price-sensitive markets.

- Technical and workflow integration: Seamlessly embedding new systems into clinical routines requires significant change management.

- Regulatory complexities: From Food and Drug Administration (FDA) approvals in North America to Medical Device Regulation (MDR) compliance in Europe, regional regulations can either accelerate or delay innovation.

- Data privacy and ethics: As AI takes a central role, ethical deployment and secure patient data handling become non-negotiable.

How can healthcare systems balance cost, access, and innovation in a data-driven surgical ecosystem?

Regional Insights: A Global Race for Leadership

The analysis highlights how the digital surgery evolution varies by region:

- North America: Regulatory agility and hospital innovation budgets drive adoption, but tariffs on imported components can inflate costs.

- Europe: Strong safety and efficacy standards build trust but slow market entry.

- APAC: Rapid regulatory harmonization in China and India accelerates growth, while local manufacturing is reducing system costs.

- Middle East & Africa: Modernization initiatives under programs like Saudi Vision 2030 are streamlining approvals and boosting uptake.

Which regions will emerge as digital surgery powerhouses by 2029 and why?

From Technology to Strategy: The Executive Imperative

For MedTech and healthcare leaders, digital surgery is not just a technological trend, it’s a strategic inflection point. Executives must now ask:

- How can we align R&D, data strategy, and clinical innovation to capture this market?

- What partnerships will accelerate our digital ecosystem?

- Are we investing fast enough to compete with global frontrunners?

The Frost & Sullivan analysis equips decision-makers with the data, insights, and foresight needed to navigate these questions and seize new opportunities in Surgery 4.0.

Will your organization lead the digital surgery revolution or follow it?

The Next Chapter in Surgical Excellence

The convergence of AI, robotics, and data analytics is setting the stage for a new era in precision medicine.

The winners of this transformation will be those who act now, rethinking their innovation roadmaps, strengthening collaborations, and building the digital infrastructure for the next generation of surgical excellence.

Download Frost & Sullivan’s full analysis, “Global Digital Surgery Devices Market, 2024–2029,” to gain access to detailed forecasts, competitive benchmarking, and strategic opportunities across the global MedTech landscape.